The most successful companies in vertical markets pair product innovation with go-to-market disruption. In this series we explore that marriage, how companies many have never heard of came to dominate their markets, and how they scaled with distinct tactics. These history lessons inform what we look for when investing in vertical markets at Scale Venture Partners, and hopefully provide blueprints for the next generation of vertical market winners.

Company name: LPL Financial

Founder: Todd Robinson, David Butterfield, and Jim Putnam

Year founded: 1989 (through Linsco’s acquisition of Private Ledger)

Company vertical: Financial Services

Market dominance: Financial Advisory

What do they actually do: LPL provides financial advisors with front, middle, and back office support so they can focus on running their advisory practice. They offer a number of different tools and services to advisors such as a complete tech stack or services to help with marketing strategies, and as a self clearing broker and custodian, they can settle their advisors own trades and safeguard customer assets, meaning an advisor has everything they need under a single roof. They serve every type of financial advisor, from independent advisors, RIAs, employee models, and institutions that want to outsource their advisory business and have some solution for all 300k+ advisors in the US.

Product innovation: LPL’s product innovation stemmed from the idea that you should treat the advisor as the customer. When LPL was founded, wirehouses (e.g. Merrill Lynch, Morgan Stanley) dominated the financial advisory market with somewhere on the order of 80% market share. A typical advisor at a wirehouse sold proprietary products to clients and were paid commissions on how much product they sold. It was a very top down structure with quotas to hit leaving little room for the advisor to shine and really act in their clients best interest. Advisors were a tool for big organizations to move products and both advisors and clients wanted more.

Investing in better ways to support their advisors has been key to LPLs growth and they do this through four main strategies – technology, custodian and clearing services, practice management, and research. LPL has been innovating on the tech stack for their advisors ever since the early 90s when they rolled out real time market data and the beginnings of their full tech stack in the late 90s, which they have been iterating on and adding features to since. Financial advisory comes with regulation as well, so LPL handles the three main regulatory hurdles for advisors – executing the transactions (self clearing), holding the assets (custodial services), and the compliance services that go along with providing investment advice. Since advisory is a client services business, they provide a suite of services and several conferences for advisors to attend, that cover everything to help run and grow a practice from sales and marketing strategies, new financial product info, and M&A advice for advisors looking to buy or sell. Another product that LPL provides to their advisors that typically only came with a wirehouse when they started is an in-house research department, which they launched in 1992 and continues to this day to help advisors find the right products for their clients. Everything you need as a financial advisor to run your business, no matter how you want to run your shop.

The last innovation LPL made to financial advisory was around compensation. Compared to the wirehouses they positioned against, LPL touted 80%+ payout to advisors, compared to the 30-50% that is common with captive channels. Their scale and vertical integration allowed them to pass savings to their customers (the advisors) which further enticed advisors to turn independent under LPL.

Scaling magic moment: LPL benefitted from a few megatrends in the advisory space, mainly the migration to independence for advisors, which along from benefiting from LPL also helped fuel, and the growth in investments, both from the perspective of more clients coming to advisors and growth in the market (today for every 1% increase in the market, LPL gets an additional $15M in gross profit!)

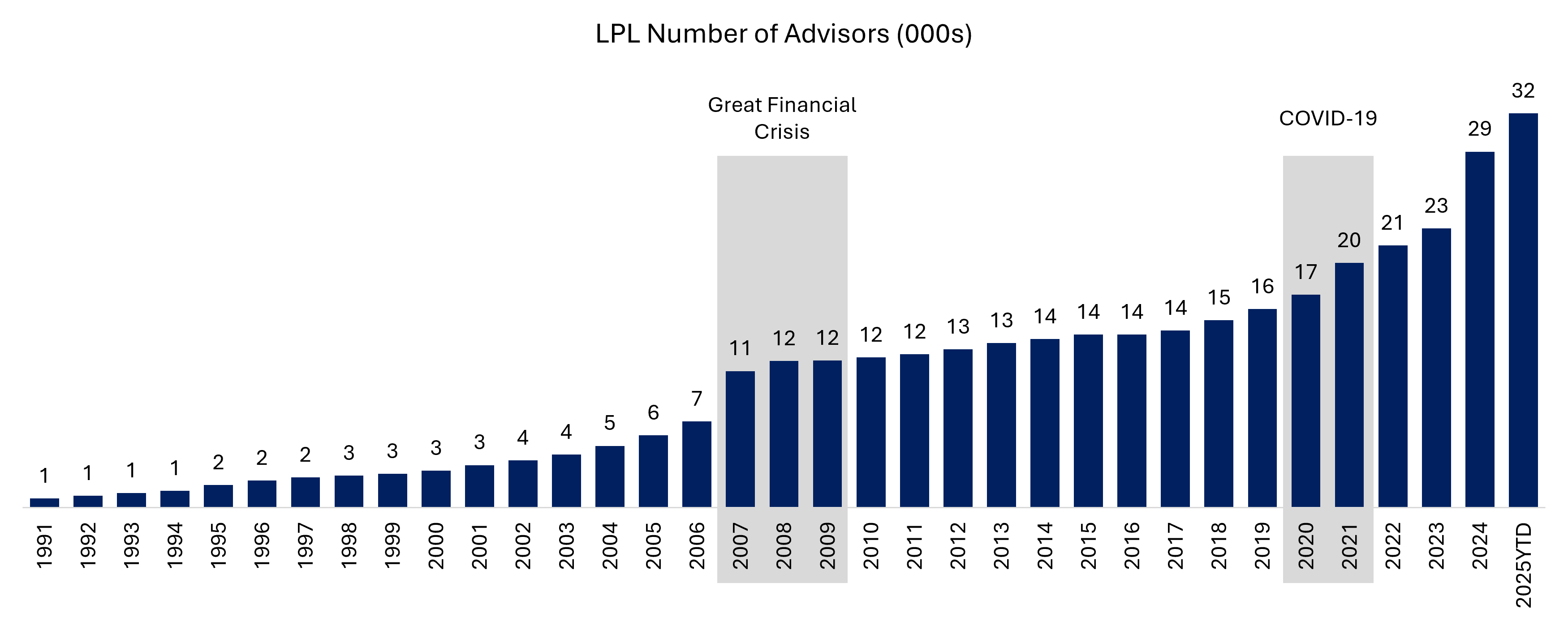

But the real magic in LPL’s growth came from M&A. In the period from 1991 to 2006, LPL grew their advisor count at 16% CAGR, a strong number for a 15 year period, but nothing compared to the 58% growth in advisor count they experienced in 2007, largely from a 2k+ advisor acquisition of 3 of Pacific Life’s broker dealers . After the GFC and until COVID-19, LPL grew advisors at a measly 3% annually. Then during COVID, LPL went on another buying spree and grew advisor count 15% between 2020 and 2021. Since then, they have continued their aggressive M&A strategy and as the largest player in the space, they can now target larger firms, shown by their recent acquisition of Atria with 2,200 advisors, the outsourcing of Prudential’s advisory business with 2,800 advisors, and the acquisition of Commonwealth with 3,000 advisors.

Where are they now: LPL went public in 2010, and has since scaled to being the largest independent broker-dealer in the US, with a near $30Bn market cap, 32k advisors and $2.3Tr in assets across advisory and brokerage.