The Old Gray Lady is worried about a bubble in tech, and did a nice graphic comparing the valuations of Facebook and four other social media deals, to the valuations of the crop of 1999 tech IPO’s. Nice graphic, wrong comparison. Given that Facebook is reported to have had revenues last year of $2B and growth of over 100%, a more helpful comparison would be looking at Facebook, versus some of other great technology companies of the last two decades at a similar stage.

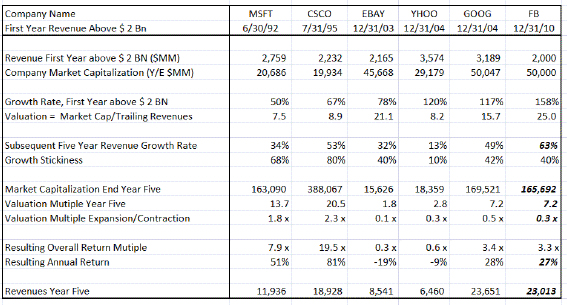

The table below shows five of the most successful technology and internet companies of the last twenty years, and the year that each of them first passed $2B in revenue, Microsoft (1992), Cisco (1995), EBAY (2003), Yahoo (2004) and Google (2004). The table shows some key performance and valuation metrics for the companies, starting with the revenue and revenue growth year for the $2B+ year as well as revenue growth and valuation five years later. Then for comparison, the table shows current numbers for Facebook, based on publicly leaked information. The key points are:

These were all amazing, high growth companies. In the $2B year, the slowest growth company was Microsoft at 50% in trailing revenue growth, and the highest growth companies were Yahoo at 120% and Google at 117%.

The companies were never value stocks. Trailing revenue multiples ranged from 7.5x for Microsoft to 21x for EBay. The market capitalization of the companies ranged from $19B for Cisco to $50B for Google.

The companies continued to growth after crossing the $2B revenue threshold but at a slower rate. The revenue growth rate for the next five years, was, in every case lower than the revenue growth rate for the $2B year. Growth always slows at scale, hence the old Wall Street aphorism, “trees don’t grow to the sky”. As a rough and ready metric for this, I have calculated a number I call, Growth Stickiness, which is the ratio of the average growth rate for the next five years, to the growth rate in the year crossing the $2B level. For example, if a company is growing at 80%, and the growth stickiness is 50%, that implies the average growth rate over the next five years, will be 40%. For these companies, Growth Stickiness ranges from an impressively high 80% (Cisco), and 68% (Microsoft) to approximately 40% for Google and Ebay and a wholly lame 10% for Yahoo.

It suggests that technology centric plays like Microsoft and Cisco compound more slowly, but keep growing more consistently, while internet companies have exploding growth rates but level out more quickly. This makes sense. Many of the internet companies have strong network effects and low friction for revenue: they get what they can get fairly quickly, and then level out.

Changes in valuation levels, separate from operating performance, can really impact investment return. Microsoft and Cisco were valued at going in revenue multiples of sub 10x revenues. For the five years after the $2B year, Microsoft and Cisco had consistent revenue growth (34% and 53% CAGR’s), but because the timing was now late in the tech bubble, they also had seen enormous valuation multiple expansion. The result is that the overall value of these companies had gone way up at the five year mark. These stocks were goldmines to own, with an average annual return of 51% per annum for Microsoft and 81% per annum for Cisco.

By contrast, Ebay, Yahoo and Google all saw revenue multiple contraction, in the next five years after crossing $2B, ranging from a 50% contraction for Google to a 90% contraction for Ebay whose fifth year ended in Dec 2008. The result was that investors lost money in Ebay, lost money in Yahoo, and made 28% per annum in Google. This points to the risks of investing in high growth companies. Three things can go wrong at the same time. Growth can turn out not to be sticky, the valuation multiple then contracts and, sometimes the overall markets can contract at the same time. It is worth noting that Google was able to “ride out” the multiple contraction because it was swamped by the revenue growth, Ebay and Yahoo were not.

Now put Facebook in context here. If the numbers as rumored are correct, the company did $2Bn last year with a CAGR of 158%, the highest of the entire group. Having the highest CAGR, it also had the highest revenue multiple, at 25x trailing revenues and so was valued at $50B. Assuming growth persistence of 40%, (the same as the other great internet companies, Google and Ebay), implies a five year growth rate of 63% (still the highest growth rate of the entire group reflecting the high going in revenue growth of 158%) and revenues in 2015 of $23B. Assuming a revenue multiple the same as Google’s in 2009,(7.2x), the company will be worth approximately $166 M for a 3.3x return in five years and an annual return of 24%.

Thus an investor can expect to make 3x their money in five years if Facebook turns out to be, or continues to be the fastest growing $2B + revenue company of the last twenty five years, and if the company is then valued at the same multiple as Google was in 2009. A compound average growth rate of merely Microsoft proportions (34% per annum over 5 years) will result a 1% return. Anything less will be a disaster. It is not yet a bubble valuation, it is credible compared to other world class companies, but it is priced, perhaps justifiably, as the best high growth company in the US today.

These companies are all among the most successful equity investments in history. Every one of them yielded early stage investors, returns of 1000x their investment. In every case, for multiple years, doubters who felt the stock was too high, or the market too small, were spectacularly wrong. But in every case, the growth rates slowed inexorably over time, and the valuation multiples usually declined also. At some point the math takes over. Surprisingly (to me) I can still see the upside for Facebook at $50B as the high going growth rate, overcomes the inevitable drags of growth slowing down and multiples contracting. However what is overwhelmingly clear is the “ten bagger” returns in the public market, available in the 1990’s for Microsoft and Cisco, will not be available when Facebook goes public. It looks like a public investor buying into the most successful Internet company of the last decade, will make 3x to 1.5x depending on IPO valuation. The big money has been made.