Supply chain chaos in recent years put a spotlight on everything from port backups to last-mile delays, spurring a wave of startup activity (and significant funding) across the board. Some segments are packed with well-capitalized players, but others still have plenty of whitespace.

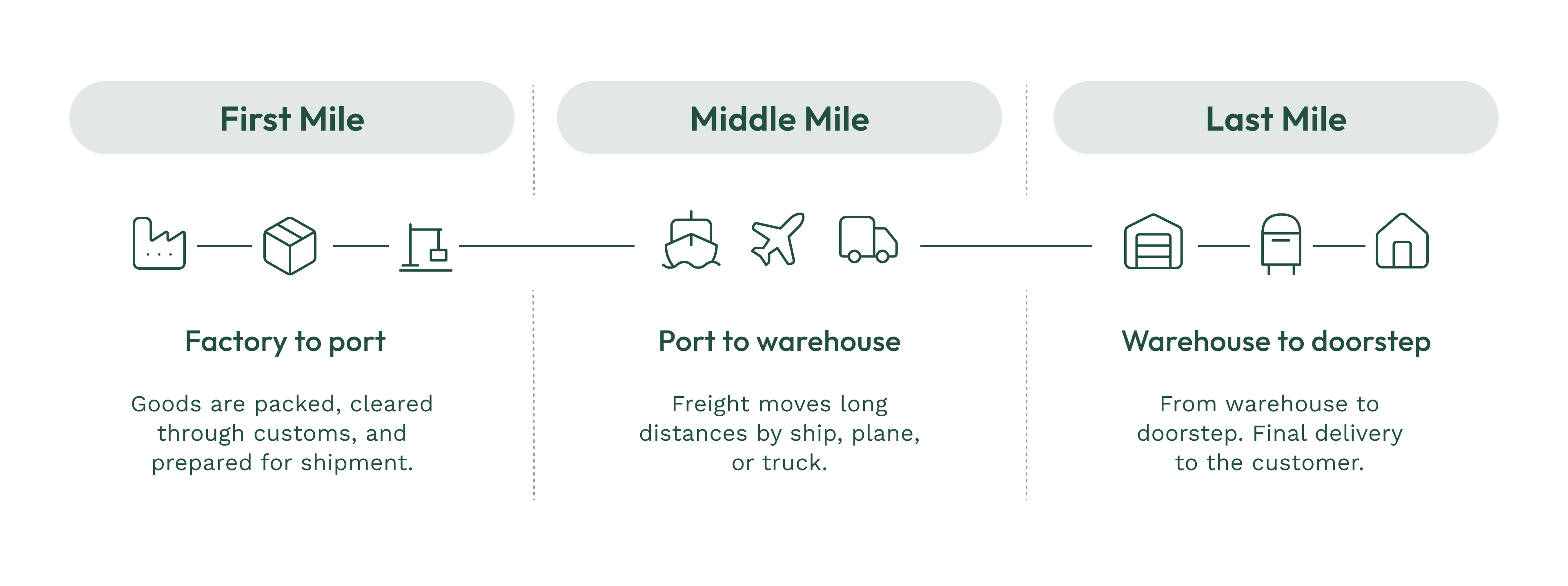

The land of logistics is very large and very complicated. Logistics is a tangled web of upstream producers, global forwarders, customs brokers, carriers, and couriers, all stitched together by data that often doesn’t flow as freely as the goods themselves. So before diving deeper, it’s worth getting oriented and breaking down every part of the supply chain, spanning the journey from the point of origin to final delivery. The journey all begins with the first mile, and that’s where we’re focusing our attention.

Journey from factory to your front door

The first mile is when goods leave the factories and are prepared for international shipment. That means arranging trips from factory to port, compiling export documentation, securing customs clearance, and paying duties. Without this step, containers never leave the dock or clear an airport.

At the center of the first mile are exporters (manufacturers) and importers (retailers / distributors). They’re the ones footing the bill for taxes and tariffs, as well as managing documentation like invoices, certificates of origin, and customs declaration: basically all the paperwork that proves what’s being shipped, where’s it from, and what’s owed at the border.

To actually move goods, they rely on global freight forwarders (essentially travel agents for cargo) that manage international shipments end-to-end. Big names here are DHL, Kuehne+Nagel ($18b market cap), and Expeditors. They often work alongside customs brokers who handle that paperwork. These forwarders typically use software platforms like CargoWise or Descartes for bookings, documentation, and customs. Actual transportation is handled by carriers, who own the ships.

Recent macroeconomic factors have also made the first mile prime for tech innovation. Mainly, tariffs! With tariff rates spiking and constantly changing, there’s virtually no margin for error in compliance and classification. This volatility is forcing companies to overhaul first-mile operations, where real-time visibility and precision classification have become mission-critical. Billions of dollars in duty refunds and tariff exposures are at stake, and only those who file correctly and move fast will capture the upside.

Many manufacturers are also moving productions closer to home in order to mitigate tariff exposure and build domestic resilience. Supply chains are being redrawn, and the first mile is at the center of this realignment. And recent shocks, from COVID to geopolitical conflicts, have exposed how vulnerable logistics really are. These disruptions showed that if the first mile falters, the entire chain will suffer.

Next comes the middle mile, the long haul of goods across continents or countries, whether by 18-wheeler, freight train, or plane. The middle mile is where transportation management systems (TMS), freight marketplaces, and real-time visibility platforms operate. At Scale, we love the middle mile! Our investments include Motive in fleet management and Airspace in time-critical shipments.

Last is, of course, the last mile. It’s the final stretch, where goods travel from a local hub, fulfillment center, or retail store to the end customer’s doorstep. It’s the most expensive piece of delivery and the one customers notice the most. A retailer can get everything else right, but if the box arrives late or damaged, that’s what you and I will remember.

Across all these stages, there’s also a fintech layer intertwined with logistics. Money often moves slower than freight in this industry. A trucking company can wait 60-90+ days to get paid, but fuel and payroll come due upfront. For small and mid-sized operators, fintech tools are what make survival possible in a capital-intensive, low-margin business.

Clearly plenty is happening across logistics, but why are we paying particular attention to the first mile?

Before it ships, it slips: Fixing the first mile

Selling into the first mile has been hard for the same reasons that selling into many verticals is hard: the tools were not useful enough to justify the cost of implementation. We see this in other verticals with multiple key stakeholders like construction. The economics are already razor thin, everyone works within their own systems that don’t talk to each other, the data itself is bad both in structure and legibility, and the industry is built on relationships and tribal knowledge that are difficult to systematize and automate.

Now, AI is able to meet the industry where it is. It can read messy PDFs, emails, invoices, and unstructured data, more easily manage edge cases, and reconcile multiple systems-of-record, greatly increasing its utility. At the same time, the cost of inefficiencies has become higher with tariffs, volatility, compliance pressure, labor shortages, and margin compression.

The pain points are oh-so-ever painful, and for startups building in the space, the timing couldn’t be better. Here are some of the biggest pain points we see:

- International trade is notoriously complex, paper-driven, and fragmented. One cross-border transaction involves 40+ docs, 100s of copies, and 30+ parties.

- Tariff codes, customs regulations, and trade agreements are intricate and constantly changing. Misclassifying a product or form = clearance delays, fines, or duties paid in error. Many firms rely on human expertise that doesn’t scale.

- Once goods leave the factory, shippers lose visibility until the cargo arrives at the destination port or customs. There’s lack of real–time tracking in this leg (especially for drayage, which is short-haul trucking from factory to port).

- Forwarders and customs brokers juggle communications between shippers, carriers, port authorities, and customs agencies. Much of this coordination happens via phone and email. There’s no shared comms platform, which means critical updates (e.g. a doc is missing) might not spread quickly to all parties.

- Paying duties and filing trade taxes are separate manual processes. Duties are paid upfront at customs, and reclaiming overpaid or ineligible refunds (aka duty drawback), is an extremely tedious, paperwork-heavy process. This is cash flow strain + money left on the table.

The first mile clearly has its issues. It’s complex, messy, and still way behind the rest of the supply chain when it comes to visibility. The good news is, every bottleneck, whether stuck paperwork, hidden fees, or wasted drayage miles, is also an opportunity for tech to deliver clear, tangible ROI. Here’s how we’re thinking about value creation in the first mile:

- Duty recovery = found money: Many companies miss out on tariff refunds because the process is too cumbersome. Automating duty drawback filings turns a manual headache into a steady source of recovered free cash.

- Faster clearance = fewer fees. Every extra day a container sits at a port racks up fees in storage and demurrage (late fees charged by ports/terminals when you overstay your welcome). Clear shipments faster and you not only dodge those fees but also get products to market sooner. Fewer stockouts, happier customers.

- Compliance automation = more volume. Trade compliance is a grind of re-keying data, emailing brokers, and chasing missing docs. Automating fillings reduces errors and lets smaller teams manage bigger volumes.

- Drayage optimization = less waste. Drayage is a black hole of inefficiency. Tech that matches import empties with export loads saves $$$ per trip, and port visibility tools cut wait times and convert wasted hours into revenue-earning miles.

- Better visibility = smarter inventory. When you actually know where your cargo is, you don’t need to overstock just in case. That frees up working capital, cuts storage costs, and avoids panic expediting when something gets delayed.

What’s got our attention

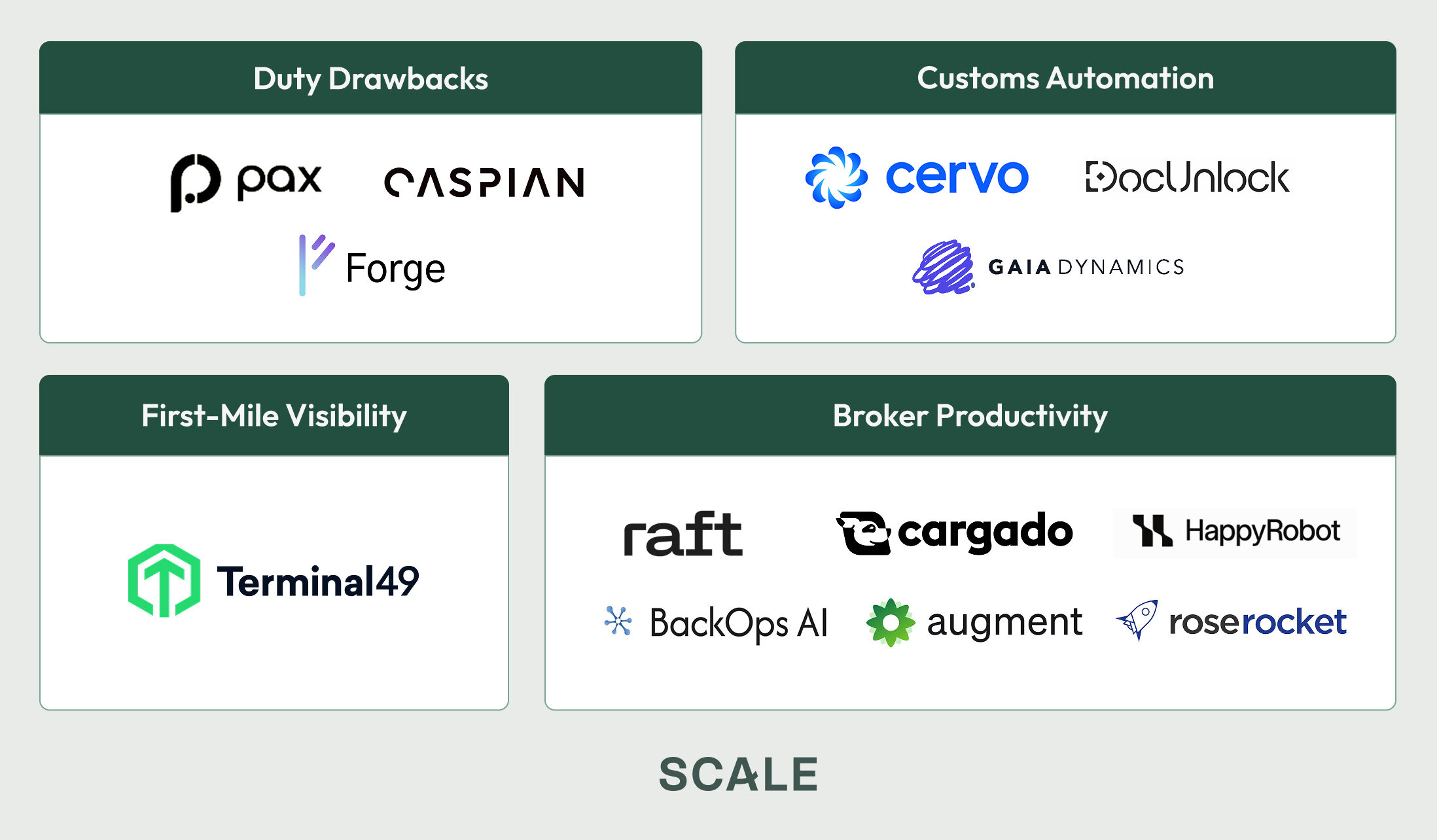

Let’s start with duty drawback and tariff recovery. When goods are re-exported or misclassified, companies are often eligible to reclaim duties (this is cash flow!). Apparel brands, electronics manufacturers, and auto suppliers are great examples. They often re-export, refurbish, or destroy imported goods, all of which qualify for duty recovery. But the majority of eligible refunds never get claimed, because the process is that convoluted. Platforms like Caspian, Forge, and Pax that match import/export records and automate filings can raise claim recovery rates and shorten cycle times. Duty drawback automation transforms a complex compliance chore into a tangible financial opportunity. To tell a CFO, “here’s a few million dollars in duty rebates we can get back,” is a pretty easy sell.

Next, first-mile visibility. Local port trucking (aka drayage) remains a notorious bottleneck. Containers can spend days waiting at terminals, and ships arrive on schedule about 50-60% of the time. The lack of first-mile visibility leads to mounting demurrage fees, driver frustration, and missed downstream deadlines. Enter companies like Terminal49 that track container moves, integrate port schedules, and optimize pickup/drop-off slots can reduce drayage turn times and ease congestion at major gateways.

Then there’s customs automation. Global trade runs on arcane codes and paperwork. Every product needs the correct HS/HTS codes, and every shipment requires property filed entries. The challenge is that classifying products and preparing customs filings is labor-intense and error-prone. AI is well-suited here. LLMs interpret messy product descriptions to suggest HS/HTS codes, while OCR extracts and validates data from invoices and packing lists. Software like Cervo, DocUnlock and Gaia Dynamics automates tariff code classification and filings improve classification accuracy and cut costly delays.

And finally, broker productivity. We led Rose Rocket’s Series B back in 2023 and continue to be really excited about the space. Brokers still waste hours re-keying shipment data and chasing emails/PDFs between shippers, carriers, and forwarders. Players like Augment, HappyRobot, Vooma, BackOps AI, and Raft are your AI co-workers. They pull data straight from documents, auto-fill filings, and sync updates across parties, cutting out the busywork that slows down shipments and ties up skilled personnel on low-value tasks. Another really interesting play here is Cargado, an invite-only load platform connecting carriers and shippers for cross-border freight in North America.

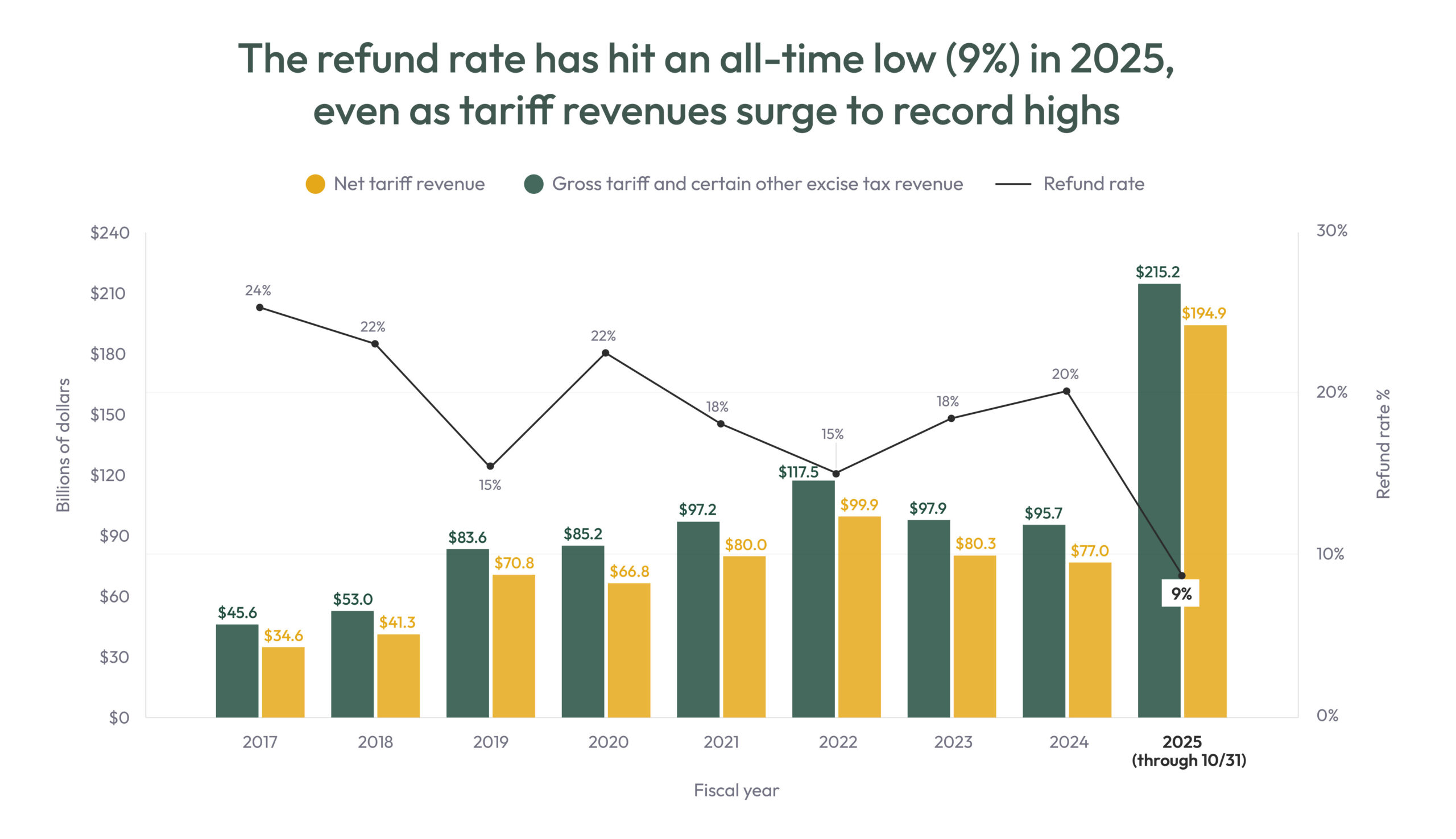

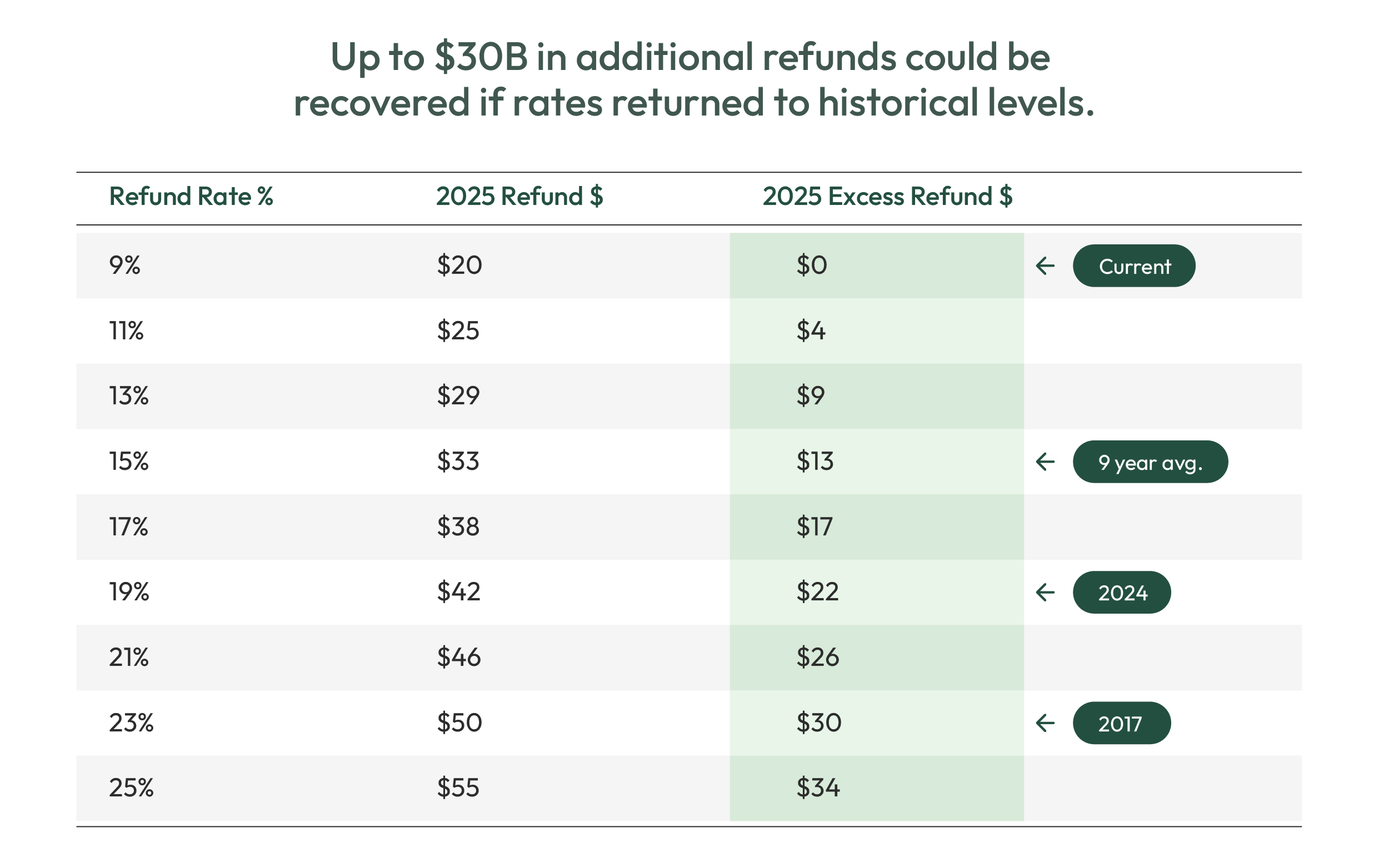

The scale of some of these first mile opportunities is massive. Take players tackling duty drawback as an example. Over the past nine years, gross tariff and excise tax revenues have averaged ~$100b annually, while net revenues after refunds have averaged ~$85b. The $15b difference (15% refund rate) represents the amount reclaimed through refunds and drawback. In 2025, gross tariff revenues have already topped $215B, with only $20B refunded. That’s an all-time low 9% refund rate. With these numbers, every 1% improvement unlocks $2B, and simply returning historical levels could free up to $30B. If you’re a company tackling this problem, it’s not hard to get to an attractive market size.

Closing

The logistics tech landscape is huge and messy, just like the global supply chains it supports. The market can be unforgiving, yet the upside for getting it right is enormous, because logistics underpins trillions of dollars of commerce and is essential to well… everything. We’re really excited about the first mile. Fix the very beginning, and the rest runs smoother.

If you’re a founder or investor in logistics land, I’d love to connect. Email me at aurelia@scalevp.com.