SaaS or cloud has been the motherlode of enterprise software investing for two decades now. Venture investors, entrepreneurs, and Wall Street have all learned to pile on, leading to a shared consensus that cloud investing is “a sure thing”. Nothing is more destructive to investors over the long term than a sure thing, so I began to wonder, “What could cause the wonderful economics of cloud investing to unravel?”

My conclusion is that while the cloud is obviously here to stay, the next five years in cloud investing will neither be the same nor as easy as the last 10. My reason for writing this post is not to be a party pooper, but to provide a context for startups to navigate this potentially harsher environment. This post identifies three different startup strategies, all of which can work even in the more competitive cloud economy that I envisage. More on that below.

Big picture, the summary points are as follows:

First, cloud company valuations are at all-time highs which cannot be justified by improved company operating performance but can explained by 20 years of consistent 30% growth in the cloud software market. This has given investors the comfort to “pay up”.

Second, within the next two to three years, there will be a “growth crunch” as many cloud markets saturate. At that point the Gold Rush will become the Hunger Games as cloud companies large and small compete against each other for survival.

Third, there will be three winning strategies for a startup when this happens: Fight, or compete head on in an existing cloud market; Focus, or find those parts of the cloud market where there is still low competition and good growth; Fly, which is to build a company based on more than just the move to the cloud.

Fourth, “beyond the cloud” means “assume the cloud” and build on top of that stack using newer technologies and a design approach where instead of the user working for the software, the software works for (or instead of) the user. At Scale we think of this as building the Intelligent Connected World (ICW).

Let’s walk through the details.

How did we get here?

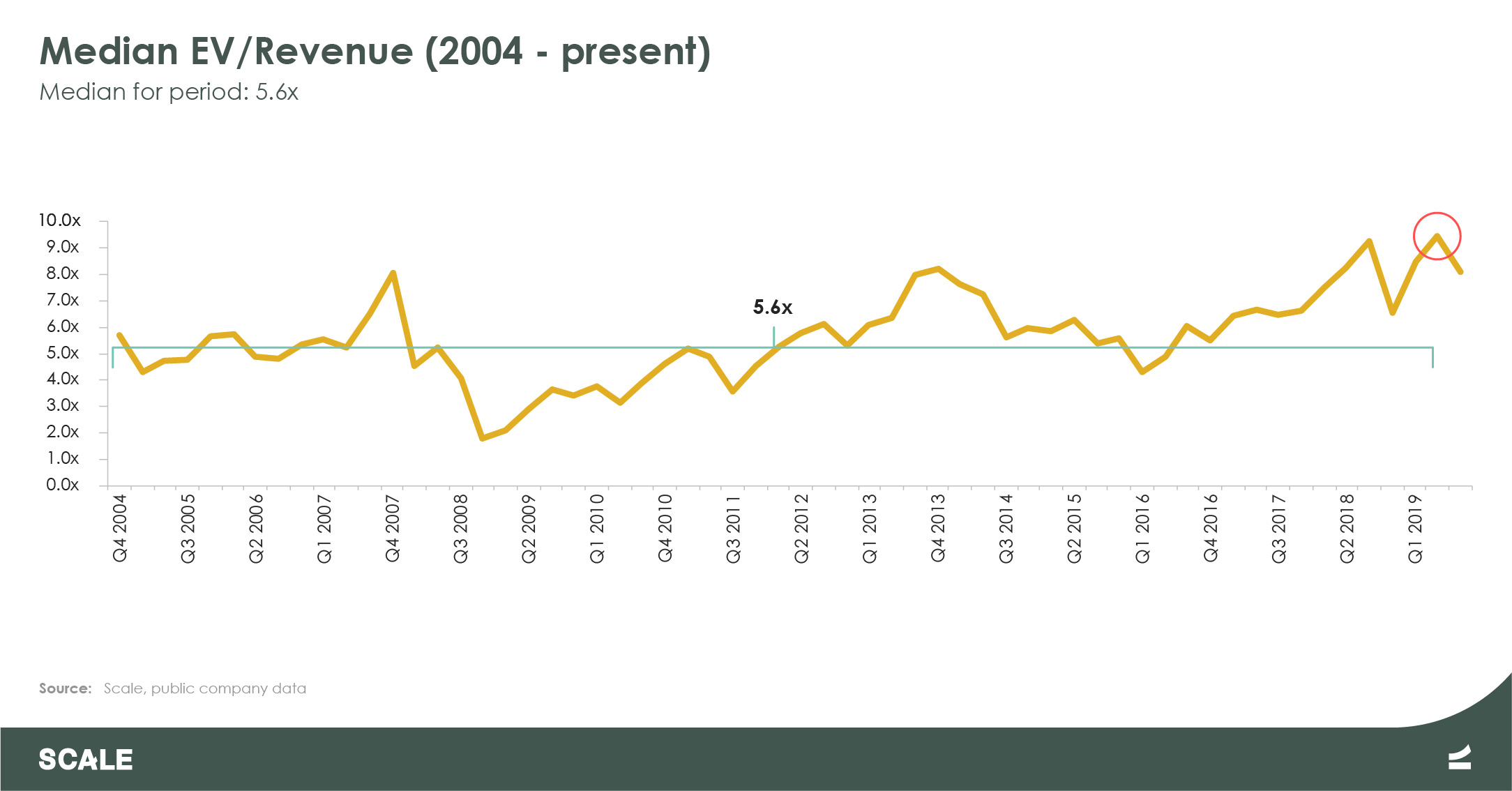

We got here because the cloud model works. It works as a computer architecture, and there is no clear replacement architecture on the horizon. It works for customers by aligning incentives with vendors to keep their software working. And it works – brilliantly – as a financial model. In a world of low growth and low interest rates, SaaS looks like a perpetual motion machine and the valuations show it. Today the median SaaS multiple is 8.5x run rate versus an all-time average of 5.6x. Higher growth companies trade at even loftier multiples of 20x and 30x.

Are cloud companies performing better than ever?

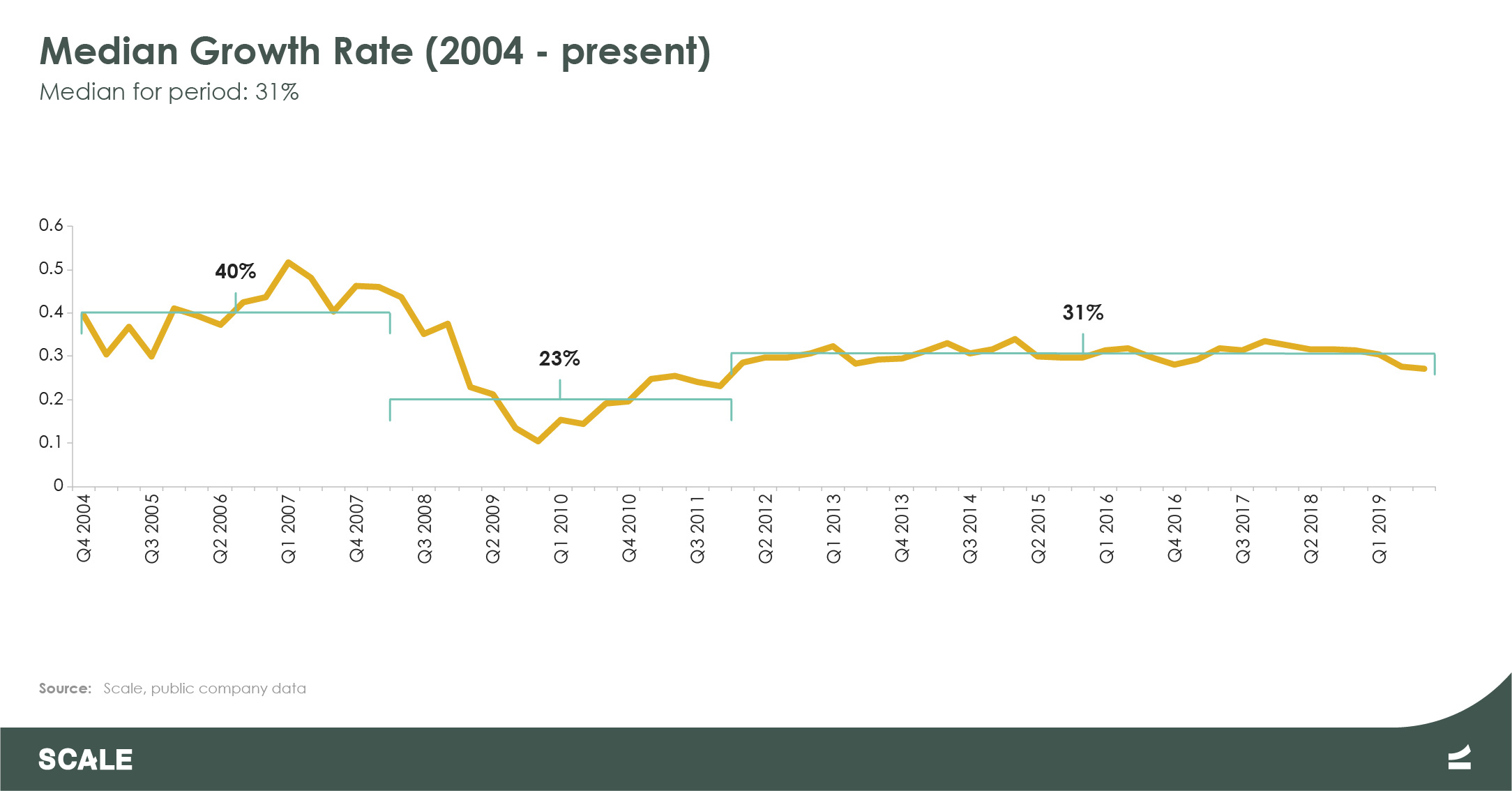

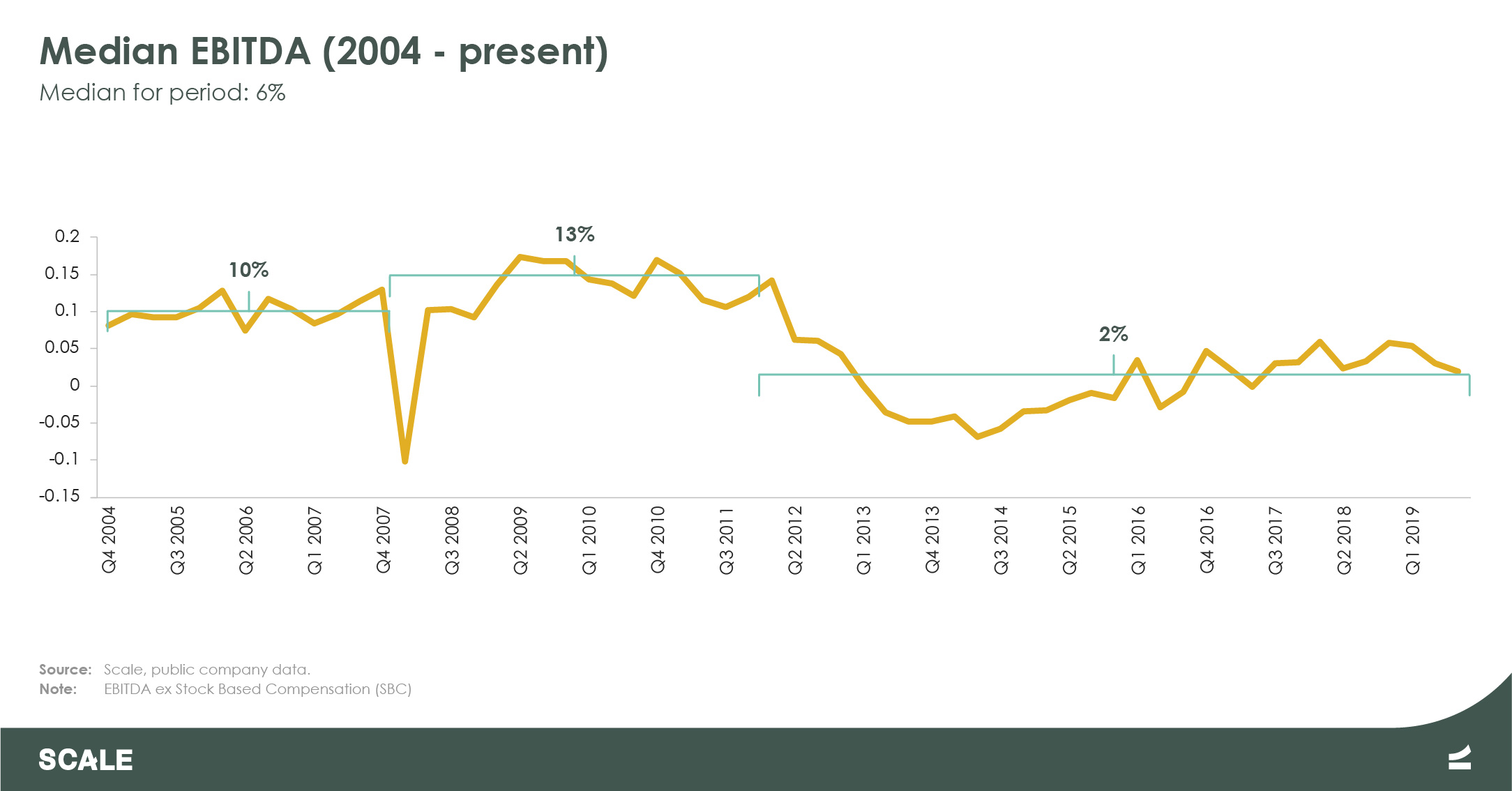

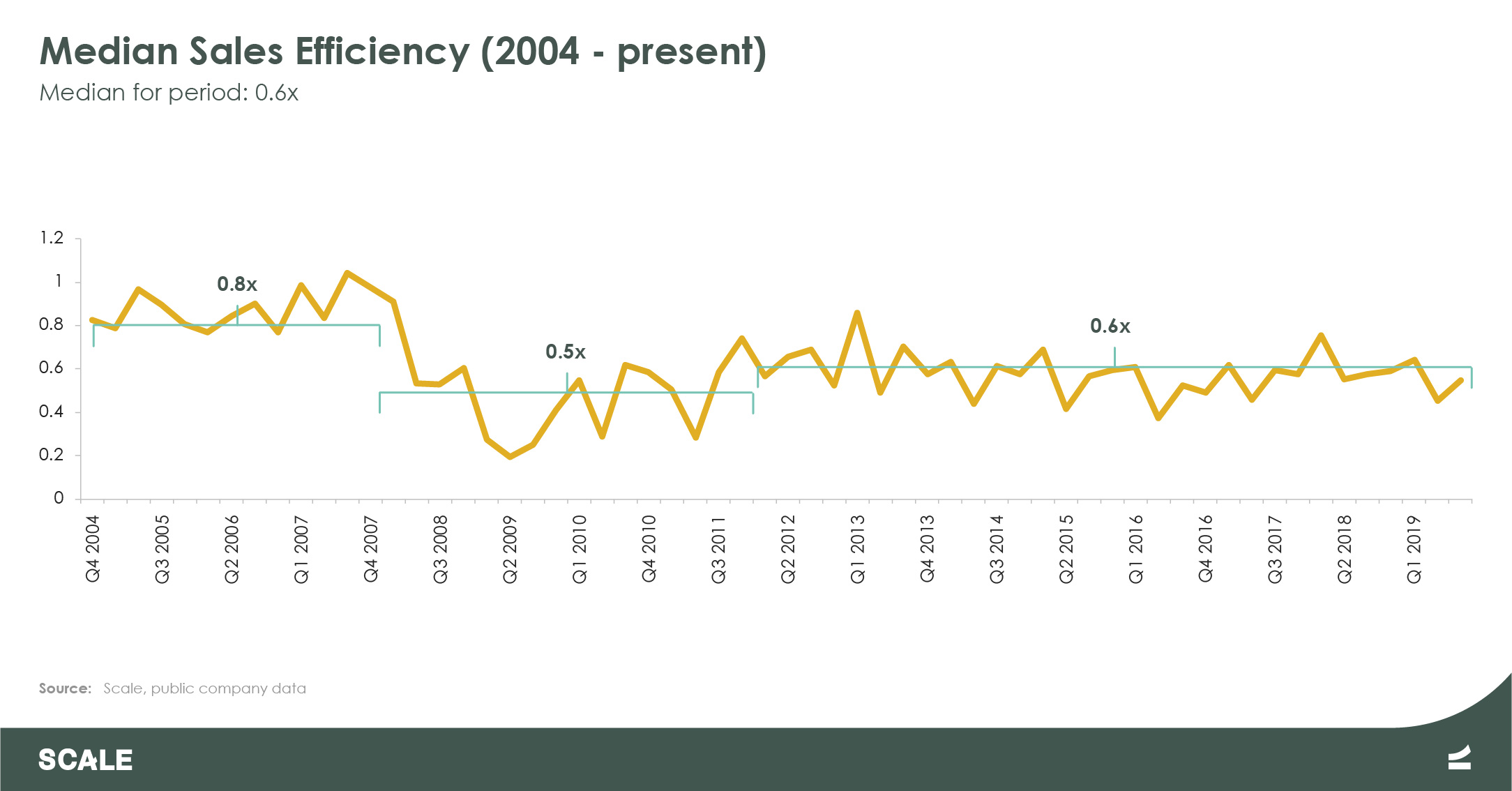

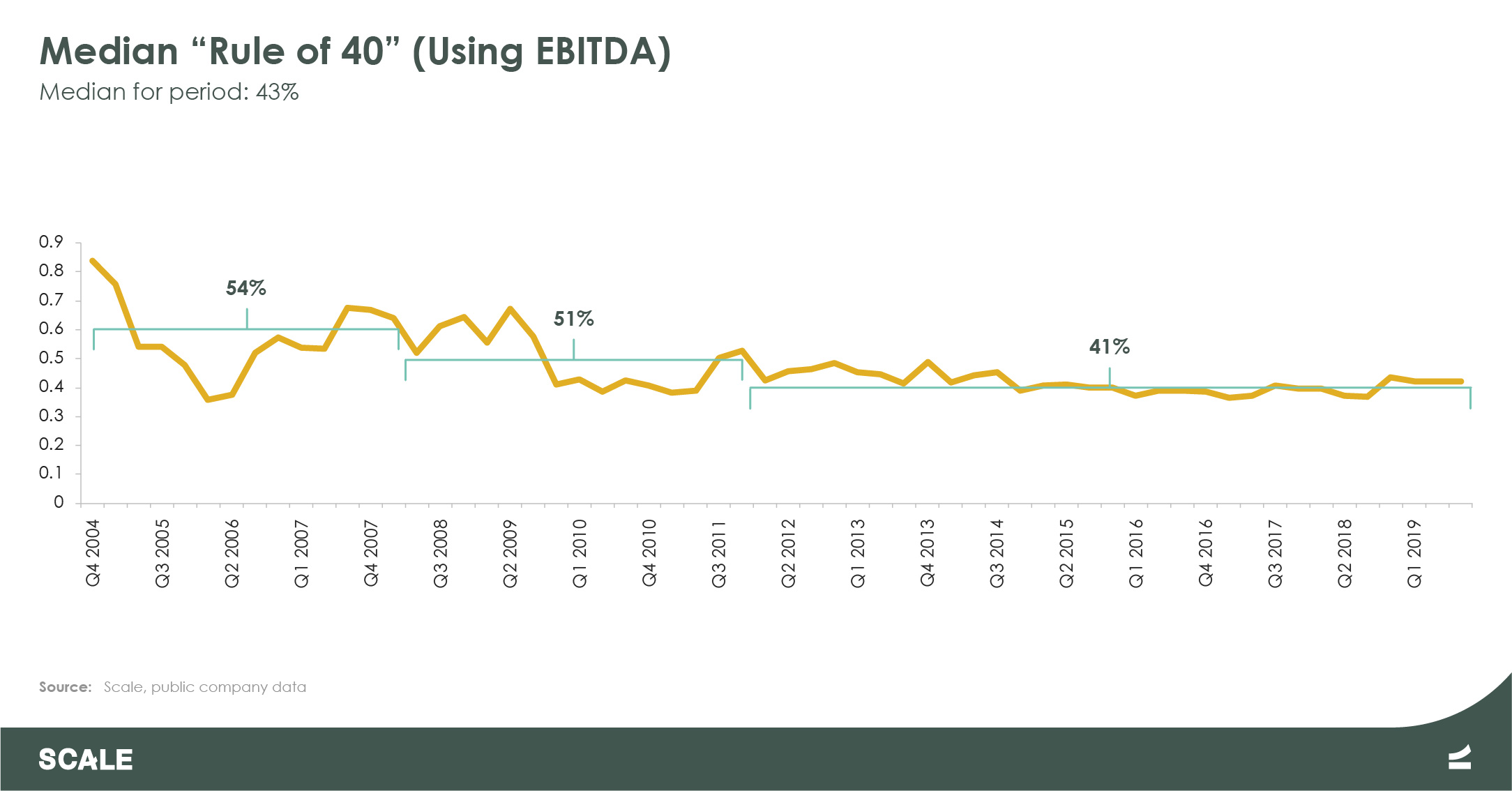

The short answer is no. The four charts below show growth rate, profitability, Sales Efficiency and the Rule of 40 (a combination of growth and profitability) for the entire public SaaS universe from 2004 to today. Each chart also shows separately the median for three sub-periods within this time period: pre-crash (2004 to 2008), the crash period (2009 to 2011), and post-crash (2011 to today).

The story is the same in every case. Pre-crash operating performance was stellar in what was then a new uncrowded market. The crash was brutal on growth and forced companies to get profitable fast. But since 2011, growth rates, EBITDA, Sales Efficiency and Rule of 40 measures have all been roughly flat and provide no justification for almost a doubling of valuations in the last two years.

So why are these companies trading so richly?

It’s all about the growth

Sometimes the answer is in plain sight. The big picture in all the above numbers is that the public companies in this sector have been growing at 30% plus for 15 years now, since the Salesforce IPO in 2004. Growth has not gone up but – far more importantly – it has not gone down.

With 30% growth, even if multiples permanently collapse by 30%, cloud stocks regain their entire value on a per share basis after one year and four months. Even a multiple collapse of 50% can be earned back in two years and nine months of steady 30% growth. As a result, these stocks are very resilient and bounce back very quickly from market drops.

The cloud has represented an opportunity for investors to deploy large amounts of capital at declining but still profitable and predictable rates of return, in the once-a-generation task of re-writing every software application for the cloud and re-selling those applications to the enterprise. A dollar invested at a 0.6x sales efficiency turns into $0.60 cents of revenue that promptly gets valued at 10x revenues or $6.00. It’s six-to-one money in a 2% world.

Given this math, the correct strategy for investors over the last 20 years has been to pile on to the cloud. If you miss the Series A, do the Series B. If you miss the Series B, pay up for the Series C or D. Buy the stock at IPO, or if you cannot get that, just buy in the aftermarket. There have been 103 IPOs each of which has represented an opportunity to pile on and make a return. As long as the growth is there, the risk of paying up is low—which is why the valuations can be explained, if not justified, by this 20-year track record of consistent growth.

When does cloud growth slow down?

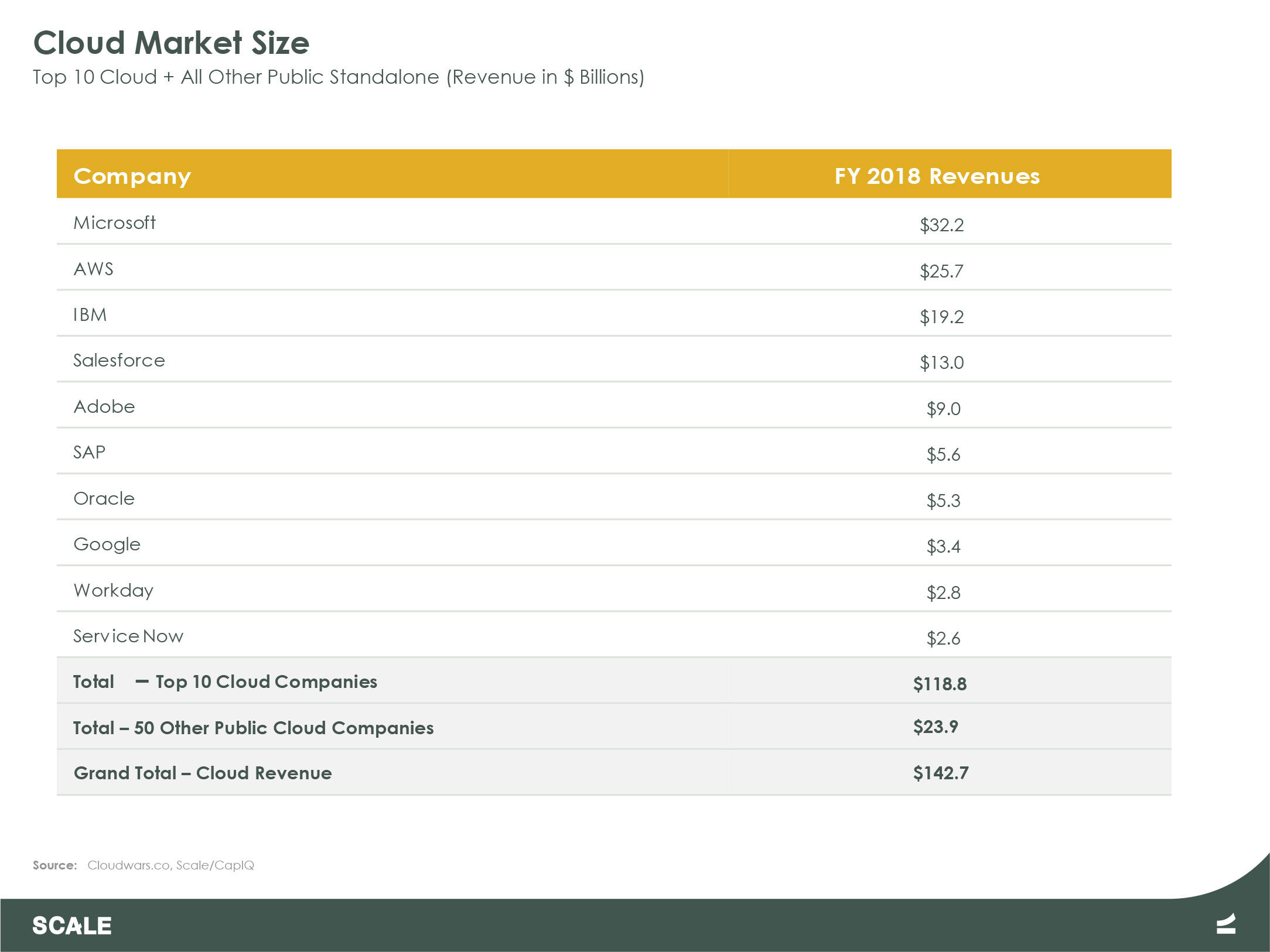

The cloud software market was $142 billion in 2018, growing at 30%, measured just by the actual revenue dollars generated by the top 10 cloud companies plus the revenues of the 50 other standalone public Cloud companies.

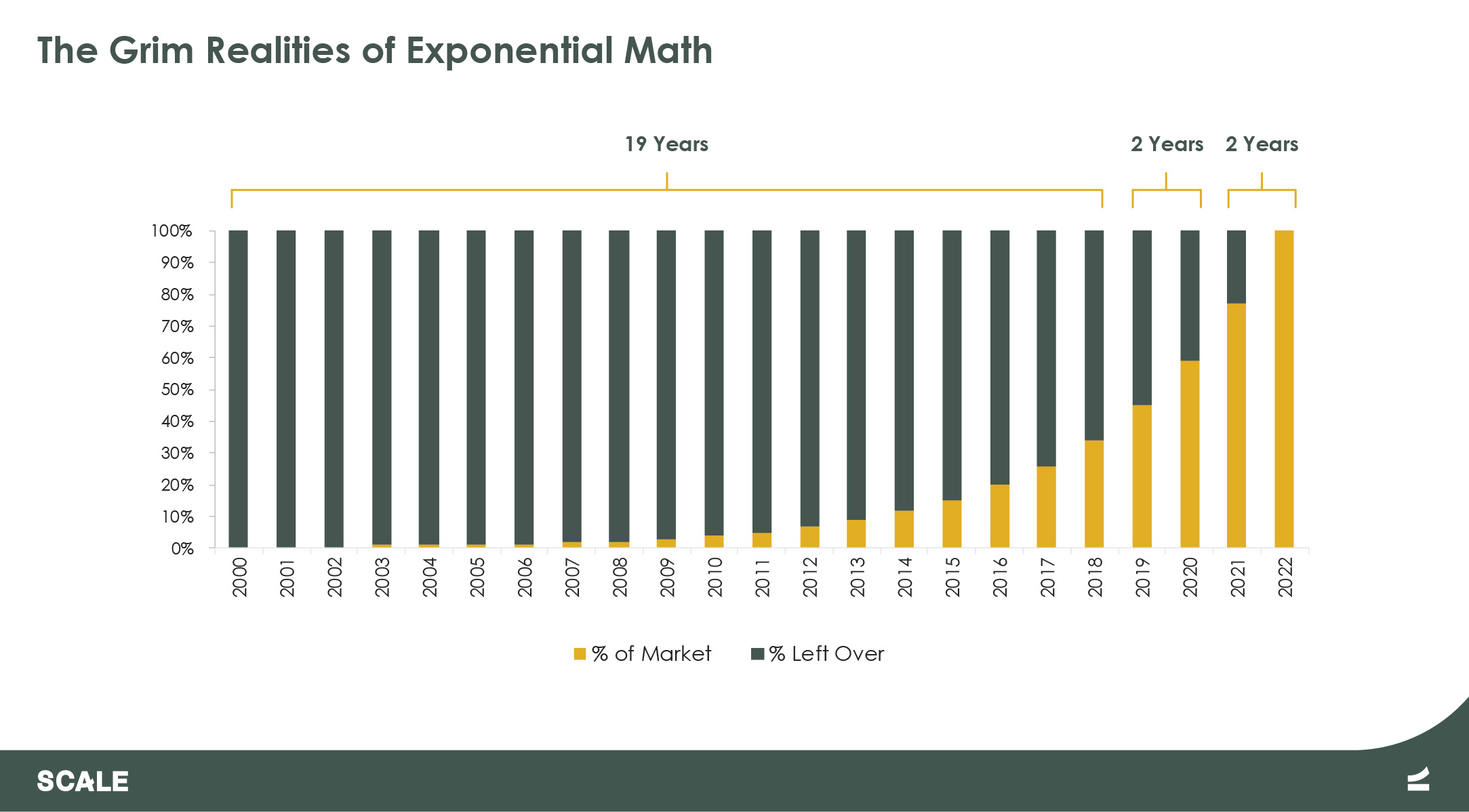

Cloud software is a subset of the $419 billion (2018) enterprise software market, so after 19 years cloud is still only 31% of the total market. Intuitively, you might feel there is a lot of runway left. But that intuition would be horribly wrong. The grim reality of exponential math means that it takes 19 years growing at 30% to go from 0.25% market share to a 31% market share, but it only takes two more years to get to a greater than 50% market share and two more years after that to be at 100% of the software market. With no growth in the overall software market, cloud would reach 100% penetration by 2022. This would be a growth crash.

Software Industry Growth: The Andreessen Eating Factor

Software Industry Growth: The Andreessen Eating Factor

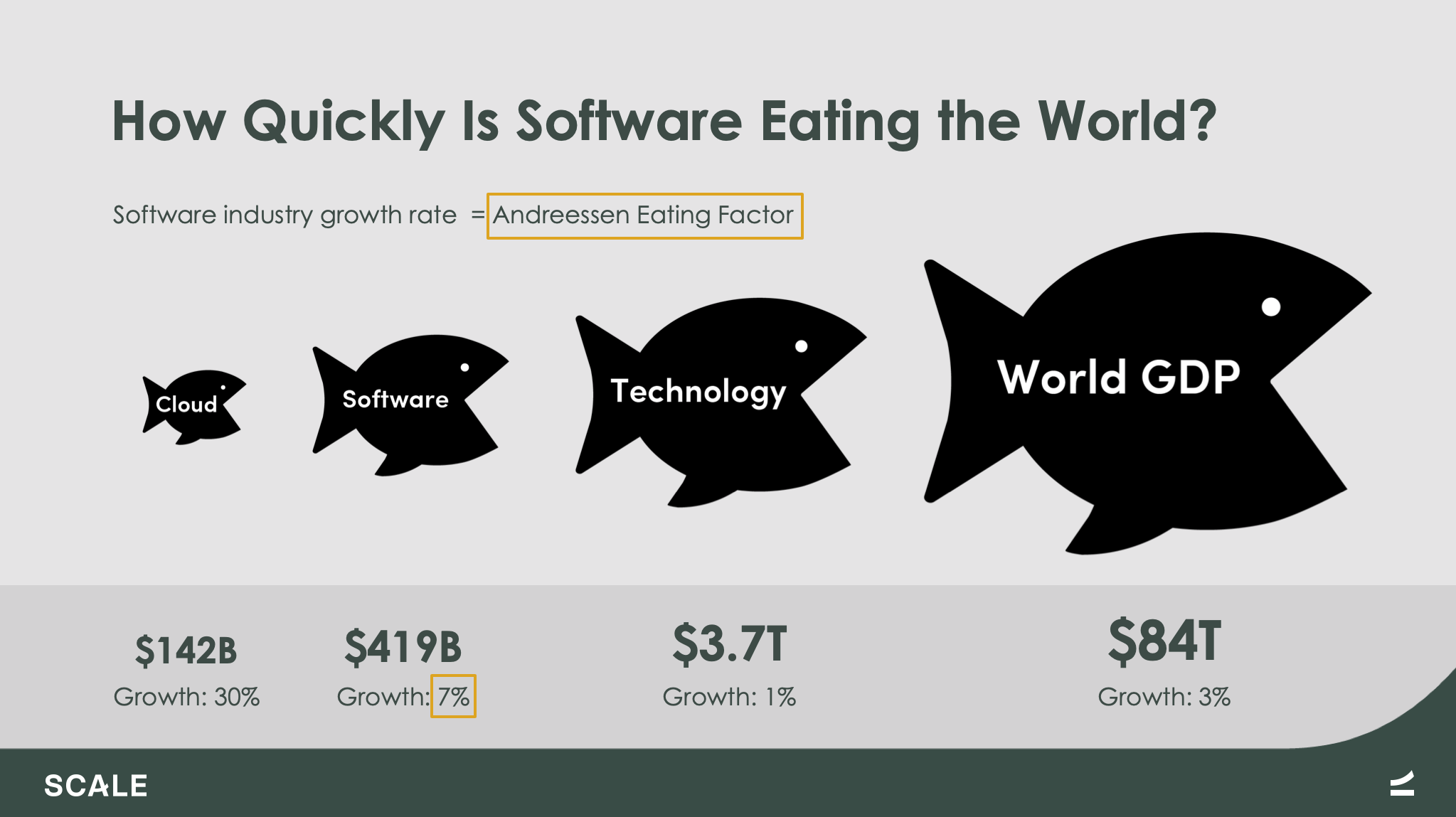

Fortunately, the future is not so grim because the overall enterprise software market itself is growing nicely. Marc Andreessen famously stated that “software is eating the world,” but we need to actually quantify this phenomenon because the growth rate of the enterprise software market over the next five years (call this the Andreessen Eating Factor) is the “get out of jail free card” for cloud growth.

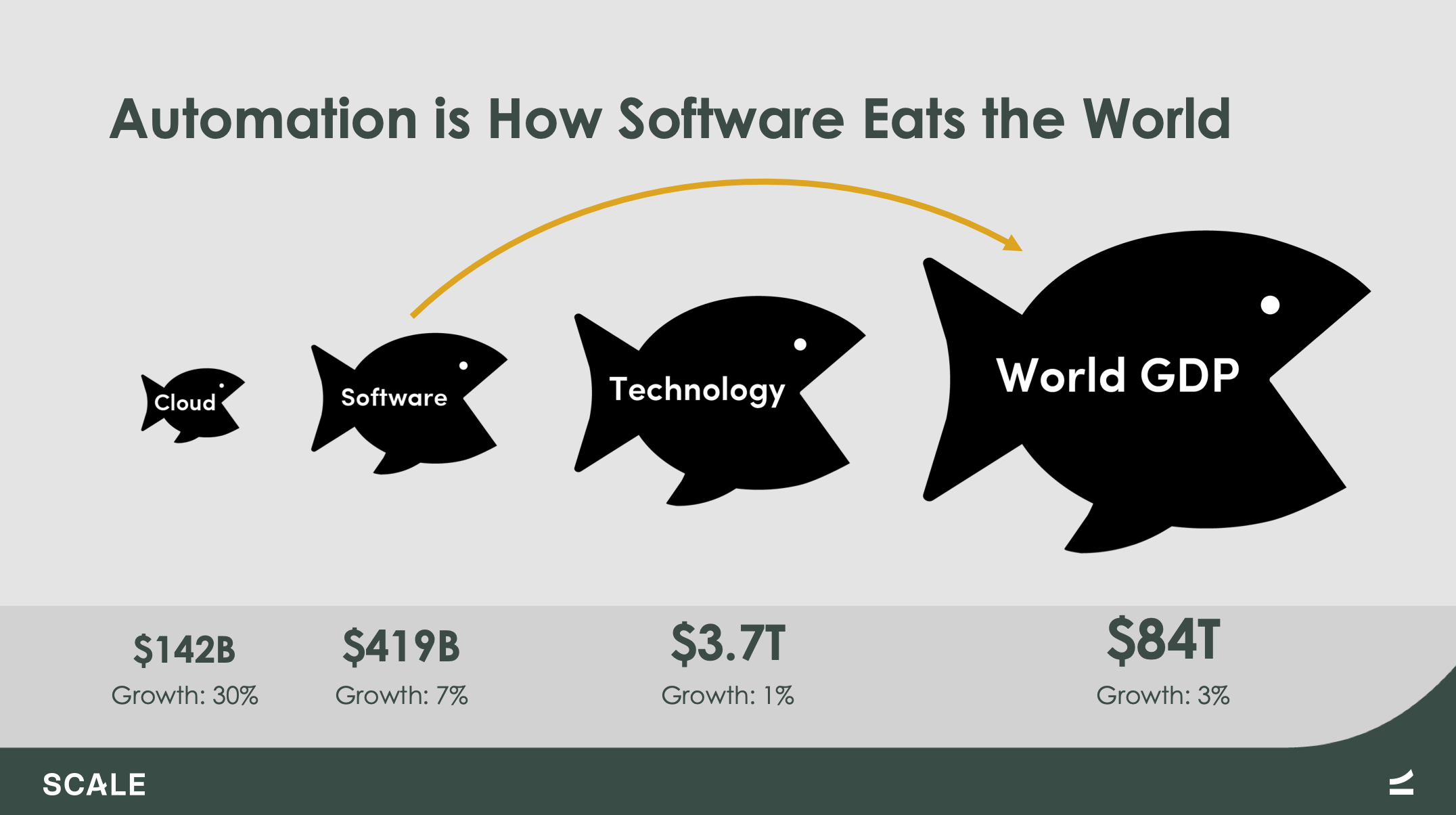

The graphic below shows the big picture. The cloud is growing 30% in a Software market that itself is growing 7% per annum by eating into the wider overall Technology and Telecom market. The wider tech market overall is only growing 1% per annum for the past six years and is about 4.4% of worldwide GDP. Although enterprise software can sometimes bypass Technology and eat directly from that big GDP fish (and we will come back to that), I believe that today in the enterprise software market, “Software Eats the World” mainly resolves to “Software Eats the Rest of Technology”.

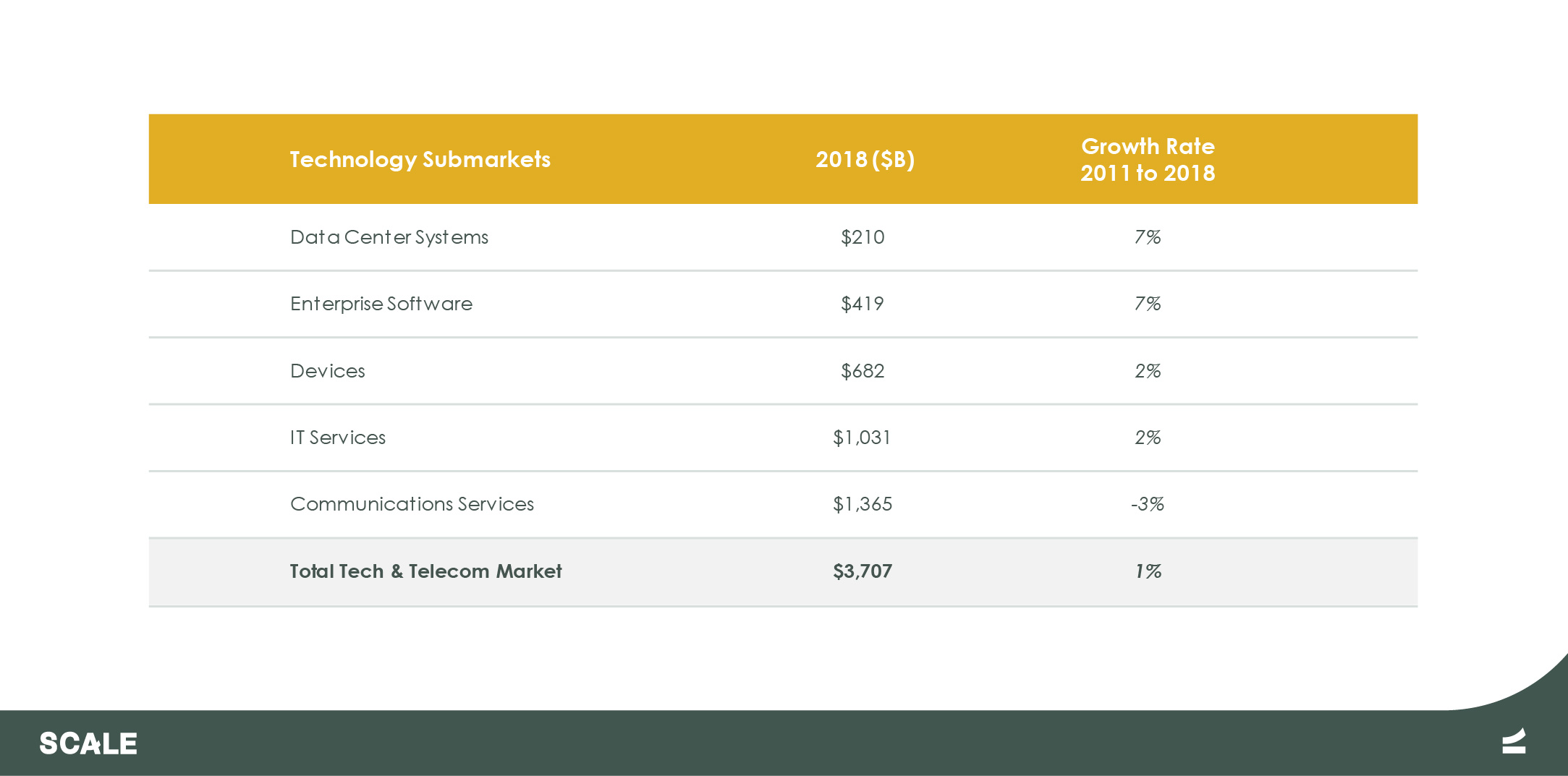

The major components of the overall Technology market are shown in the table below.

Software (and cloud as part of Software) is eating Technology when Zoom replaces communications services spend (that formerly went to AT&T) with software spend. Or AWS replaces datacenter spend (HP) with cloud revenue. It is no accident that these companies are some of the fastest growing companies in the cloud economy—there are lots of legacy telecom and datacenter dollars to chew on.

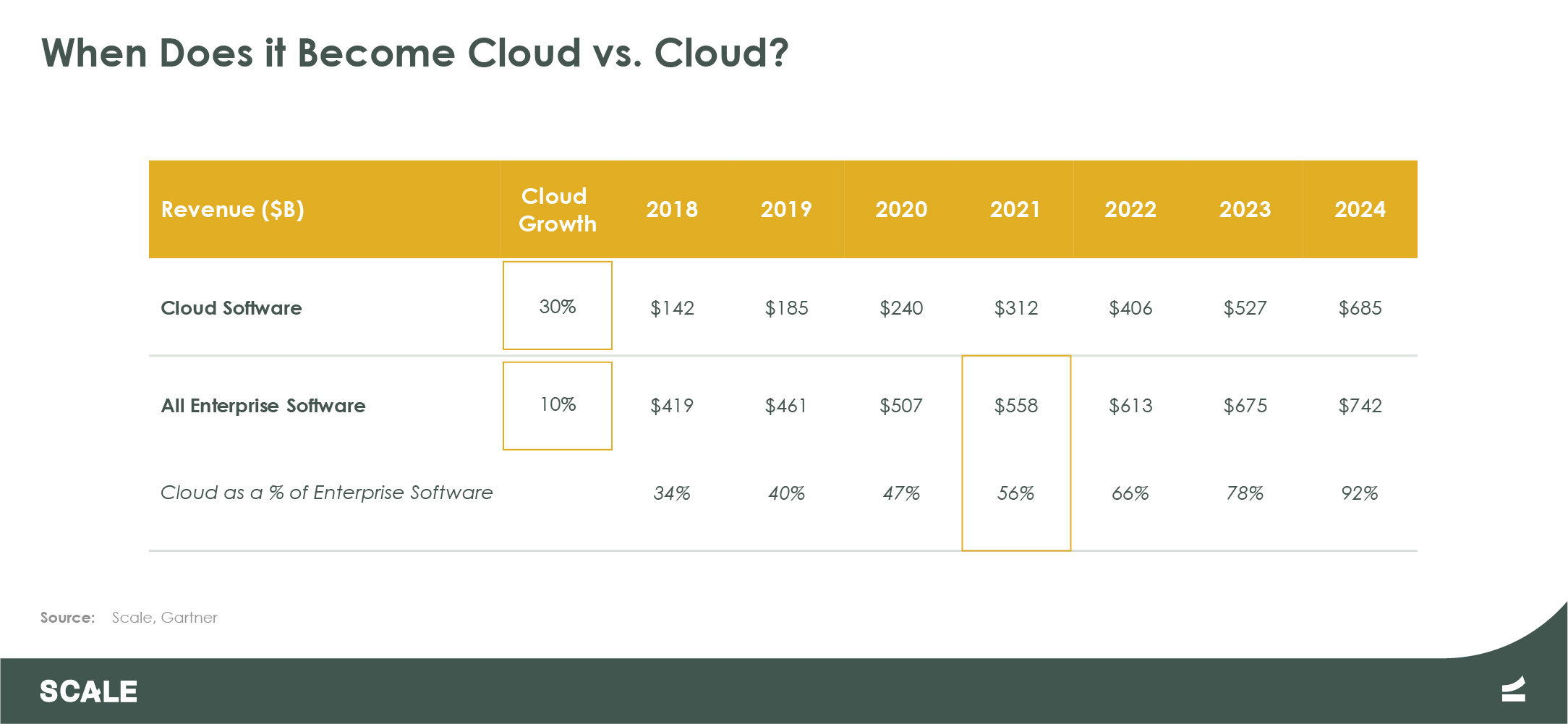

Over the last six years, the average growth rate of the software market was 7%. For 2018 alone, it was a stellar 13% and Gartner is forecasting an average of 10% a year for the next two years. Even if we optimistically extrapolate that growth rate (indefinitely!) into the future, the table below shows that by 2021, more than 50% of all enterprise software revenues are cloud and by 2024 cloud penetration is almost 100%. Once the cloud market is 100% of the Software market, then by definition the cloud growth rate of 30% has to converge with the overall Software growth rate of 10%. This is not a growth collapse — but it is a growth crunch — and it will happen over the next five years.

When does it become Cloud vs. Cloud?

I believe a meaningful tipping point will be when the majority of Software revenues come from the cloud, which is likely to happen by 2021. At that point, instead of taking market share from legacy vendors, the “average” cloud company will have to take it from a fellow cloud company. Goodbye Gold Rush, hello Hunger Games.

The largest cloud companies will feel the pressure first as they hit growth limits in their core markets and are forced to diversify into adjacent markets to keep up growth. For startups, the competitive dynamic will shift from “you vs. the company you have competed with for five years” to “you vs. a large behemoth cloud company in an adjacent market that wants to add your product and take your market”.

Because the largest expense for an enterprise software company is Sales & Marketing, an adjacent behemoth that already has the customer relationship can offer a second product to that customer at a dramatically lower price point than a single-product company can. The power of the bundle is even stronger if the products are in fact “better together” from the end customer’s perspective. This was Microsoft’s strategy in the 1990’s and, again today, it is AWS’ strategy as they announce 10+ new products every year. We can expect it from Salesforce as they leverage their eight cloud products. The key question for every startup has to be “who is your adjacent behemoth bundler?”

Startup Strategies in a Harsher Cloud World

There will be three winning strategies for a startup when this happens:

Fight. And win. Compete head on and win in an existing served cloud market. The perfect example is Zoom, the next generation video conferencing company that went toe-to-toe with large incumbents and won big in a wildly cash efficient manner. The fact that Zoom created $20Bn of value in a mature cloud market with competitors including Microsoft, Cisco, and LogMeIn, makes it one of the most impressive entrepreneurial achievements of the past decade. Other startups looking to emulate Zoom will have to bring to the table the same market knowledge (the team came from WebEx), clarity of product vision, and raw execution ability.

Focus on a newer cloud market within software where cloud penetration is still low. Software is not a single market but a thousand different niche markets. An entrepreneur selling cloud software to small and mid-sized trucking companies does not care a hoot about the market penetration of ERP software in the Fortune 1000, nor should she. Obvious parts of the software market that are still underpenetrated today include many industry verticals, most SMB’s, and the parts of the cloud that are being carved out of the wider telco industry.

The one non-negotiable here is a clear-eyed understanding of the likely adjacent behemoth bundler and how to position against them. What big SaaS company will want to steal your lunch money? Remember too, the typical SaaS startup takes eight or more years to get to scale, so it is not enough to have a clear runway now—that runway has to stay clear for a long time.

Fly beyond the cloud. The last option is to build a company that is based on more than just the move to the cloud, instead building the next generation of applications that we are calling the Intelligent Connected World.

Building the Intelligent Connected World

What does that new world look like? Software in the next 10 years will be:

- Driven by progress in three technologies: AI, sensors, and ubiquitous connectivity

- Designed to coach us, assist us, or in some cases actually do the work for us

- Built to leverage existing cloud applications, not replace them

We have started to refer to this collection of technologies as the enablers of the Intelligent Connected World, where “Intelligent” comes from AI, “Connected” means not just physical connectivity but interconnectedness at every level of the OSI stack via APIs, and the “World” reflects the way sensors of all types take computing away from the keyboard and mouse to the real-world of vision, movement, and voice. Most interesting companies today are leveraging at least one or two of these technologies.

For entrepreneurs, the product design implications of this new world are what really matter. The idea that our software will coach, assist, or do the work for us sounds obvious but it is in fact a massive shift from the SaaS world where we worked for the software. We input information into Salesforce, just as we did for Siebel in client server land, but the next generation of CRM will tell the rep whom to call and what to say.

Leveraging existing cloud applications will be a reality — the first generation of SaaS apps are not going away. This has business model consequences. Many new applications will have to exist in an uneasy co-dependence with underlying systems of record, creating a running border war over who captures the most value: the AI-driven systems of engagement/intelligence or the underlying system of record.

An ICW Example: Next Generation Bookkeeping

An example might help. A market we are interested in is the market for next generation AI-driven bookkeeping services for SMB’s. Companies in this space are not replacing the cloud provider (almost always Quick Books Online from Intuit). Instead they are sitting on top of QBO and using AI and connectivity to replace a human bookkeeper with a service powered by a combination of AI and humans for a more cost-effective solution.

The most important point is that these companies are not replacing a cloud software product or eating IT, instead (and back to the fishes), they are reaching all the way forward to that World GDP and eating the work of the bookkeeper. Instead of fighting over $500 per year versus QBO, they are getting $5K a year as a replacement for $10K of old school bookkeeping services.

This is going to be the meta trend of the next 10 years. Cloud software has eaten Enterprise Software and is already eroding the vulnerable parts of the Technology market. The next huge lift in growth has to come by reaching deep into the “real world” and earning dollars by automating or, more bluntly, eating, the work that today is outside the scope of current technology spend.

Onto the Future

This is an interesting time in technology. Investors are paying unprecedented prices for cloud companies, driven by the universally held opinion that the 30% growth of the last 15 years will continue for the foreseeable future. Lurking below the surface of this blind optimism are data showing that we’re about two to five years away from the simple “pvSaaS” play (plain vanilla SaaS) no longer working.

The next New Thing is emerging just in time: software designed to take over more of our work, leveraging new technologies that have matured in the last five years, all sitting on top of the prior generation of cloud software (and wrestling with that generation for share-of-wallet).

And the end of the day, I am not trying to call a market top – but I am willing to bet that the next five years will not be as simple as the last ten. Simply piling on will not work. If you are a startup for whom this makes sense, we would love to hear from you.

Credits

Sam Baker was instrumental in generating the analysis on cloud multiples and valuations as well as the insights that came from that work. The wider Scale team has all collaborated on thinking about the Intelligent Connected World. Errors are of course all mine.