In the first installment of our Liquidation Guide, we showed how to calculate liquidation under the cleanest scenario, with Non-Participating Liquidation Preference and No Seniority (the base case). Today, we’re going to explore how things change when we add seniority to a cap table.

Seniority is the first attempt by investors to add structure to a term sheet. We won’t go too deep into why investors add structure (I would again encourage you to refer to this article by Charles Yu for more context). The high-level idea is that seniority is a risk mitigation tool where the investors with seniority get their preference ahead of other preferred investors to help protect against losses. We’re going to walk through how the previous analysis changes to account for the introduction of seniority, and of course, the consequences on distributions.

The Excel template for this example can be downloaded here.

How Seniority Changes the Base Case Model

When doing this type of analysis, the first step is always to gather all the inputs and figure out the point of conversion for each series. This is actually the exact same as in the non-senior previous scenario that we went through in Vol. 1, so we’re not going to walk through all those calculations again. We’ll discuss in more detail below the effects of seniority, but it’s important to note that it does not change the conversion price, it is only shuffling who gets their preference, and when. Check out Vol. 1 if you need a refresher on this first piece.

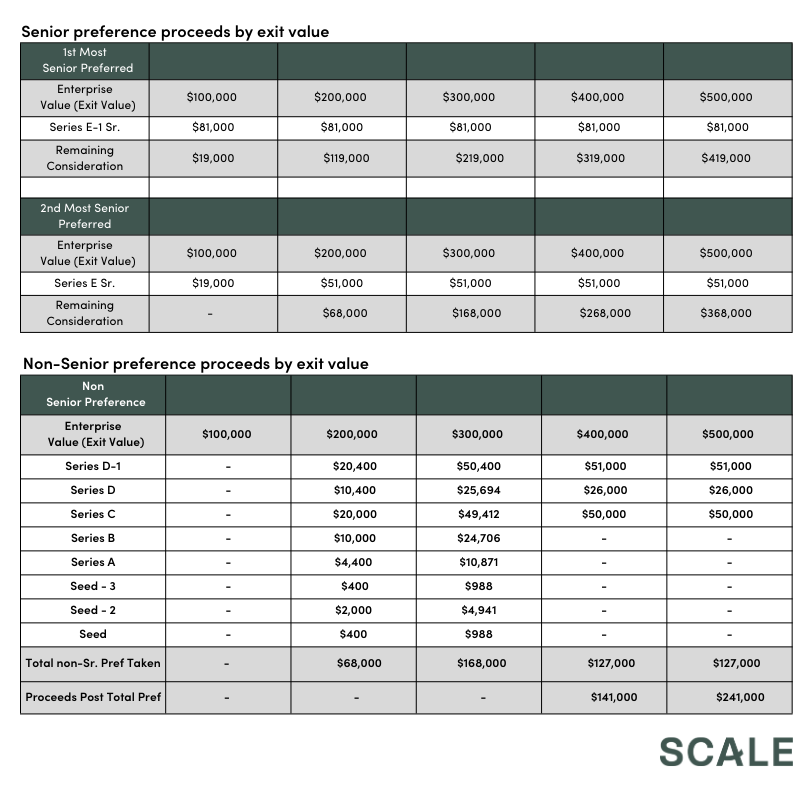

The real difference is the proceeds distribution. Instead of having one big section for the preferred distribution like in the base case last time, we’re now going to have a section for each of the senior preferred series (series E-1 and E) and then a section for all the other preferred series (Seed to D-1). See below how we structure it and now let’s discuss the new logic for each piece.

Senior Preferred Logic

Senior preferred series get their preference before the other preferred series. Based on the table above, let’s break down the logic:

- For both series E-1 and E, the first part of the logic is the same as in the base case (without seniority). If the remaining consideration to equity holders is greater than their respective conversion points, then they convert to common and don’t take their preference.

- If the series doesn’t convert to common in the last step, then the series with the most seniority (series E-1 in this case) gets either their full preference amount – or if the remaining consideration isn’t enough to cover their full preference – then they get the full remaining consideration.

- The series with the next most seniority (series E) asks the same question (assuming they didn’t convert to common in the first step), except now they are looking at the remaining consideration after the most senior series took their preference. So they get either their full preference amount or – if the remaining consideration isn’t enough to cover their full preference – then they get the full remaining consideration (again after the Series E-1).

- We only have two senior preferred series in this example but the logic continues for as many senior series as you have. There could be a situation where all series from seed to series E-1 all have seniority. Assuming the seniority follows chronological order, then the series E-1 would have preference first and the seed would get their preference last. This would also be how preference would be taken if this scenario wasn’t pari passu.

Non-Senior Preferred Series Logic

We also need to tweak the logic for the preferred series without seniority to account for the fact that the senior preferred got first dibs on the consideration. Because we’re assuming pari passu, the revised logic is the same for the rest of the preferred series. Let’s break this into a few parts:

- If the remaining consideration after the senior preferred has taken their preference is less than the remaining preference stack, then each series will take their prorated portion of the remaining consideration. Remember, it’s their prorated portion of the remaining preference, so this doesn’t include the series E and E-1 in this situation.

- If not, then for each series you check if the initial consideration to equity holders (before the senior preferred) is greater than the conversion point. If so, then the series convert and the preference taken is 0. It’s a super important detail here that the point of conversion is still compared to the initial consideration to equity holders before the senior preferred take their preference. Adding seniority does not change the point of conversation!

- If neither of the above is true, then the series take their full preference.

Those are the only changes. All other calculations are the exact same as in the base case (see Vol. 1).

How Does Seniority Work in Practice?

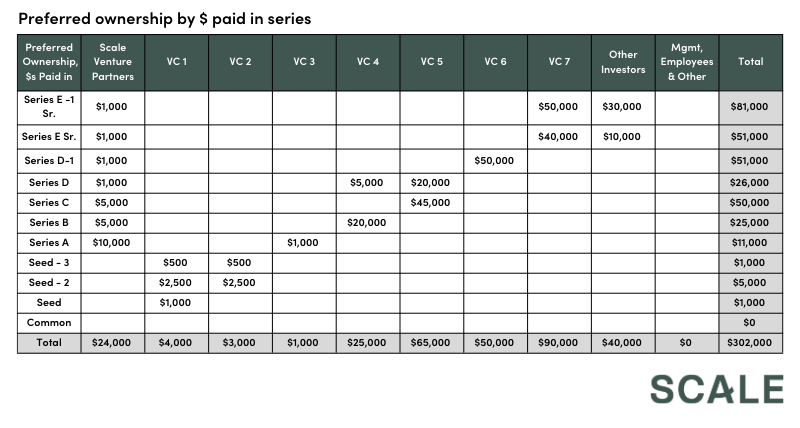

To demonstrate what happens when seniority is introduced, let’s take the logic above and show what happens with real numbers. The below table has the exact same numbers as the base case, but with the Series E-1 and E now having seniority.

As you can see in the above table, series E-1 has $81M of preference and series E has $51M of senior preference. Let’s look at what happens when the initial consideration to equity holders is the following:

- $50M: If the initial consideration to equity holders is only $50M, the series E-1, which is the most senior of all, has the right to get their full $81M of preference before any other series. But since there is not enough consideration for them to get their full preference, they just take the full $50M. Nothing is left over for series E, the series without seniority, or common shareholders.

- $100M: If the initial consideration to equity holders is $100M, the series E-1 gets their full preference of $81M first, leaving $19M remaining for everyone else. Series E, the next most senior series, has the right to get back $51M of preference, but since there is only $19M they will take the rest. Nothing is left over for the series without seniority or common.

- $200M: If the initial consideration to equity holders is $200M, the series E-1 gets their full preference of $81M and the series E gets their full preference of $51M. After the 2 senior preferred series take their full preference, there is still $68M remaining.Excluding the 2 senior preferred series (since they already got their preference), there is still $170M of preference owed to the remaining preferred holders. Now the remaining preferred holders will split the remaining $68M, since it’s pari passu, they divide the remaining $68M by their prorated preferred ownership, excluding the 2 senior series. Since the non-senior preferred holders didn’t even get their full money back, there is nothing left for common shareholders.

Consequences of Adding Seniority

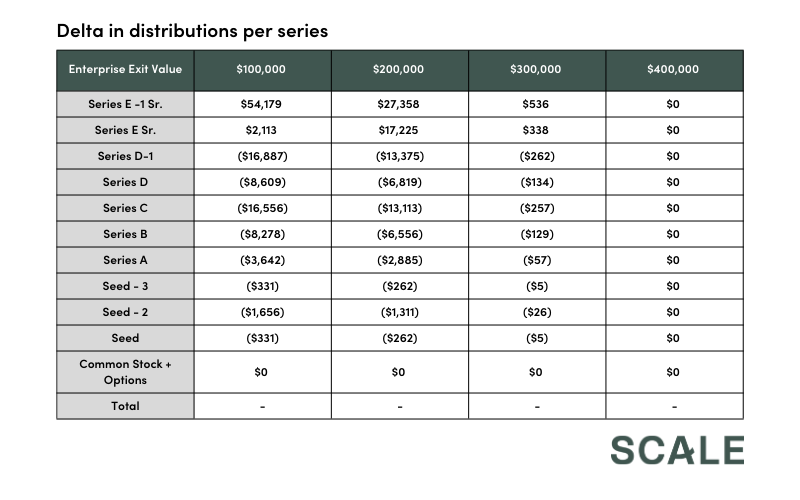

Breaking it into three categories of shareholders, let’s talk about how each is impacted by seniority.

- Senior preferred series: These are the obvious winners. They have reduced risk by getting returns first before the other preferred series. At exit values that are lower than the total preference stack, they get higher returns than they would if they didn’t have seniority. Once the total consideration meets the total preference stack and implicitly once they convert to common, their returns would be the same.

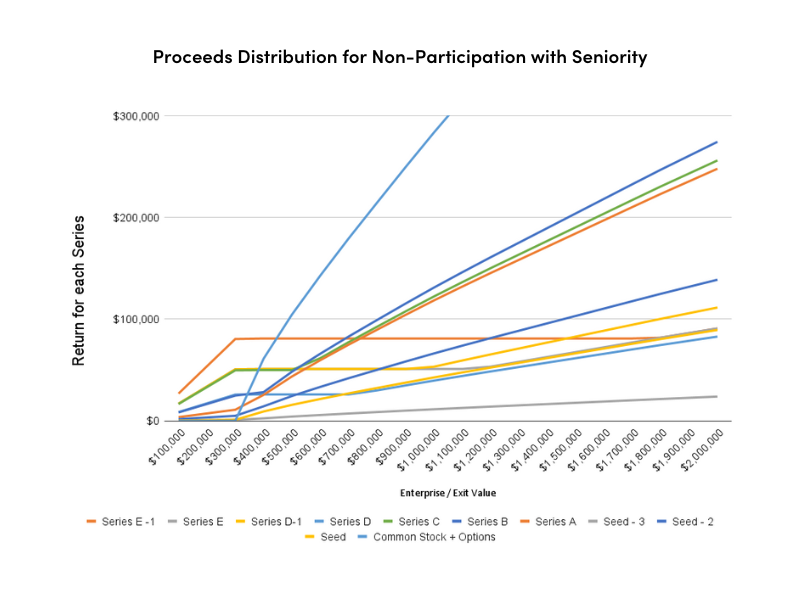

- Non-senior preferred series: These shareholders suffer until the total consideration is greater than the preference stack. For the lower exits, because the senior preferred series gets dibs, there is either less or no remaining consideration left to divvy up among these non-senior preferred series compared to the previous scenario where there is no seniority. But once the consideration is at least the size of the entire preference stack, then it doesn’t matter that the senior series gets first dibs, because everyone still gets their full preference amount.Implicitly, that also means once a series converts to common, seniority doesn’t matter. Again, seniority does not change the conversion point, it just shuffles who gets preference and when. If you check the graph below or the Excel template, you will see the conversion points are the exact same for each series as they were in the last scenario without seniority.

- Common shareholders: Common is never affected because again this is just a reshuffling of who gets preference, and when. The common proceeds are the exact same.

The table below shows the returns delta per series compared to the base case (returns in this scenario with seniority minus the returns in the base case without seniority). You can see exactly the results we discussed above – the senior series win and the preferred lose until the consideration is at least the total preference stack and meanwhile common isn’t affected.

The graph below shows the proceeds per series under this scenario, you can compare it to the base case scenario’s graph and see the results we discussed above.

We will see in the next scenarios how participation changes things even more dramatically, especially for common shareholders.

This concludes Volume 2 of our Liquidation Survival Guide. Here’s one more link to the template. I hope you’ve found it useful. Please remember, the template is a tool, and please work with your advisors as you use it. If you have any comments, questions, or have found any issues with the template, please let me know! This is an effort to help the startup community better understand these analyses and save everyone time. We will periodically update the guide and template if any issues arise.