This is the accompanying template to our Liquidation Survival Guide Vol. 2.

The goal of this guide is to help entrepreneurs, venture capitalists, and any others who are entangled in the nitty gritty details of modeling these complex liquidity situations.

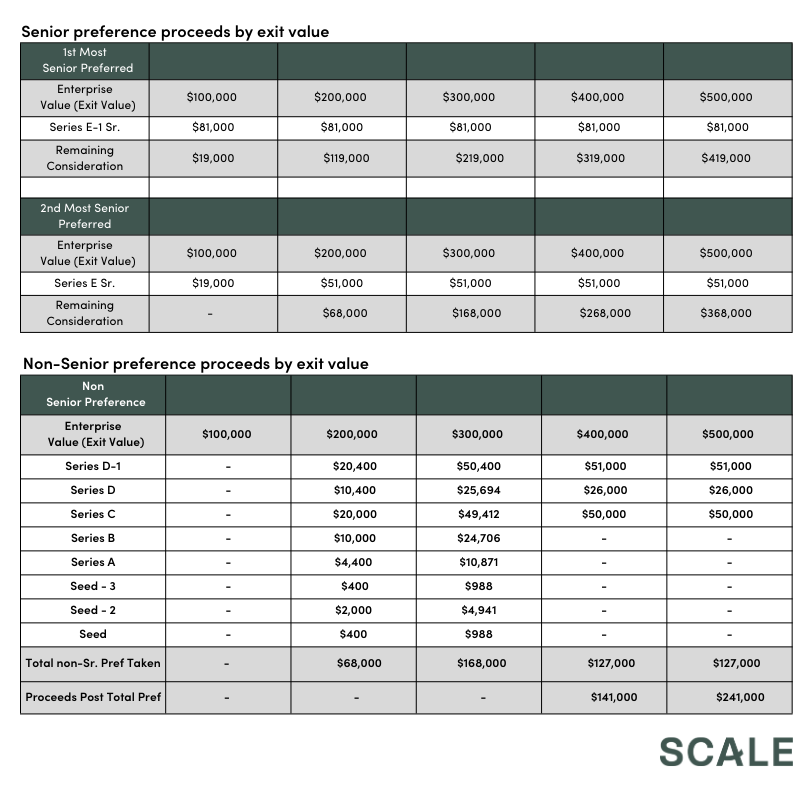

Seniority is the first attempt by investors to add structure to a term sheet. We won’t go too deep into why investors add structure (I would again encourage you to refer to this article by Charles Yu for more context). The high-level idea is that seniority is a risk mitigation tool where the investors with seniority get their preference ahead of other preferred investors to help protect against losses. We’re going to walk through how the previous analysis changes to account for the introduction of seniority, and of course, the consequences on distributions.