Ideal customer profiles are a great example of what sales trainer David Sandler called “mutual mystification,” which is when people nod in agreement but fail to understand each other. Just because everyone in sales and marketing uses the term “ICP” does not mean they share a definition. Few can explain it generally, much less specifically, in terms of their actual buyers. This matters because, without a definitional anchor, people tend to use the term for whatever person or group is before them. They wind up scattering their budget and effort across a broad expanse of accounts that never had any hope of buying and struggle to hit industry benchmarks.

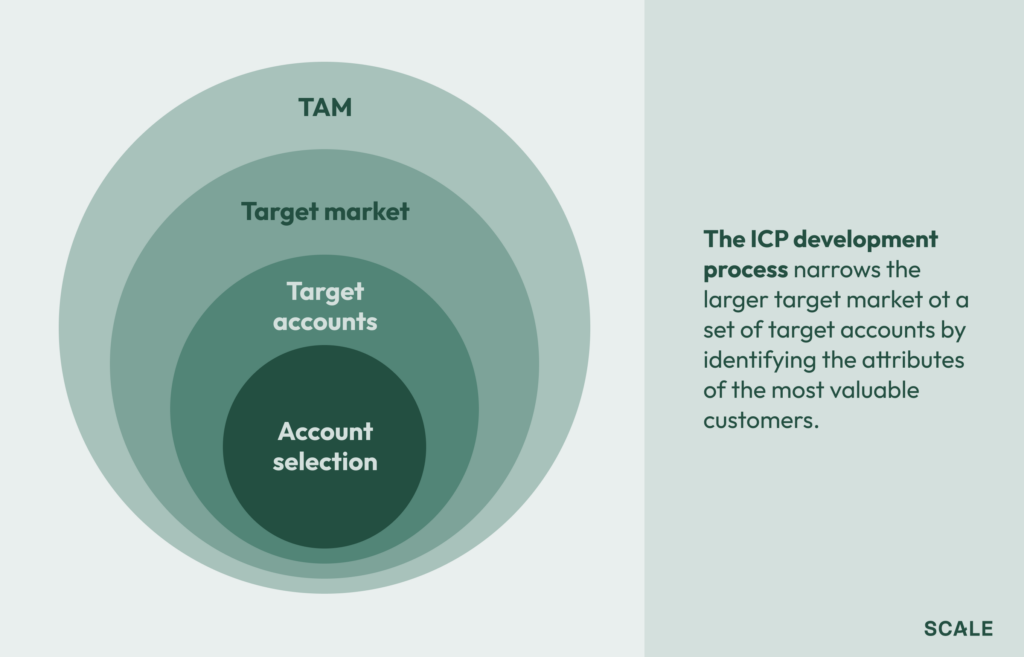

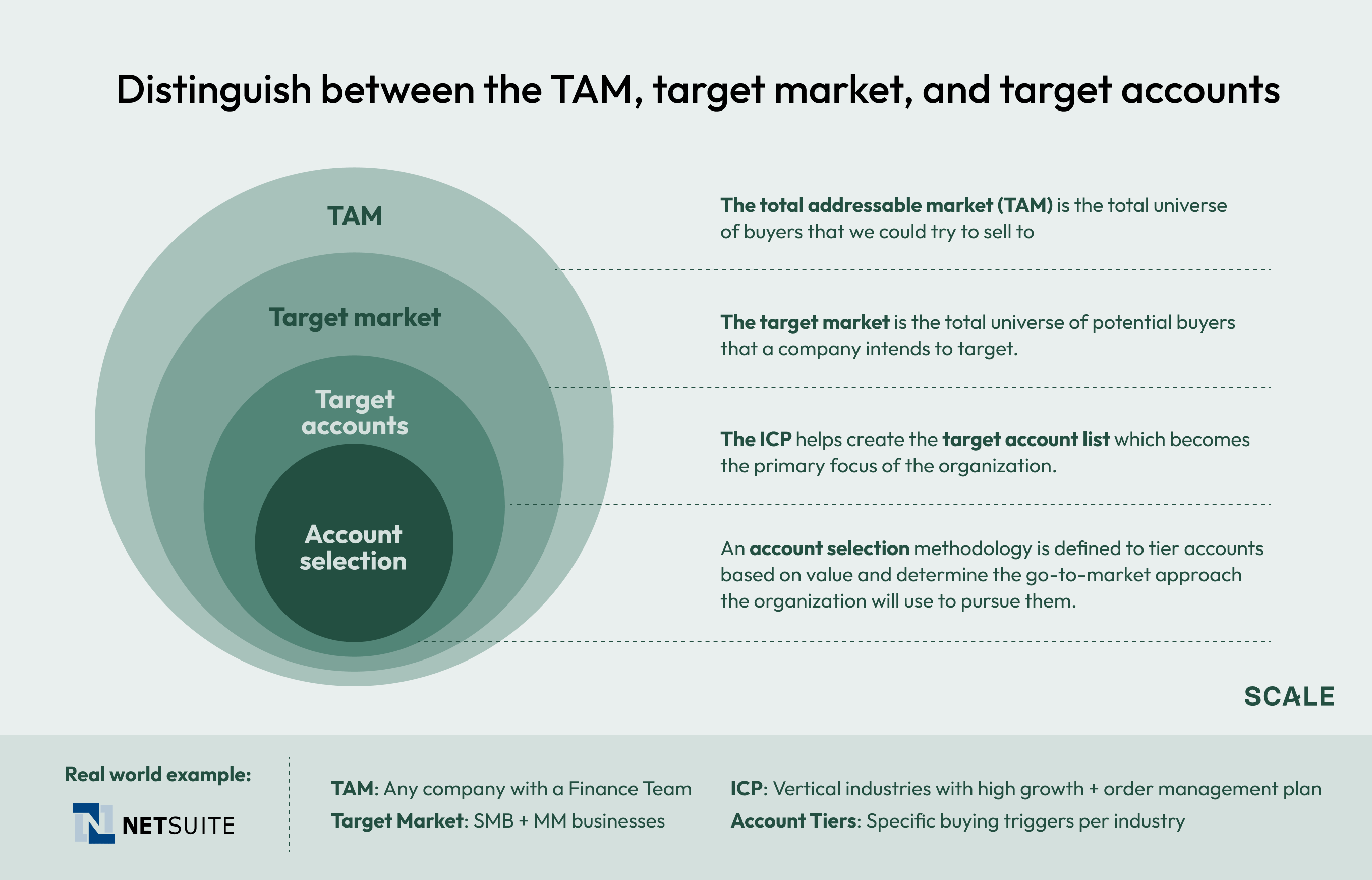

Here is the definition, simply: Your ideal customer is a manageable subset of accounts from your target market. And whereas the target market is an imprecise estimation of all the companies who could eventually buy, your ideal buyer profile is an exact list of companies in your database you plan to go after.

This narrowness is the point. Rather than diffusing everyone’s effort, you focus on the accounts most likely to buy big, buy fast, and grow. It may distress everyone to have to say “No” to chasing the whole market, but in the end, it leads to more “Yeses” and more revenue.

In this guide, we explain the process for narrowing that entire market down to just the accounts you want to target and select. Then, to operationalize that definition within your organization. We’ll share everything you would learn in one of our ICP workshops including examples of companies that focused their ICP and sold more.

This article is based on a presentation by Mini Peiris, Chief Marketing Officer at Nintex, and Craig Rosenberg, Chief Platform Officer at Scale Venture Partners, in August of 2023.

But first, why ICP projects can fail

The thing that gives an ideal customer profile its power is universal agreement and observance. As anyone who has tried to change company course knows, this is no easy task. Much can go wrong. For example, you can complete the full exercise in this guide, and in the end, it won’t work because:

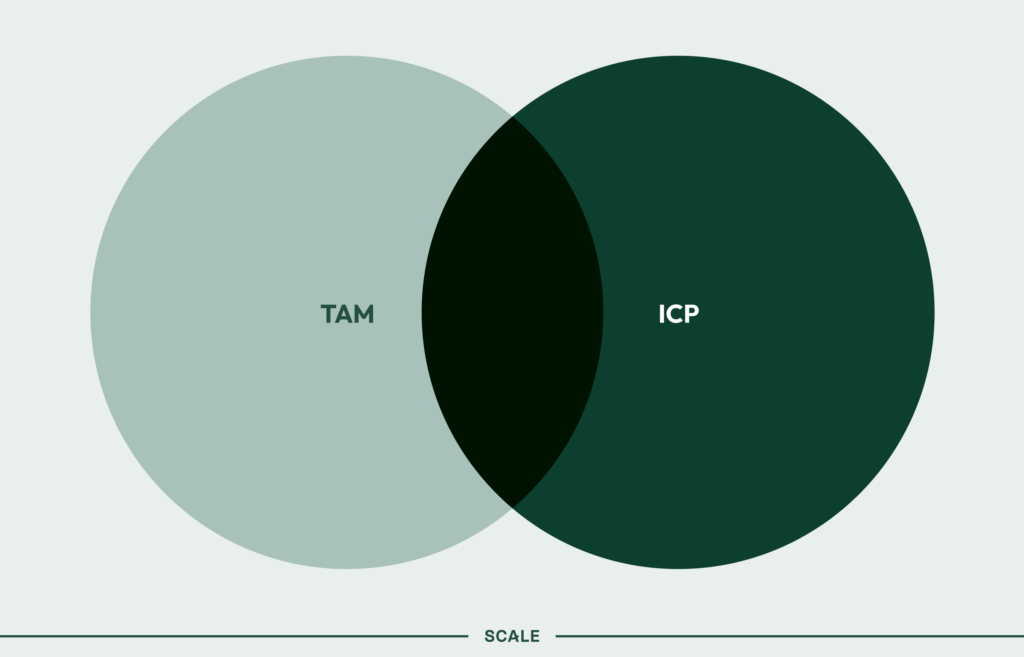

1. There is no real difference between ICP and TAM

Some revenue leaders may struggle with the idea of limiting their target accounts. They’ll argue to enlarge the ICP until it is basically the TAM. This means the organization has resisted the hard but necessary work of making difficult decisions. It is an early warning sign that they will diffuse their effort across too many low-value opportunities.

2. It was primarily created by one team

2. It was primarily created by one team

You cannot achieve organizational consensus if all parties aren’t present. If marketing simply decides, they won’t have buy-in from sales, product, and success, and changing everyone’s behavior will be difficult. Even if sales leadership agrees, salespeople may still quietly disobey. You must bring everyone through the process so they know how you arrived at the result and see how it benefits them.

3. The company doesn’t actually operationalize the account tiers and target

Sometimes the project never goes beyond intellectual exercise, either because marketing operations was not involved and the definition is not actually technically feasible or because senior leaders aren’t willing to get it done over other priorities. If it is not made operable in all your revenue systems and teams, it will not work.

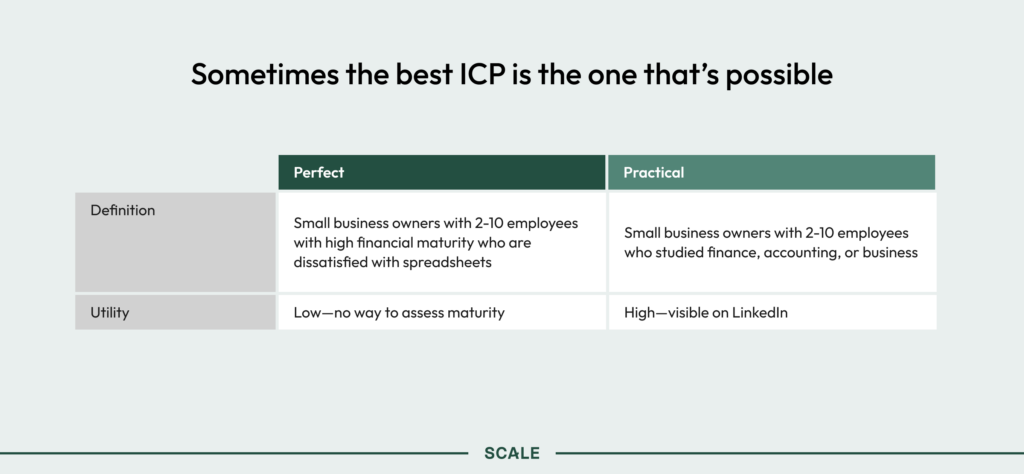

4. There’s no tie to objective data sources

An ICP definition might not actually be measurable or trackable. For example, if it relies on, say, margin data for small businesses that don’t even collect that data themselves. Or if it’s based on an unmeasurable mindset, like “chief legal officers seeking to grow their influence,” where there are no publicly available signals of that intention. ICP definition is the art of the possible. It means using the data that actually exists.

5. Leadership doesn’t regularly hold everyone account

Sales and marketing teams who are already under immense pressure probably won’t change unless forced to. If some leaders fail to help their team to act on the new definition, the project can lose momentum.

With those risks in mind, let’s explore the ICP exercise.

Conduct your ICP planning in time for next year

Redefining your ICP is not free. Pipeline will temporarily dip as sellers and marketers figure out that new motion, stumble over new questions, and form new habits. As such, it’s important to be ready for that short-term pipeline hit and schedule it for the beginning of the fiscal year. This allows you to cleanly update quotas to match and gives you three quarters to make up for the loss. Planning for next year may also buy your marketing and sales development team time to start testing messages and building early pipeline.

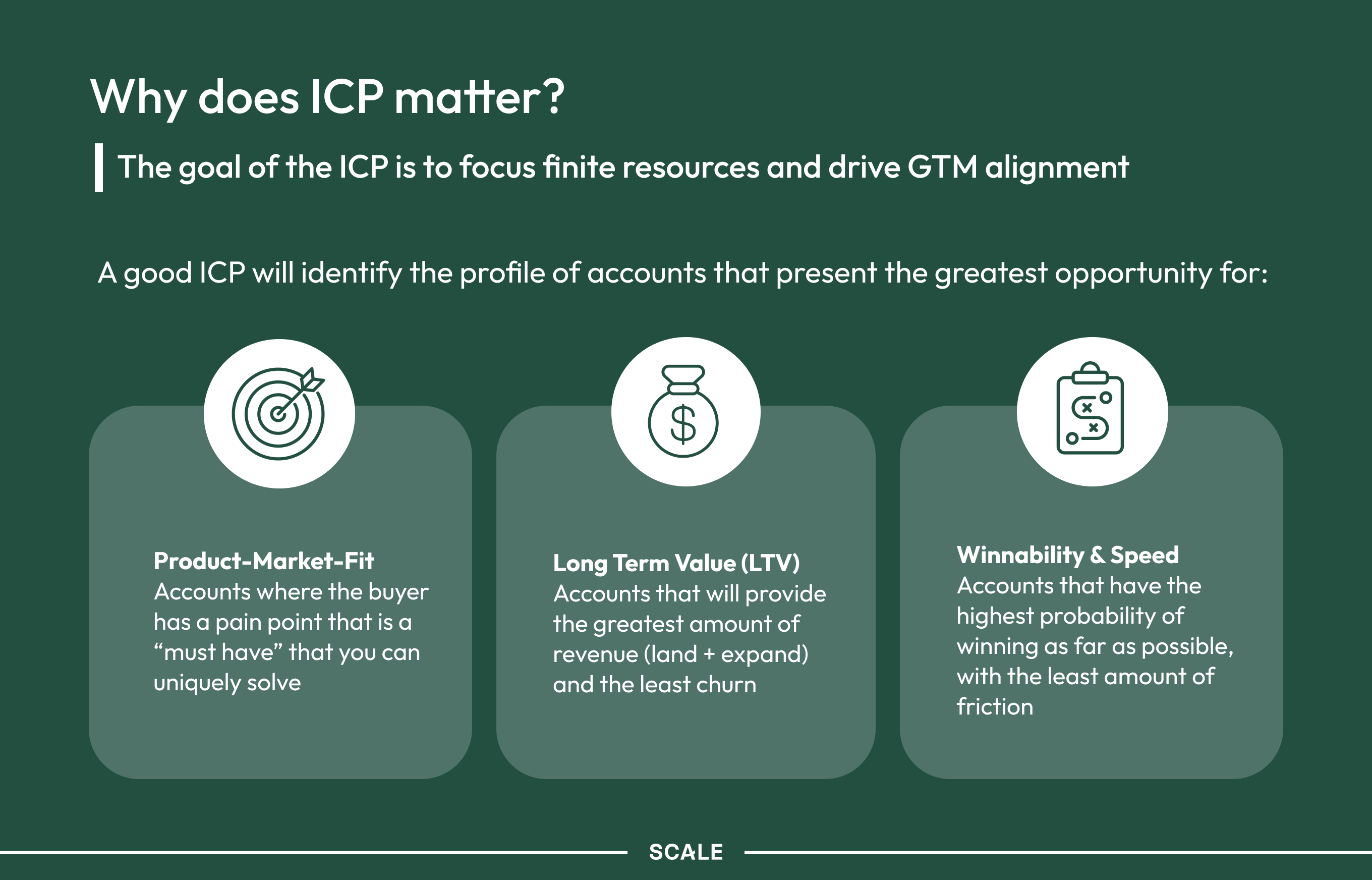

If a hit to pipeline sounds bad, the cost of not defining your ICP is worse. Few things are more expensive than selling to the wrong buyers at the wrong times. The ICP exercise will ensure that after the dip, you swing out of the decline with a higher win rate. You’ll be focused on accounts for which you have product-market fit, are likely to increase their billings, and will sign fast.

Define your target market, then apply criteria “filters”

A good ICP definition will have three qualities:

- Meaningfully narrow focus—It allows you to conduct proactive, outbound efforts to a limited set of high-value accounts with limited sales, marketing, and executive resources.

- Data- or signal-driven—It’s based on specific, measurable attributes that you can identify before sales development or sales talks to the account.

- It’s easy to understand and apply—Keep it simple. It is better to be memorable than utterly correct.

In practical terms, narrowing means carving a target market out of your total market and selecting those accounts you can reasonably reach this year. While the total market likely includes some customers that you want but can’t yet service, the target market is bracingly practical: It is just those companies that you could sell to today and who would get value.

But of course, your target market is still too large for your team to build campaigns for. That’s why you segment once more to build your ICP. Select target accounts within that market that you could send outreach to immediately.

To get to that much-reduced list, you are essentially applying a series of criteria “filters” to the overall list. Let’s explore a real-world example using NetSuite:

- Total addressable market = any company with a finance team

- Target market = same, plus small-to-medium businesses

- Ideal customer = same, plus vertical industries with high growth and order management pain

- Account tiers = same, plus specific buying triggers per industry

What criteria should you apply?

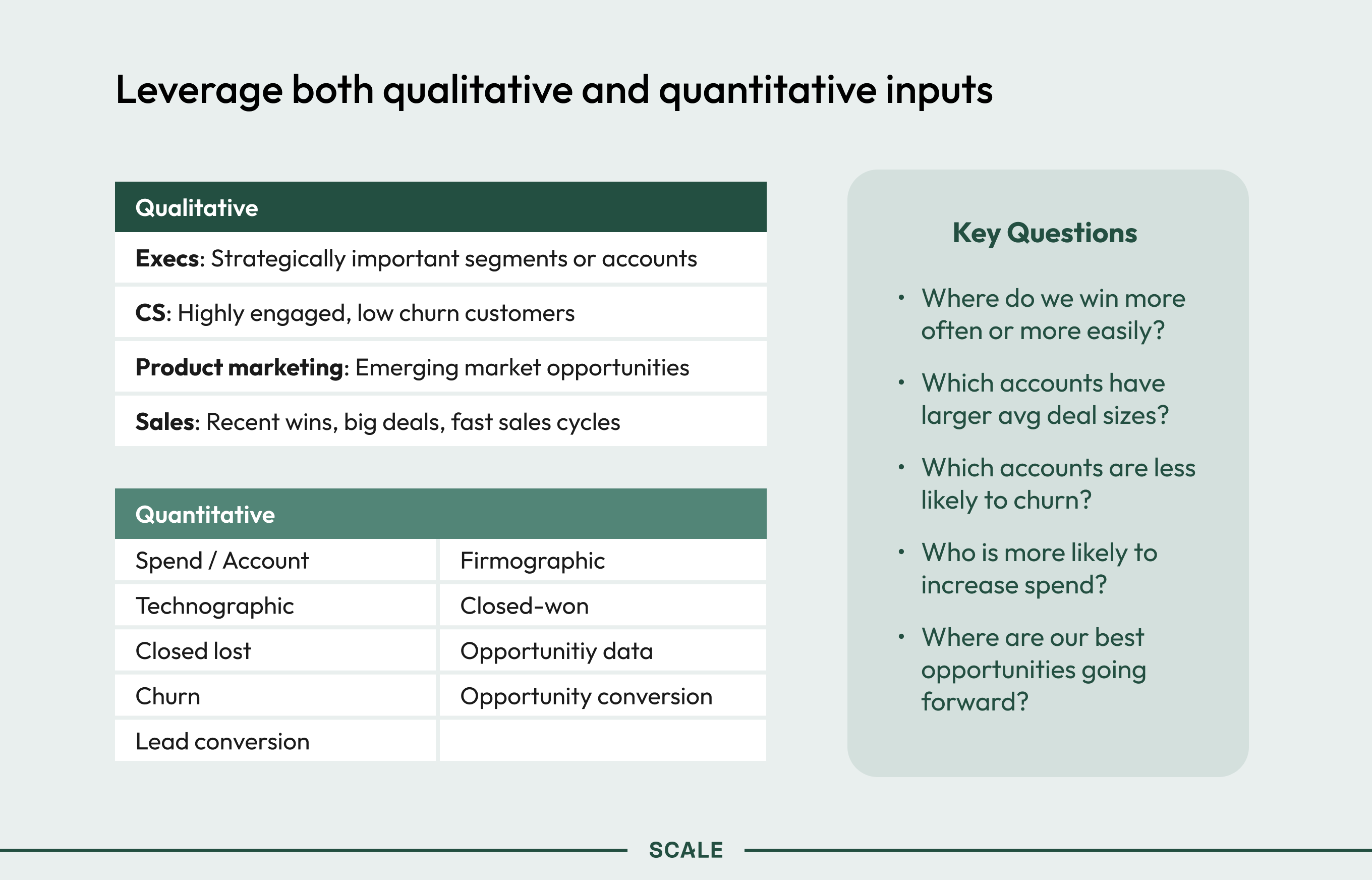

To decide on your list criteria, run a team exercise. Gather a leader or authorized representative of each team to brainstorm all the inputs you have with which to make a decision. Rank the attributes in order of practicality—how useful is that attribute, and how practical to gather and track? By the end of this session, you should have a theoretical definition of your ICP.

At this point, those criteria can be both numerical data like opportunity data and just team ambitions. As useful as quantitative data is, it is by definition, retrospective. It can only tell you how things went, not where they will go. For that, you’ll need to leave room for your team’s foresight and intuition. For example, executives may have ambitions to land a strategically important set of accounts whose logos will unlock new segments. The customer success team may want customers that are easy to service, so they can scale. Sales might want to overlook some big recent wins that they don’t feel are representative of where the market is headed, and so on.

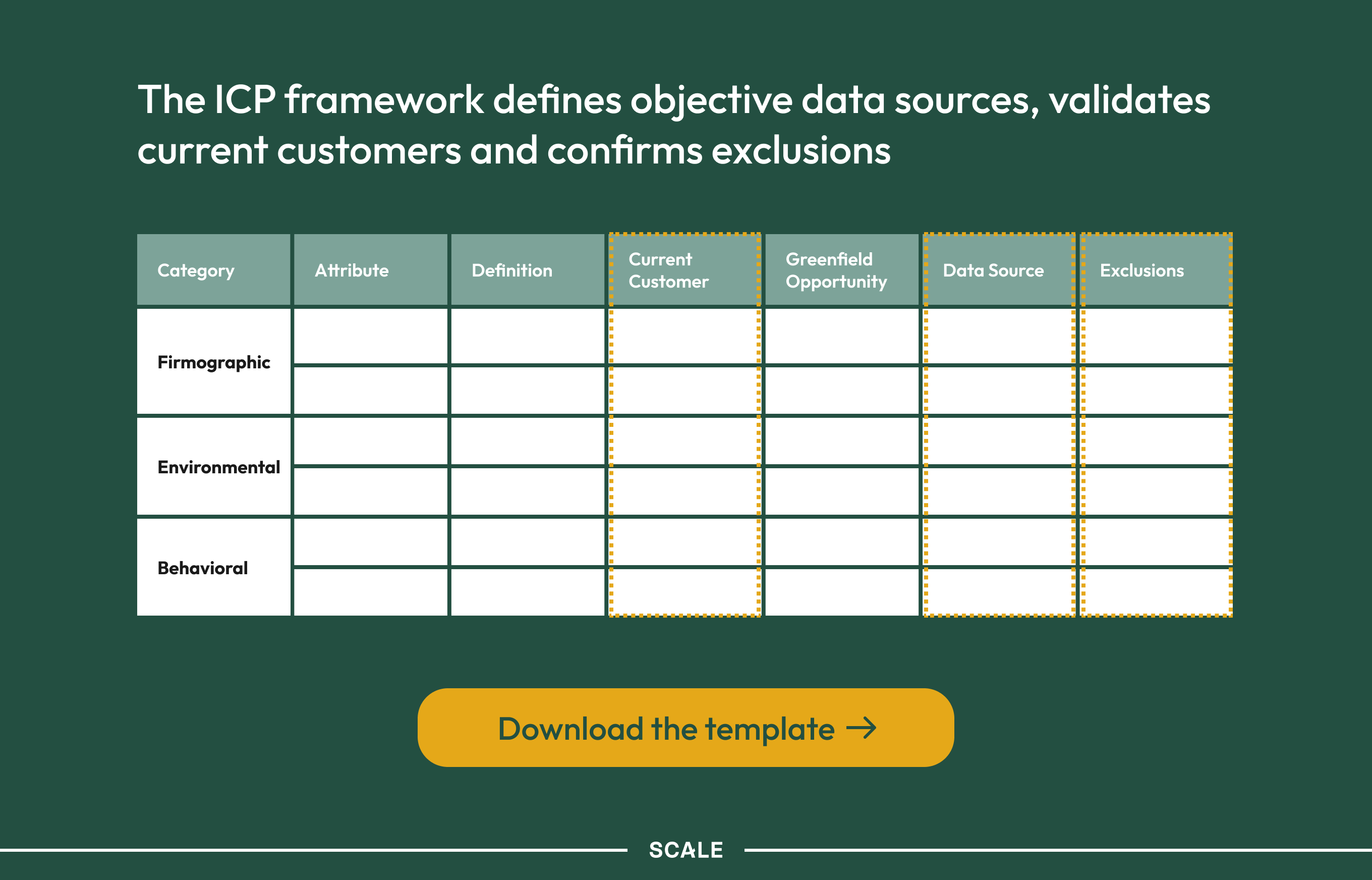

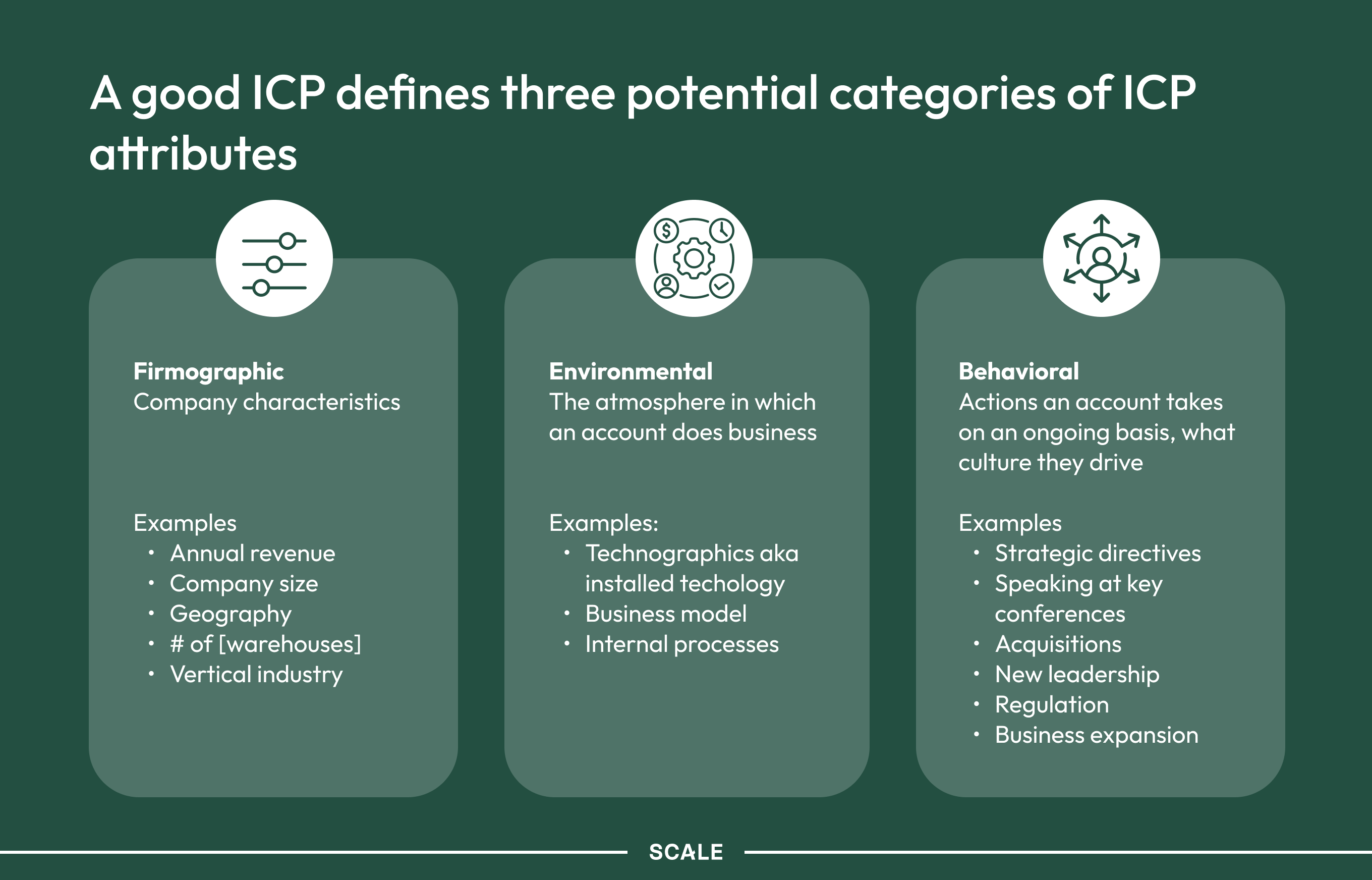

List all those potential inputs on a whiteboard or similar. Then start to work back from there to the specific attributes you’ll use to measure your ideal buyer. You’ll want to select a spread of attributes across the three possible categories: Firmographic, environmental, and behavioral. Together, they’ll help you triangulate to an actionable definition across systems.

Use all that information to complete the ICP definition using the template below. Congratulations, this is the first step. Next, we discuss how to operationalize the ICP, with examples.

Operationalize your ICP

This step takes much more than a workshop. It is the foundation to producing your entire go-to-market approach, for everything you do in sales and marketing should help answer the questions, “How do we engage and sell to the companies in our ICP?”

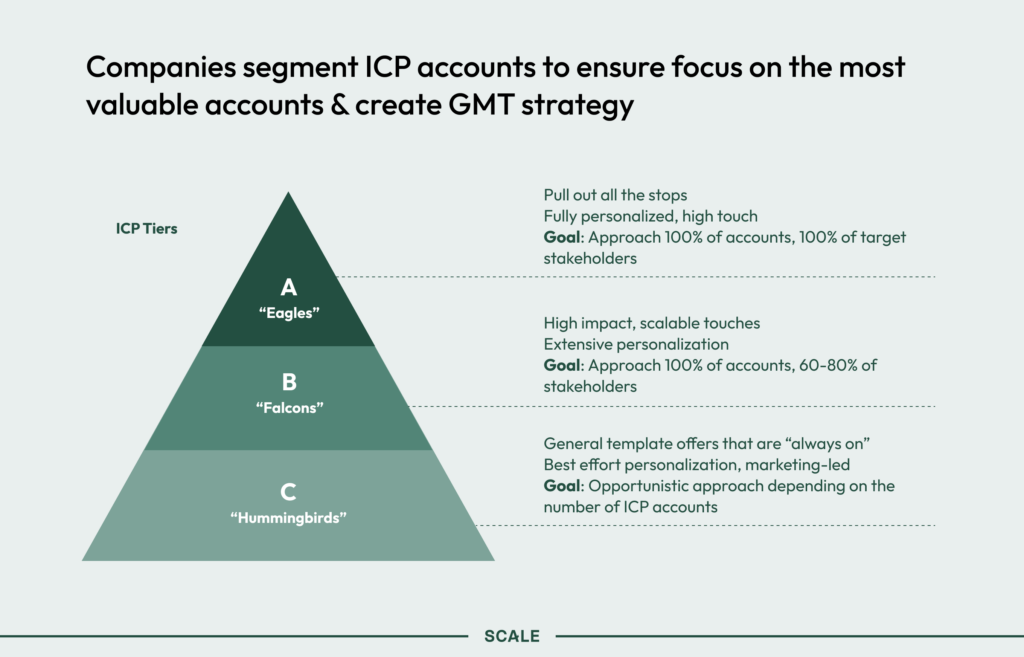

You can’t target your entire ICP at once, so as a team, you’ll carve out a target account list which you will begin reaching out to immediately.

You’ll then build a go-to-market approach by account tier with an account-based sales and marketing strategy.

Next:

- Appoint an owner of the target account list—This person or team’s job is to keep it evergreen

- Map the stakeholders within target accounts—Best practice is at least three contacts

- Align on MQL, SQL, AQO definitions and criteria

- Identify buying triggers

- Define high-value offers

- Establish demand campaigns for extra cover

Every single agreement above should be reflected in writing and also be encoded in your software systems. This is why it is crucial to have revenue operations involved: If your ICP is true but cannot be implemented because of an API, software, or ad network limitation, that must inform the definition. It must be as true everywhere in your workflows and systems as possible.

Here’s a real-world example: Ambra narrowed its list down to just 10 accounts per salesperson, set a weekly meeting, and set a game plan per subset of accounts. They then developed and sent highly targeted, research-intensive outreach to match what they inferred were each account’s strategic initiatives. They personalized all outreach by solution stack, role, and region. By the end, they were driving far greater results than when the salespeople were targeting more accounts.

Examples of increasing performance by narrowing an ICP

- Doubling revenue by narrowing their focus

Before the workshop, there was no difference between this company’s TAM and ICP. They didn’t have the sales and marketing resources to cover all accounts, and efforts were opportunistic. Little was repeatable. Go-to-market teams didn’t have basic definitions like what a “strong balance sheet” was (an important but murky criteria) and there was no way to know if they were open to software solutions other than through salespeople qualifying them.

- Tripling customers

Before the workshow, this global communications company had three major lines of business in six regions, which meant 18 separate ICPs — and executives across the various lines of business did not agree on those ICP definitions. Further, they were applying their marketing and sales resources equally across all.

- Enabling scalable go-to-market campaigns

Before the workshop, this supply chain startup didn’t have a documented ICP. Founder-led sales had taken them far, but it wasn’t replicable and new reps weren’t able to ramp and be productive. The sales team was selling randomly and simply picking recognizable named accounts in industries they were personally familiar with.

To win, narrow everyone’s focus

Here’s the tricky part: Your ICP is not static. Whoever owns your account list must be constantly pulling off sold deals and cycling out closed-lost ones. What you learn in that go-to-market and how you progress through the target list must filter up into your ICP definition, target market definition, and total market definition. But if you invest this greater effort and commit the focus of all your activity to better-fit accounts, ICP can be a way to earn 10X more results from your same marketing spend.

And if nothing else, it marks the end of “mutual mystification.” With nothing definitional left to argue about, revenue teams will have no choice but to reconcile with why outreach isn’t working, and how they can work together to pull out a win.