And what it means going forward – A post in four parts

When Facebook goes public, the Russian venture capital firm DST, will be one of the largest investors in the most significant technology IPO since Google. DST could make $5 Bn on one investment. A question for any LP to ask the US venture capital industry is, how the heck did you let this happen? Someone walked in off the street and scooped the big pot. If this were Vegas, the casino floor manager would get whacked.

It began with the bubble

The bigger story is that the DST investment is emblematic of a wider change in the venture industry. The story began in the dot com bubble when hundreds of immature technology companies went public, and then promptly ran out of money before ever showing a dime of profit. The Nasdaq declined by 80% between 2000 and 2002, and it is still 50% below its 2000 peak. At the same time, regulatory overreach made IPO’s harder to get done. Sarbanes Oxley was designed to solve the Enron problem, but the high fixed costs of compliance ended up hurting early stage companies proportionately more, even though outright fraud was minor to non existent for venture backed companies in the tech boom. Enron, Worldcom and Tyco were all big established companies who lied about the past. Very few “dot.com” companies lied about the past; instead, at worst, they exaggerated the future. However the result of regulation and risk aversion, was that venture backed IPO volume plummeted, from a high of 200 plus in 1999 to a low of 9 in 2009.

Who loses when IPO’s don’t happen?

The economy definitely loses big time. Fewer IPO’s means less recycling of scarce venture capital and thus fewer new startups. Venture dollars invested in 2011 are still only 30% of the 2000 total, and all those extra invested dollars created jobs.

Does the venture business lose? The conventional wisdom would say yes. Venture capitalists are in the capital gains business, so if you cannot take companies public, it is harder to realize a big capital gain. However, a closer look would show the impact of the IPO dearth on venture backed companies, and ultimately on venture returns, has been more nuanced. For companies in intrinsically high burn rate businesses, like biotech and clean tech, it has clearly been a disaster. For these companies IPO’s are a necessary financing, not an exit, so no IPO’s has meant no money, and thus the closure of many promising opportunities.

But for many technology companies the picture has been different. The story that the “internet is capital efficient” has been overdone but it is true that companies in the internet space can get substantially de-risked, and even get to cashflow break even on relatively little capital, amounts of money that are within the capabilities of the venture industry. Here the closed IPO window was not a matter of life or death, instead it simply meant that companies spent more of their early middle age (for lack of a better term) as private companies, than would have been the case in the 1990’s. For the investors this has translated into longer holding periods. What in turn does that mean?

Key point, Fewer, Bigger Winners, more Losers

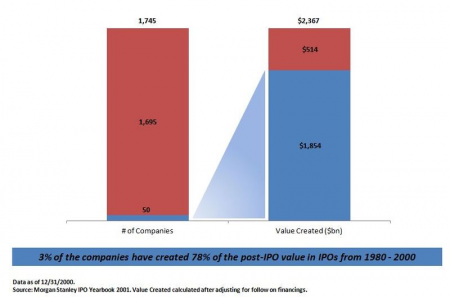

As holding periods got longer, something very interesting happens. Dispersion sets in. Mary Meeker used to prepare an annual report at Morgan Stanley showing the fate of every technology IPO since 1980. Every year the big picture conclusion was the same. After the IPO, many, sometimes most, tech IPO’s underperform. Fifty percent or more of them trade below their offer price forever, and almost all the overall gain comes from a small handful of companies. However, the gains from these few companies massively outweighed the losses on many smaller deals and overall, investing in technology IPO’s, has been a good business. Microsoft, Cisco, Oracle and Apple covered a multitude of sins and a basic index fund strategy across the category made money. It is the same pattern of winners and losers that is seen at the start up stage, except played out for bigger dollars, in the public markets after the venture capital investors have exited. The table below shows the calculation for twenty years worth of IPO’s (1980-2000), showing that 78% of the post IPO value was created by 50 IPOs, approximately 3% of the total number.

This process of winnowing, and continually separating, the winners from the losers, is independent of whether the companies are public. It is a basic part of how technology markets operate. With the IPO window shut, all that happened is more of this process took place in the private markets. Some companies that reached $100 MM in revenues and would have gone public, instead remained private, saw their growth rates decline and got sold for minor sums, others went on to have $ 2 BN in revenues, and are now valued in the many billions, all the while still private.

Venture Industry is healthy, many firms, not so much

The result for the venture industry is that for a long time the industry as a whole looked sickly. Holding periods extended, IPO’s were sparse and returns were dreadful. Capital left the industry. Meanwhile the underlying assets were compounding merrily, and now the returns from the small number of huge exits, are starting to swamp the losses, the management fees and the small profits from the earlier smaller exits. Just as Ebay, Cisco, Microsoft and Oracle more than covered a multitude of mediocre IPO’s in the 1980’s and 1990’s, so too will Facebook, Linked In, Groupon and Zynga wash away the pain of lots of $5M bad outcomes for the industry. If Facebook is worth $ 100 Bn, the venture investors will probably make $ 30 Bn covering, in one deal, almost two years invested capital for the whole industry.

However the result for individual venture firms can be harsher. In the 1990’s world everyone got to put some points on the board, and no one’s points were that much bigger than anyone else’s. Because companies went public earlier in their life cycle, most firms had winners and even the great companies went public at sub one billion valuations (EBay, Amazon). The dispersion took place once public. In the current world some firms get to put huge points on the board and some firms get to put none. Pretty scary. Figuring out how to survive in that reality, required new thinking and no one figured out that better than DST. In the next post I will lay out what the “right play” was, why DST was positioned better than anyone else to find it, and why that opening has now been filled.