When CEOs retire, the CFO is often their logical successor—for the logical reason that finance touches everything. Done right, finance can be your central nervous system. It’s where your company senses the pain of churn and the joy of sales while generating ideas for unlocking new funding. It can forecast the future, quantify risks, and discover opportunities. As such, finance can and should inform all your executive decisions.

Good finance begins with a clear mission. A startup finance team is not there just to mind the books but rather to help the company grow. Without that growth focus, finance experts often apply the wrong playbook—what works for a mature startup or public company does not work for scaling startups. That leads to system sprawl and too little insight at a time when you need more insight and clearer answers.

In this guide, I share how to build a finance team for that critical seed-to-Series A transition and how to grow it with the company. I’ll also share my templated reporting dashboard, which you can download. This is all based on my 15 years of experience as a finance leader at venture-backed companies. I’ve helped teams scale from nothing to hundreds of employees and raise millions in capital, and I’d like to see you set up the right financial foundation.

Making the big shift from seed to Series A

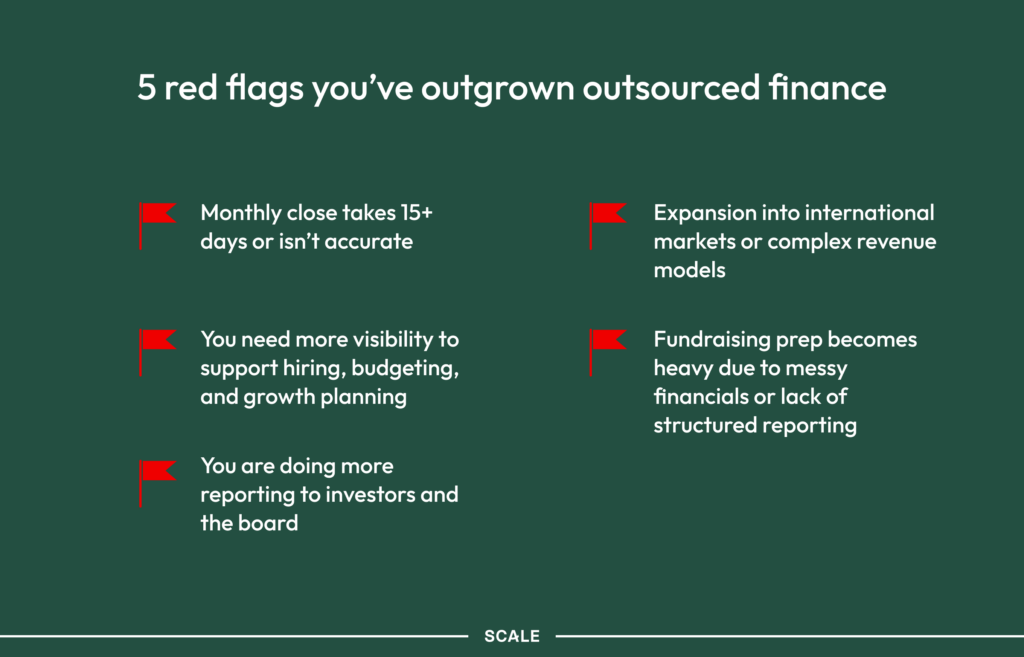

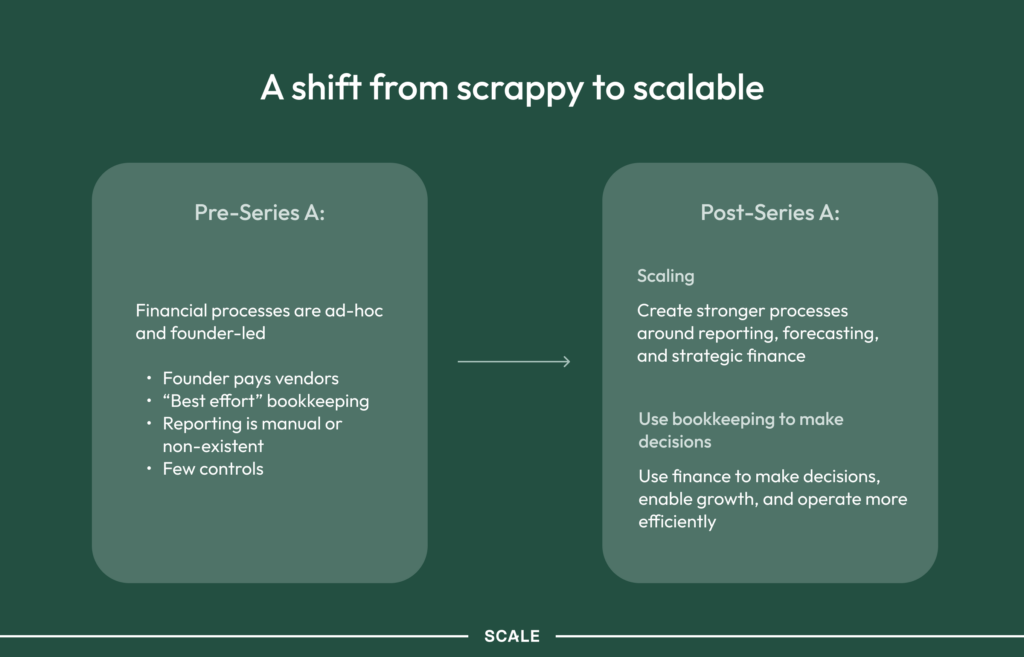

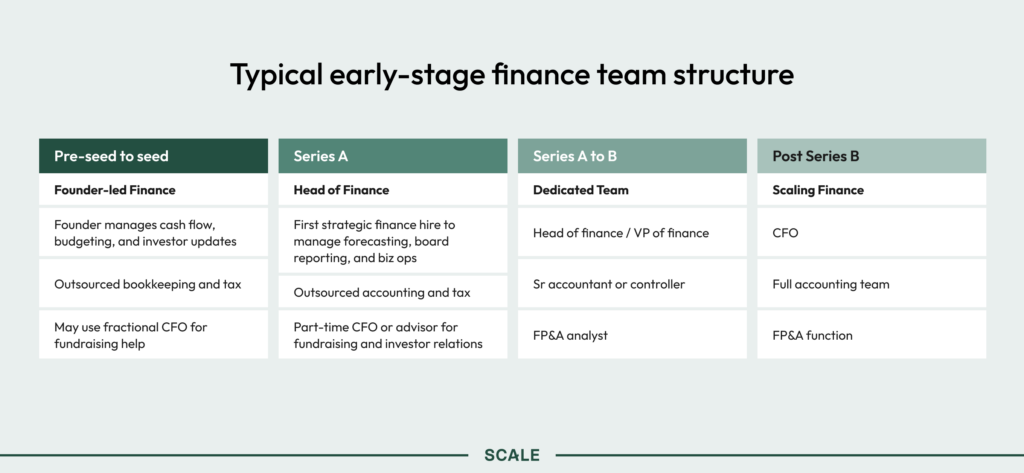

Series A is typically a big transition because prior to that, the founder handles most finance tasks. They are often the ones paying contractors, running payroll, and managing their outsourced accountant. Some have a fractional CFO for guidance. But with product-market fit and funding secured, the rest of the company needs the founder’s full focus. It’s time to hand things over.

Just to be clear, this transition is not a question of whether a founder can continue to handle finance. They might be able to, for a while. Rather, it’s a question of whether they should. There are the basics of startup finances—CAC, runway, cash flow—that a founder can probably handle and should be thinking about a lot. But it’s unlikely they’ll have time to do meaningful financial planning and analysis, and more importantly, know what to do with that information. Without professionalized finance, you invite chaos such as:

- Burning cash too quickly (or conversely, not taking the risks that drive growth)

- Spending inefficiently

- Missing the key metrics that drive valuation

- Building reports and decks that give the board pause

- Ignoring finances outside of board reporting

Chaos means risk. Risk comes from when you don’t know what you’re doing. Every startup is inventing to some degree, but it’s wasteful in finance where the playbook is well-established.

Your first hire is probably a head of finance. Unlike other departments where you might not hire the most senior person first, here you should look for someone who’s presented to boards, seen the startup cycle, and can guide you as you build out the team.

That person knows to focus on:

- Enabling growth—Allocating capital efficiently and supporting data-driven decisions.

- Supporting fundraising—Ensuring basic financial hygiene, modeling scenarios, and articulating a compelling financial story to investors.

- Improving operational efficiency—Identifying cost savings and ways to grow sustainably.

- Growing the team to fulfill the function—People, processes, systems, and workflows.

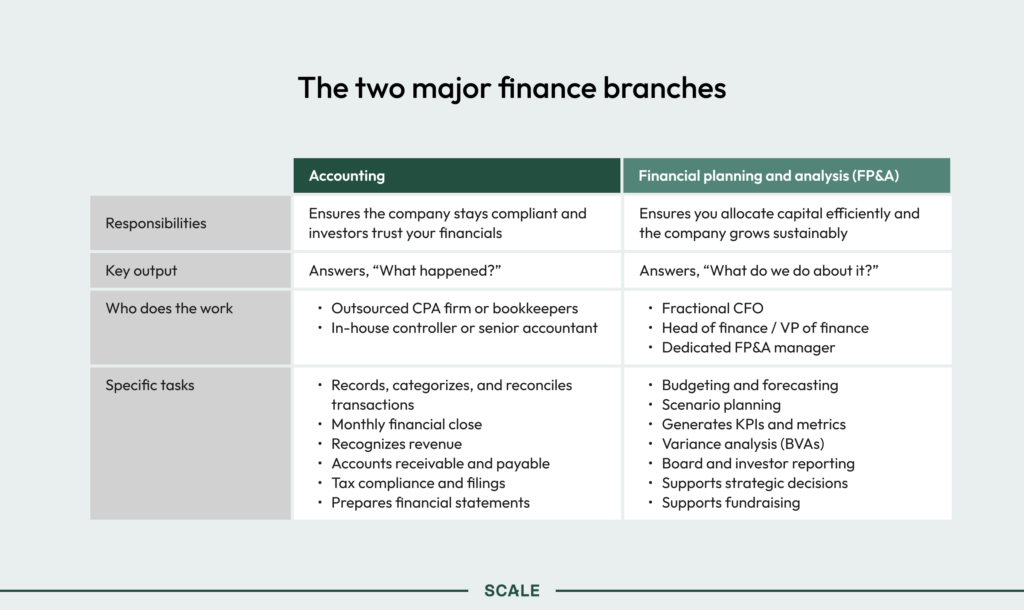

That new head of finance hire will know the difference between the two branches of finance and specialize in one or the other, pictured below. What is not pictured is the quasi-third function of business operations, the team that owns your data technology: CRM, product analytics, and ERP systems. That team may report to the FP&A team, but more on that later.

Your first head of finance should spike on FP&A skills rather than accounting skills; accounting is more standardized and will remain easy to outsource. You will eventually bring that function in-house, when you hire a controller or senior accountant, for even better reporting and a more customized ledger. You might also, as needs dictate, hire a junior analyst for hands-on modeling.

The caveat: If your company has a high volume of transactions and lots of accounts payable and vendors to manage, you may need to bring that accounting help in-house sooner.

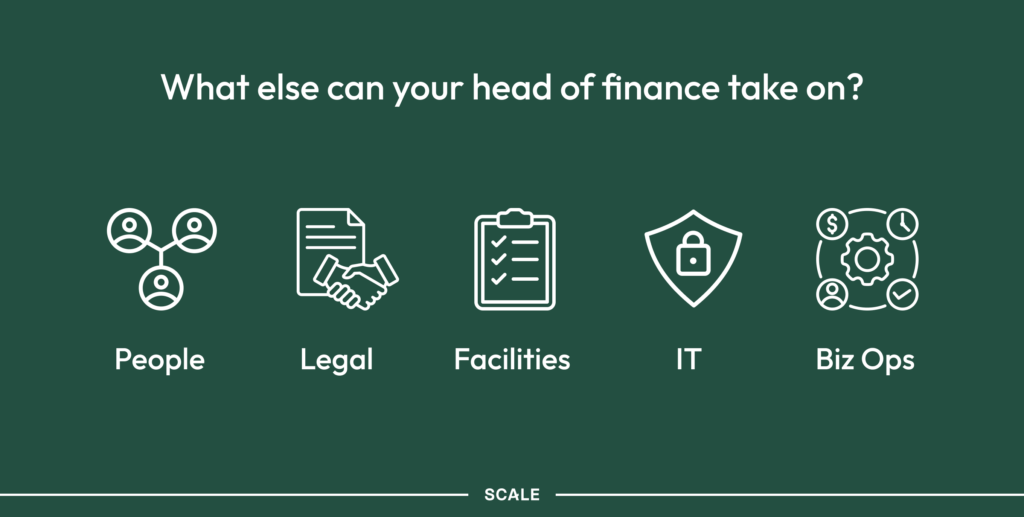

In building out your team, at this early stage, you don’t want to hire people who have strict “lanes.” The team’s purpose is to help grow the company and the last thing you need is more general and administrative expenses—like finance or operations people. A strong generalist is more valuable than a hyper-targeted specialist at this stage. You need people who’ll roll up their sleeves and manage the business operations team, HR, and IT.

Here’s what that team will look like as it grows.

Your first head of finance’s first 90 days

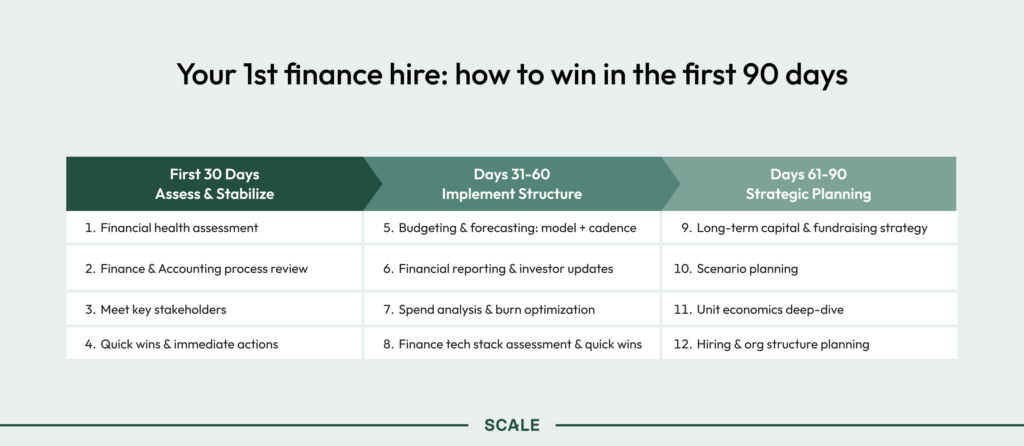

Every head of finance is going to need some time to understand what preceded them and how your systems work. We recommend measuring them on whether they can hit the milestones pictured below. They should get your mission-critical systems figured out within 30 days (accounting, payroll, expenses), reform your financial reporting and spend structures within 60 days, and start strategic planning within 90 days.

All this makes the case for hiring someone who’s done this before. You can’t really afford to have this individual testing and learning for the first time.

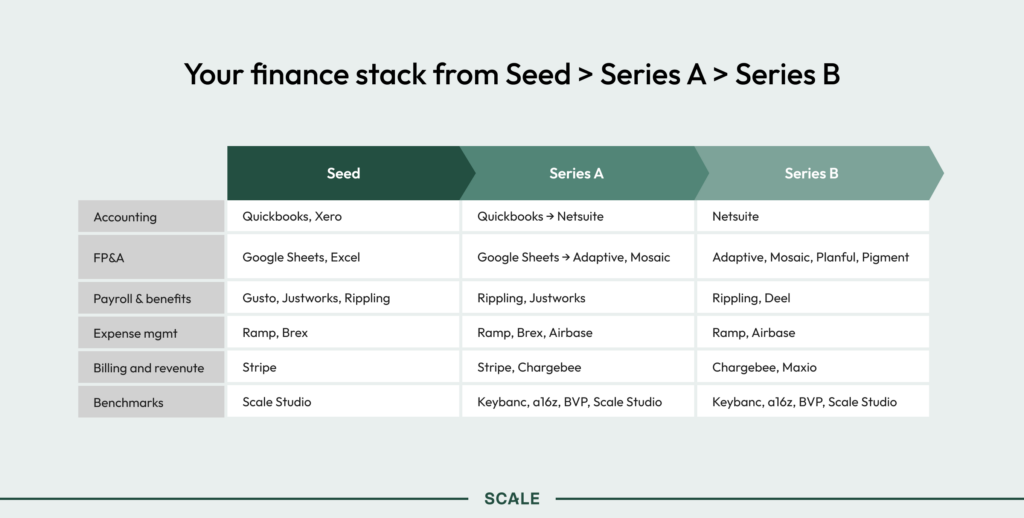

Your head of finance should be setting the foundation for scale, visibility, and discipline from day one. For example, if they know you’ll eventually launch a product-led growth motion, they should anticipate that in their reporting and ledger accounts so they don’t have to refactor everything later. At the same time, and this is why startup finance is difficult, they should be able to do almost everything in spreadsheets.

This is the overbuilding fallacy we talked about earlier: Some new heads of finance may long for the FP&A software they had previously, but spreadsheets and QuickBooks can often get you to Series B. A key trait for this person is they are as relentlessly focused as you are on what drives efficiency. They should be excited about reducing costs and finding ways to automate—not just for the direct savings, but the secondary savings of making fewer manual mistakes.

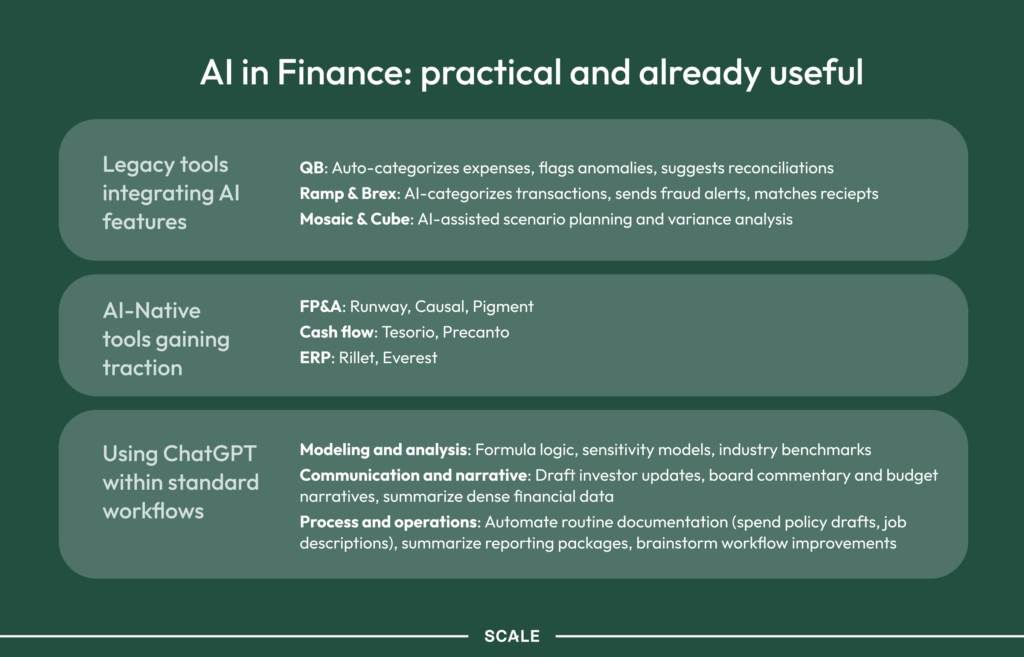

Your head of finance should be just as excited about AI as you are. They should be looking into auto-categorization and automated scenario planning; using ChatGPT to build complex formulas and Claude to draft scenarios. If there is a reason to move off spreadsheets early, it should be to permit more integration and automation. How can you get to true AI forecasting? Generated model scenarios? Can they save themselves a junior employee?

Your head of finance should be excellent at establishing processes. They should be anticipating your questions and gathering the data in advance of when it’s needed. They will produce:

- Internal reporting—Core metric to track and review.

- Financial planning—Forecasting and budgeting processes.

- Accounting—Monthly close and spend controls.

The metrics they select are vital, and you are an important partner in that conversation. They should only track metrics if you both know what decisions you plan to make with them. It’s far too easy for a finance team to produce a complex Excel dashboard full of numbers that don’t actually relate to how you run the business. All metrics must align with topline business strategy—if they don’t make sense, continue asking questions.

Pictured below are metrics we recommend—5-7 is plenty. Focus on both leading and lagging indicators so you know what you should do now and what to do next time. Prioritize what investors want to see and make someone in leadership responsible for each one. Set a review cadence—possibly as often as weekly, where you look at cash and spend, new logos, and how much pipeline you’ve built. This meeting brings all that nervous system data back to you so you can make decisions.

![]()

With that, here’s the dashboard spreadsheet

We’ve built all of the above into a dashboard and board reporting spreadsheet. It’s organized by timeline, left to right; years roll up, then quarters, then months. Anything in blue is a data input. If you put all this information in and keep it up to date, you can see your churn rates, waterfalls, unit economics, sales data, bookings, and more.

Your new head of finance can help you build it out. They can add additional information like number of salespeople as well as number of ramped salespeople, but we didn’t want to overcomplicate it. As the rule goes, don’t overbuild. Spreadsheets like this one can take you most of the way at this stage.