AI Apps

Historically, SaaS applications have served to store and report on data. The next generation of intelligent business applications will move beyond merely organizing the work product to actually automating the work. The scale of the opportunity for companies building in this space is in the trillions of dollars currently spent on labor to complete the mundane and repetitive tasks able to be completed by AI, or “mechanical turk work.”

We believe that this shift is so substantial that in many cases incumbents will be unable to adapt their legacy applications, leaving significant room for new entrants. We see potential across a range of industries, functions, and business models to capitalize on these opportunities.

Industries and functions we frequently return to include sales, medicine, law, finance, insurance, customer service, and various areas of work traditionally addressed by BPO firms. We see potential across various business models, from playing the role of an AI-enabled agency, to serving as a system of intelligence sitting on top of various long-standing systems of record, or even building a new system of record category through a new AI-enabled wedge product.

Areas of interest

Law

Though the legal profession has historically been slow to adopt technology, we believe LLMs enable a huge step in the value lawyers can draw from legal tech.

Few fields are as text-based as the law. Common sources of information include a firm’s document management system, an e-discovery system, or a case law database. Work output is almost always in the form of a Word document, or occasionally a text-based spreadsheet, and often is the result of synthesizing various research sources, identifying text relevant to a particular fact/issue, or revising relevant clauses to be more in-line with the desired position.

We are excited to explore new solutions for litigators, transactional lawyers, and specialists in tax and immigration, as well as in-house counsel.

Finance

A few precious “aha!” moments of insight drive enormous value in the finance industry. Getting to these moments is often the result of gathering mountains of unstructured data drawn from a variety of siloed data sources, both public and proprietary, and then distilling these down to key insights points as inputs for deeper thinking. In the status quo, this distillation is a fully manual process, driven by armies of highly-paid junior staff who summarize 10-Ks and earnings calls, build excel models, and equip their teams for decision-making.

AI holds substantial promise for getting to these moments of insight more quickly and cheaply. Examples include: LLMs for crunching textual data and performing reasoning tasks, agents that can “own the excel” (structure numerical data and build models), and knowledge graphs for representing market data on key deal terms.

Accounting

Millions of SMBs use a combination of accounting software and third-party bookkeepers to manage their finances. Intuit’s QuickBooks dominates the market for small business finance software, claiming 8 million small business customers. And, there are nearly 2 million bookkeepers and accounting clerks maintaining those books.

A small business might pay $500 annually for QuickBooks but $5,000 to the bookkeeper who keeps it running. Right off the bat, one thing is clear: the big opportunity here is to automate the rote manual work done to make QuickBooks work. (More here.)

We’re excited by the opportunity available to do just this that is presented by LLMs, which can help solve tasks like GL categorization, better data extraction from PDFs, and automating FP&A analysis.

RFP response writing & procurement

The RFP’s response writer’s workflow is one of sifting through prior responses, marketing materials, pricing calculators, and certifications to write responses that are thorough, bespoke, and highly repetitive. The manual labor involved makes RFP response writing expensive and combined with hard-to-scale capacity can make the workload of writers a rate limiter on growth.

However, this information collection and drafting process is one clearly well suited to Retrieval-Augmented Generation (”RAG”) for automating the rote work of RFP response. Such products shift the role of the RFP response writer from a collector of information to a strategist on the optimal response. Further, feedback loops offer the promise of improving response success rate by learning what the most performant responses look like.

Similar opportunities exist for automation on the procurement side of these relationships, where LLMs can assist the buyer in building structured analysis of bids received.

Architecture and engineering

Today many software-driven architectural and engineering processes (e.g. BIM-creation and 3D model rendering) remain highly manual. As a result, new iterations on a design can take days, and the solution space of possible designs remain under-explored, with these professionals forced to follow their intuition for a “good-enough” design given the obstacles of slow and manual iteration.

A new generation of software products for architects and engineers replace manual iteration and rendering with AI copilots that variously (1) simulate all possible iterations of a design and (2) automate manual steps like rendering.

Creative tools

Many of the predominant software tools of the creative profession are the same that have existed for a decade or more. These products are cumbersome, can take years to master, and are too burdened with legacy technology to easily integrate new features.

Against this backdrop are entering a new cohort of startups with a focus on collaboration-first functionality, AI-enabled UI, and text-based generation. These features make them an exciting new choice for a next-generation of increasingly multi-disciplinary creatives and marketers, who appreciate a reduction of tedious manual steps in favor of more time for actual creative work.

BPO automation

LLMs have opened the frontier for automating some kinds of work end-to-end (leading many to adopt the refrain of ‘sell work, not software’). Nowhere is this approach a better fit than in replacing the incumbents in a variety of Business Process Outsourcing (”BPO”) categories. These are firms who manage for-hire workforces that are often low-skill and high-turnover on behalf of clients who just want the work done. We expect these clients will be just as happy to pay for automation as for human labor if the end product is of similar standards.

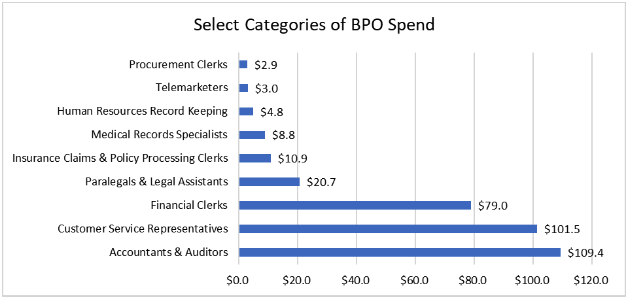

Though the most obvious of the BPO categories is contact centers, we have identified 10 BPO markets of interest with a meaty ≥$2B of spend (a list that we certainly do not view as exhaustive).

Task automation

For some time we have been focused on the enterprise automation market. The paradigmatic use case for such companies is automating many-click and data-entry workflows that are high-frequency and low-variance. Vendors like UIPath have allowed companies still stuck on legacy systems to move data around their internal systems without having to hire an army of people. Ideal customers are those stuck on legacy systems and ideal workflows are a combo of both high frequency and low variance. These solutions are great where a good fit, but there’s a few critical downsides:

- It only applies to customers with sufficiently high-frequency, low-variance use cases.

- Implementations are brittle and break when components of the process slightly change.

- Required process mining is a heavy upfront cost for the customer to bear

Historically, solutions like UIPath have offered substantial ROI once properly implemented, but the problem with RPA and process mining today is that they have built out a portfolio of hyper functional or vertical specific solutions that still require massive implementation projects. Then after the upfront time and cost to manually create the automations, they are constantly breaking as components of the process slightly change.

Today, there are signs that an LLM-enabled alternative to RPA may effectively address all three of these challenges, with the capacity to build automations that are more context aware (and thus more flexible) and with much less training data required.

Education

Historically, educational content has been static, relatively one-size-fits-all, and offered limited interactivity. School teachers face a substantial burden in identifying which students are struggling where and in keeping these students on pace with the curriculum, while also completing the rote manual labor of grading assignments and managing the classroom. For those who seek ongoing learning, these same limitations leave would-be students stuck between the challenges of self-guided education and inconvenience of in-person learning.

New AI-enabled products address these challenges for learners with new abilities to (1) identify errors and gaps in understanding and (2) generate personalized explanations and course materials, all while making the learning experience more engaging. Meanwhile, for teachers, a handful of new products offer to automate the more rote parts of the job (content creation, grading, and even identifying where knowledge gaps exist), enabling educators to devote more time to student interaction.