On the heels of UiPath’s announcement of their upcoming IPO, I wanted to highlight how we are thinking about enterprise automation at large and where it’s going. One of the distinctive features of this area is that while most software products assist people in doing the work, these automation products actually do the work for you.

Looking at the development of enterprise automation in this light explains a lot about how the market got started (task automation), where it’s at today (end-to-end automation), and where it will go over the next decade and beyond (predictive automation).

We’ve spent a lot of time here as a firm because automation is a big complicated topic. We’ve had dozens of conversations with vendors and customers, and wanted to share some of what we’ve learned.

The Automation Journey

Companies have always wanted to find smarter and faster ways to do their work. The first versions of “automation” were just simply outsourcing work to BPOs. BPM companies like Pega and Appian then came onto the scene to help standardize and structure those workflows into software. In the last two decades, those products moved to the cloud and, in recent years, RPA has really come to the forefront.

Over the past few years, the term automation has often been used interchangeably with RPA. While it’s a big part of what is going on, it’s only a part of the story. Several other interconnected categories (IDP, BPM, PM, etc.) play important roles here as we move beyond the first phase of automation. But let’s start with an outline of the overall waves of automation that we’re seeing:

- Task Automation. When RPA first got popularized, one of the shining use cases was automating rote back office tasks. Customers were just getting introduced to the technology and vendors were just getting familiar with how to successfully sell and implement it. So this converged on low hanging fruit use cases that were low complexity, fast time to implement, aimed at a low-risk way of quickly showing fast ROI. This led customers to use RPA for what was “task automation” or, in other words, automating data entry. It allowed companies still stuck on legacy systems to move data around their internal systems without having to hire an army of people. Workflows like invoice processing and insurance claims processing fit naturally into this. Ideal customers were those stuck on legacy systems and ideal workflows were a combo of both high frequency and low variance. The downside was it only applied to a certain customer type, had a high services cost (both implementing and maintaining the automations), and ultimately worked with only limited use cases.

- End-to-end automation. While task automation was great to get companies started with using RPA, it was relegated to a limited set of use cases. The introduction of AI combined with increased customer familiarity with using automation in production workflows allowed automation to expand from low-complexity workflows to high-complexity workflows. With the broadening of scope, companies could now focus on end-to-end workflows that could interact directly with their own customers. For example, companies could build an automation to manage an entire customer support flow. Start with ingesting inbound support requests from multiple sources, then use AI to classify them into different buckets, and then execute different actions depending on the classification. This is dramatically increasing the value of the automations and allows customers to really ratchet up the complexity and addressable use cases that they could automate. End-to-end automation moves us from low-complexity/high-frequency workflows to high-complexity/high-frequency workflows.

- Predictive automation. End-to-end automations interact directly with customers but are still ultimately reactive – they wait for inputs and then run workflows against them. The next level is about moving from reactive to predictive. Customers want automations to not only help execute actions but, more importantly, help drive decision making. An example we’ve heard from customers is wanting to build automations to help account managers monitor their customers. For example, in a manufacturing environment, a company might want to build a bot to monitor consumption and usage for a customer, then pair that with third-party data to forecast what their customer will ultimately need, and then depending on the results either ping the account manager or directly contact the customer to tell them they should buy more to get ahead of any risk of shortage. This automation is high-complexity, low-frequency but, most importantly, high value – and will finally allow automation to flip from back office and cost savings to front office and customer facing, driving higher value.

Taking stock of where we are today, it feels like we are squarely past the task automation phase and now deep in end-to-end automation. The combination of tech, customer, and market maturity is giving the end-to-end phase the necessary tailwinds and explains a lot of the current activity here.

It also seems like the tech and customer capabilities are not quite yet ready to support predictive automation. Given it took us nearly a decade to transition from task automation to end-to-end automation, we still have some time to go before we move on to predictive automation. Getting there will take a step change in the ability to build products that can systematically discover the right processes, easily design the right bots, and then run them effectively.

Trends in End-to-End Automation

So we’re in the throes of end-to-end automation. The big picture story is that we are evolving from smaller, simpler automations to longer, more complex ones. This is pushing incumbents to expand their product suites to compete in this world and also bringing new startups into the market from different angles. For example, process mining is getting a lot of attention right now as it’s a necessary component of end-to-end automation – having an accurate map of your current processes is a critical part of building these longer workflows. So lots of new process mining startups and incumbents are acquiring or adding these products to their suites. But there’s a lot of noise and figuring out which approaches will ultimately work is hard.

Some observations about what’s happening:

- Best-of-breed is winning over the suite. A big change in customer preferences starts with maturity. Customers now know what they want, are willing to spend, and aren’t afraid of integrating multiple tools together. The first generation of RPA vendors originally started by bundling everything into a single suite. It reduced risk, promised more functionality, and customers had the “one throat to choke”. As customers have gotten more mature, they’re more focused on performance and willing to stomach more risk by having to deal with multiple vendors. Now it’s more about which vendor is the best for that particular function over a suite that can do it all. And this isn’t just for RPA-adjacent markets, but also for RPA itself!

- A fight for the orchestration layer. As customers evolve from basic to complex workflows, the number of integrations, decision points, users, etc. has expanded alongside it. Task automation was simpler with shorter workflows, meaning they could all be contained in a single system. But these complex workflows span multiple products and are too big to be contained in a single space. And so there is a fight between all of the major vendors to become the orchestration layer that customers use to manage all of the workflows and the underlying services, monitor uptime/performance, and so on. The hope is that owning this layer is how you own the workflows, which then allow you to own the customer, and ultimately commoditize the rest of the services.

- Machine + human is a first-class feature. An important part of every complex workflow is the idea of exception handling. While the machines can do an increasing amount of these workflows, humans are still responsible for a healthy chunk of it. And so if we imagine a very long automation, there are likely steps in the middle of that workflow that have a handoff from machine to human and perhaps then back to machine. Whereas task automation had humans involved in the process, they were primarily either at the start or the end of the workflow. End-to-end automation is focused on the coordination and collaboration between humans and machines within the same workflows. So products will need a clean and usable human interface but be built on a framework that allows the “work” to flow seamlessly between humans and machines.

There are clear winners in the first wave of automation but the second wave of end-to-end automation is still up for grabs. The winners of end-to-end will be well-positioned to lead the charge into enterprise automations’ predictive future.

The (Evolving) Enterprise Automation Market Map

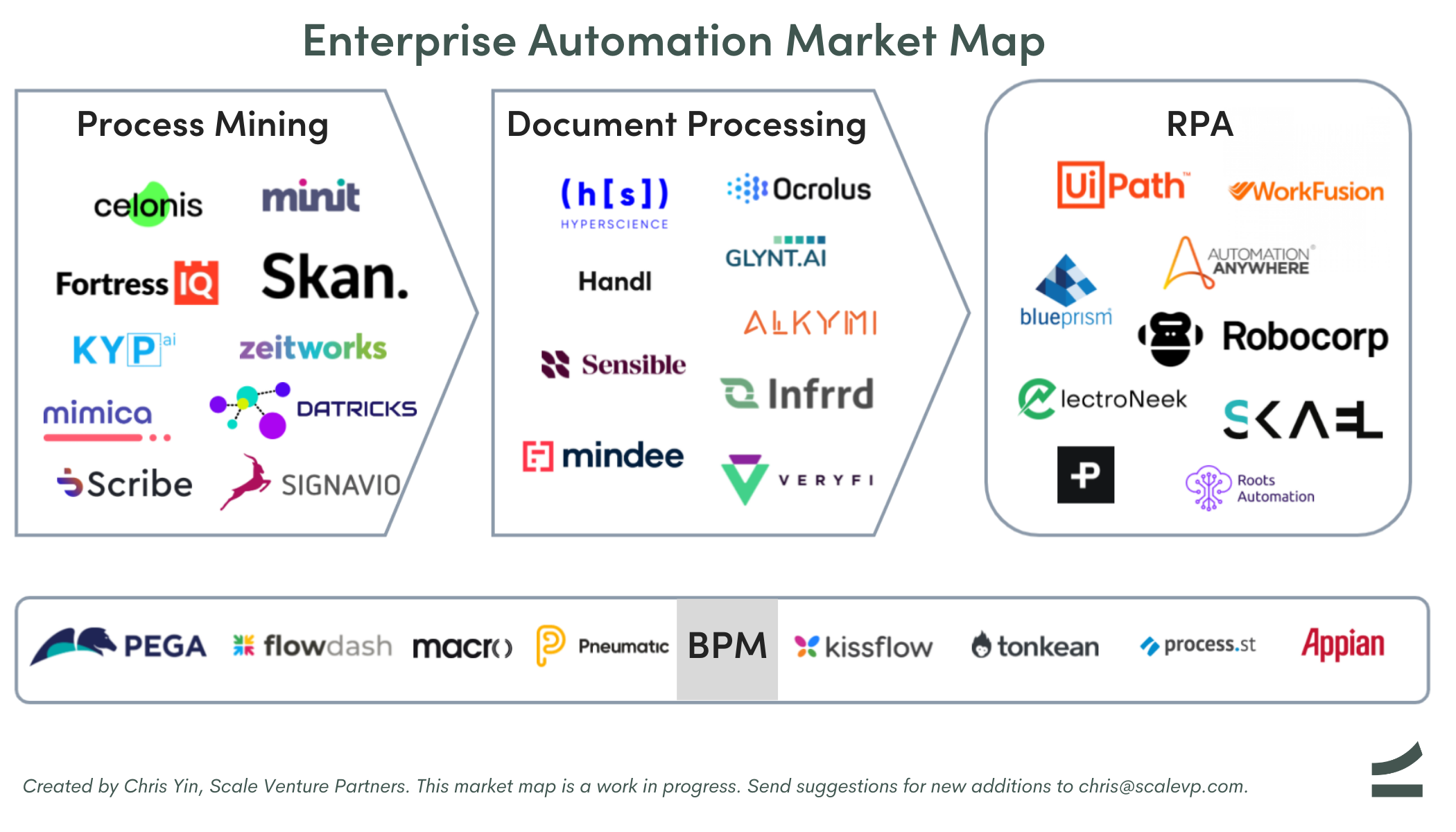

Up to this point, we’ve looked at enterprise automation from 50,000 feet. But there’s a lot going on at the startup level, with some really interesting new products tackling process mining and document processing as well as more established categories like RPA and BPM.

The endpoint of true end-to-end process automation is still a ways out. But we can see an outline of how the overall market will evolve simply because end-to-end automation by definition requires a lot of different systems to work together really well. Those functional pillars are how we’re laying out our (work in progress) market map:

Broadly speaking, being able to reliably and flexibly automate a process from start to finish takes several things:

- Process mining helps companies figure out what their actual processes are. Programmatically identifying the workflows your people are actually running (and all the variants) is foundational to figuring out how to standardize them and eventually automate. Companies like Skan.ai and others stand out here.

- Document processing makes documents machine readable. Valuable data is often stuck in PDFs, written forms, unstructured documents, etc. Turning those into structured machine-readable forms are critical to enabling machine-powered automations behind it. Companies like Veryfi and Sensible help developers more easily incorporate this into their products.

- RPA itself is getting more complex as customers look to scale live bots in the workplace. Robocorp is super interesting as they focus on empowering RPA developers with classic software development paradigms/tools and ultimately giving developers tools to reliably scale their bots.

- BPM structures human-based workflows. These products take messy human processes and turn them into repeatable flows. Products like Flowdash, Macro, and Tonkean help turn human workflows into processes that are more compatible with machines so we can build a clean interplay between those two.

The exciting thing here is how incredibly useful and valuable all of these products are to their customers. They help automate away rote work, standardize workflows for more efficiency, and help elevate the plane that we all work in. Each area is taking their own approach to solving this problem but one thing is clear: the ambition for everyone is to build a full automation platform and own the whole thing. We’re super excited with all of the innovation in this market and please do reach out if you’re working on anything here!

Our enterprise automation market map is a work in progress. Send suggestions or additions to chris@scalevp.com.