The last decade of ad tech was built for pages, feeds, and apps. You scroll. You click. You land. The ad is some rectangle, and the business model is: show enough of them to subsidize whatever the user is doing.

And whatever the user is doing happens to be an awful lot. Advertising is the business model of the internet. It funds search, social media, news, entertainment, email, and most of the free services people use every day. Global digital ad spend is over $1 trillion annually, making it one of the largest digital markets in the world. In the US, Google and Meta capture roughly 50% of that spend (with Amazon taking another ~20%) but that still leaves ~$300 billion flowing to all the other players in the market. The ecosystem that captures even a fraction of that remainder builds a massive business.

Ads are so big because they’re what make the internet tick. With ads, users get access to a vastly larger amount of content and services because they’re free, content makers reach the largest possible audience because access is free, and advertisers find customers they never could have reached otherwise. The internet wouldn’t be truly global if we had to pay $20 a month for every service we used. Advertising is what opens up the internet for billions of people to use it daily.

Now, the default consumer interface is shifting. Increasingly, people don’t browse, they prompt. A chatbot (or agent) answers in natural language, often collapsing what used to be a chain of searches, clicks, and websites into a single query and response. And once the interface becomes a conversation, “advertising” can’t stay a rectangle for long.

Why this matters now

Chatbot usage is booming, and it’s not just ChatGPT, Claude, and Gemini. 86 million desktop users (36% of online PC users) interact with AI tools each month, with AI assistants leading usage, but the real story is what’s happening beyond the AI labs.

The consumer AI chatbot landscape is exploding. Appfigures describes an ecosystem where more than a thousand new AI apps are released on the App Store and Google Play every month, in total garnering 100M+ downloads per month (and accelerating). a16z’s consumer AI rankings repeatedly show new entrants and fast-moving categories, underscoring how quickly the surface area is expanding. There is a Cambrian explosion of consumer AI interfaces: coaches, companions, study helpers, planners, and more. Any wrapper you can imagine is being created, each with its own UX and niche distribution channel.

That explosion of usage is colliding with a monetization problem. Menlo Ventures’ 2025 survey claims 61% of American adults have used AI in the past six months, and nearly one in five rely on it daily, yet only 3% pay for premium services. Usage is scaling far faster than willingness to pay, and even the biggest AI product in the world (ChatGPT) is responding by turning to ads.

If ChatGPT (with hundreds of millions of users and a robust, fast-growing subscription business) still needs ads to expand reach and maximize monetization, then smaller, more niche AI products almost certainly will. The long tail of consumer chatbots doesn’t have ChatGPT’s brand, scale, or conversion rates. Advertising will be a core path to making their services accessible beyond a small base of paying subscribers.

A very quick refresher: how “normal” ad tech works

Here’s what happens when you load a webpage:

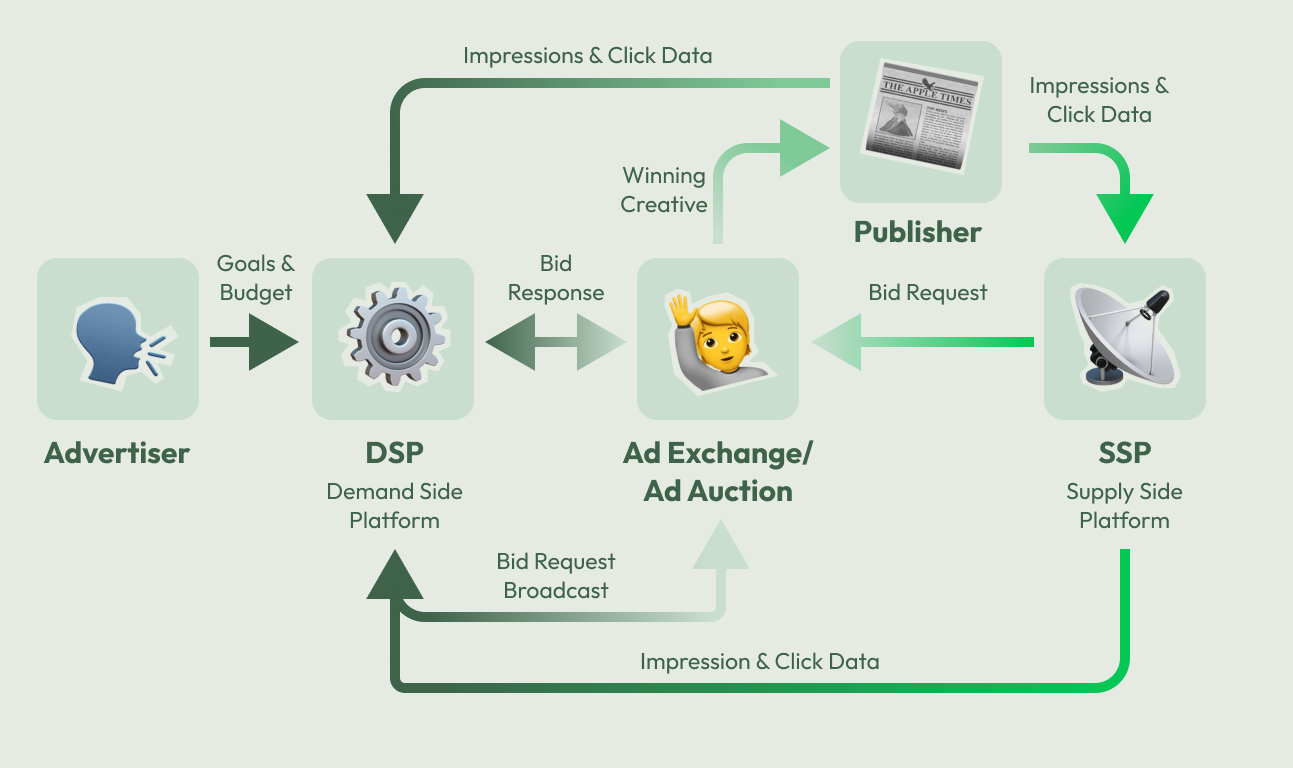

You click a link. The page starts loading. Embedded in that page is an ad slot (maybe a banner, maybe a video pre-roll). The publisher’s SSP (supply side platform) immediately broadcasts a bid request to dozens of DSPs (demand side platform) and ad exchanges. That request includes context: the page URL, your (anonymized) browsing category, device type, geography, and maybe a cookie ID.

Within 100 milliseconds, each DSP evaluates that request against thousands of active campaigns, runs targeting logic, calculates a bid price, and sends back a response with creative assets. An auction happens. The highest bid wins. The creative loads into the slot. All of this—broadcast, evaluation, auction, creative delivery—completes before the rest of the page finishes rendering.

It’s one of the most impressive engineering feats on the internet: a globally distributed, real-time marketplace that settles millions of auctions per second with sub-100ms latency.

This machinery is a two-sided marketplace. On the demand side, advertisers use a DSP to buy impressions across publishers, exchanges, and supply sources. On the supply side, publishers use an SSP to sell their inventory and maximize yield. In the middle, RTB (real-time bidding) auctions individual impressions in milliseconds; OpenRTB is the common “language” for bid requests and responses.

And it all assumes a world where the core asset is an impression and the creative is prebuilt.

Chat breaks both assumptions.

What changes when the “page” is a conversation?

Let’s start with the most basic question: what does the ad unit actually look like?

Ben Thompson has pointed out that you don’t necessarily need ads inside the conversation. You could just have traditional display ads in the UI chrome around the chat. Think of it like a page break: you’re chatting, then there’s a banner or sponsored card that uses the same DSP/auction machinery as traditional ads (still targeting based on context and user data), but it’s completely separate from what the assistant says. You can click it or scroll past it, just like a feed.

That’s a valid path, and it preserves a clean separation: the model never touches the ad, and trust stays intact. But it also leaves money on the table. The whole reason chat interfaces are powerful is that they collapse intent expression and action into a single flow. If you can monetize within that flow by offering relevant next steps the unit economics should improve dramatically.

In a conversational product, the user isn’t passively consuming content. They’re expressing intent much more clearly. Sometimes explicitly (“recommend a running shoe”), sometimes implicitly (“my knee hurts when I run”), sometimes over multiple turns (“I tried those and they didn’t work”).

That shifts the design constraints for any ad system that goes deeper than display:

Relevance becomes existential. If an ad is irrelevant in a feed, you scroll past it. If an ad is irrelevant in a conversation, it feels like the assistant is malfunctioning, or worse, manipulating you.

Trust becomes the moat. Sam Altman’s public comments on advertising keep returning to trust: people trust ChatGPT, and ads that degrade trust are dangerous. Perplexity’s ad experiment similarly emphasizes that answers should not be influenced by advertisers and that sponsored material must be clearly labeled.

Measurement has to map to outcomes, not clicks. This isn’t unique to new AI products. Outcome-based measurement is what built the Google and Facebook empires. But chat makes the problem more acute. A lot of conversational interactions don’t end in a click at all. They end in a decision: book the hotel, download the app, choose the plumber, buy the running shoes. Chatbot ad infrastructure will need to incorporate traditional tracking methods (pixels, conversion APIs, attribution windows) at a minimum, and potentially develop more sophisticated approaches for multi-turn conversations where intent develops over time and the final action happens outside the chat entirely.

The creative can be dynamic (but must be constrained). In a chat UI, the “best” ad might look like a suggested next step, a comparison, or a small block of structured options (not a static image). But once you let a model generate ad copy in real time, you inherit a policy, safety, and compliance problem.

So what is a “next‑gen DSP” for AI?

A next‑gen DSP is a market maker that matches intents to outcomes.

It looks like a DSP because advertisers still need a place to set budgets, targeting constraints, and bids. But it behaves less like classic display advertising and more like a hybrid of:

- search (because it’s intent-driven),

- native (because it must fit the UX),

- and performance marketing (because outcomes matter more than clicks).

Concretely, an AI-native DSP would likely include:

An AI-native “bid request.”

Not just device and placement, but a structured representation of what the user is trying to accomplish (intent), what constraints matter (price, location, time, preferences), and what the assistant is about to do (recommend, compare, book, summarize). Done right, this can be privacy-preserving: summarize the intent without shipping raw conversation text.

You can see early versions of this idea in how ZeroClick describes its approach: detect intent, craft a “privacy-safe summary,” then match campaigns so brands can compete to enrich answers.

New ad units: “sponsored actions,” not just placements.

A conversational interface wants ads that are closer to:

- “Book with X”

- “Try Y”

- “Sponsored option: Z”

…than “Buy now” banners. Google’s examples of ads appearing when a user is asking how to build a website hint at this direction: ads are inserted when they’re plausibly the next step.

Generative creative with guardrails.

The system may generate the final phrasing, but advertisers will demand controls (brand voice, disclaimers, claims policy).

A trust layer that is first-class.

This includes strict labeling (“Sponsored”), separation between organic response generation and sponsored modules, and clear policies about what kinds of queries can be monetized.

Outcome measurement that works in an agentic world.

If an assistant helps you decide, but the purchase happens later in another app, attribution becomes fuzzy. You need new measurement primitives—potentially privacy-preserving conversion APIs, aggregated reporting, or commerce integrations.

What products can this DSP plug into?

The open opportunity is everything outside the walled gardens of ChatGPT, Claude, and Gemini. The new crop of AI-native products that need a free tier or performance monetization. Below is a non-exhaustive list of some of these consumer chatbots which are already collecting hundreds of millions of downloads per month (and growing fast!).

Creator-led and expert-led AI mentor apps.

Purpose is a clean example of the new product shape (a dedicated AI mentor for personal growth), even though it explicitly promises users they won’t be shown ads. Purpose AI Mentor Whether they choose subscriptions, ads, or both, these “personal AI” apps create a new kind of inventory: high-trust, high-intent moments around life decisions.

Companion and character chat platforms.

TechCrunch reported 337 active, revenue-generating AI companion apps worldwide, with 128 released in 2025 and 220 million downloads as of July 2025. This is a huge engagement surface outside the big general assistants. Some of this market monetizes via subscriptions today; ad-supported tiers are a plausible next step, especially for long-tail or creator-generated characters.

AI study helpers and tutoring products.

Education has always supported a mix of free + paid. In a chat-first study product, the “ad” can be a sponsored course, test prep, or local tutoring lead—again, closer to a “next step” than a banner.

Vertical concierges (travel, food, shopping, local services).

These are the most obviously DSP-compatible surfaces because the user is literally asking what to buy or do. If an agent is helping you plan a trip, the advertising product wants to look like a booking option, a sponsored deal, or a structured set of choices.

Publisher-owned AI assistants (news, archives, communities).

Perplexity explicitly links its ad experiment to sustainability and revenue-sharing, arguing subscriptions alone don’t fund a scalable publisher program. As more publishers launch chat interfaces over their content, they’ll need similar monetization logic.

AI Browsers

Perplexity launched Comet, a browser that integrates AI assistance directly into web navigation, and The Browser Company’s Arc has been experimenting with AI features and exploring ad-supported models.

The advertising opportunity is particularly interesting because browsers sit at the intersection of intent and action. Perplexity has already experimented with ads as “sponsored follow-up questions,” and Arc has been vocal about needing sustainable monetization. Both are exactly the kind of AI-native publisher that won’t build ad infrastructure in-house but could integrate a DSP that understands conversational context.

The “vibe-coded” microapp explosion.

Platforms like Replit and Lovable show up in the a16z Top 100 consumer AI apps list, and a16z notes that sites published through them generate significant traffic. This is an underappreciated distribution channel for a next-gen DSP: integrate once with the builder ecosystem and you can reach thousands of small apps that will never build ad infrastructure on their own.

The common pattern across all of these: they’re AI-native publishers with no ad stack, and they need a monetization primitive that doesn’t destroy trust if they want to expand their reach beyond non-premium users.

The Enterprise Opportunity

The ad opportunity isn’t limited to consumer apps. Tools like Cursor (the AI coding agent), Harvey (the legal AI assistant), and OpenEvidence (which helps doctors search medical literature) could monetize through highly targeted, contextually relevant advertising.

The supply side is very eager. API providers, dev tools companies, and infrastructure vendors would pay significant premiums to reach developers at the moment they’re building something. Legal database providers want visibility when lawyers are researching case precedent. These advertisers have always struggled to reach their audiences with precision since professional intent is hard to capture in traditional display or search. An AI tool that knows what the user is actively working on is a dream ad surface.

And for the apps, there’s a clear fit as well. The most obvious application is accelerating PLG. These tools typically have free tiers to drive adoption, but free users are expensive to serve (especially when you’re paying for inference). Ads offer a way to subsidize those tiers without gating features or pushing users to convert before they’re ready. A developer using Cursor’s free tier sees an ad for an API service relevant to what they’re building; a doctor on OpenEvidence sees a sponsored research summary from a pharma company. The free tier stays free, usage grows, and the product still makes money.

The structure of these ads matters. A next-gen DSP built for AI interfaces wouldn’t serve “visit Alabama” or “download NordVPN” to a developer debugging Python. It would match intent to advertiser: a developer working on authentication sees an ad for Auth0, a lawyer researching case precedent sees a sponsored legal database, a doctor evaluating treatment options sees relevant clinical research. The ad unit looks less like a banner and more like a contextual suggestion: sponsored documentation, a recommended tool, a relevant case study.

These aren’t consumer-scale volumes, but the CPMs could be dramatically higher because the audience is narrow, professional, and high-intent. When the user is a decision-maker researching a high-stakes choice, the ad unit starts to look more like enterprise SaaS lead gen than traditional display advertising.

Early market map: who is trying to build this layer?

A small crop of companies is already describing themselves as the monetization layer for AI interfaces:

- Nexad positions itself as an AI-native advertising platform embedding context-aware ads into AI interactions, and Prosus/a16z publicly announced a $6M seed round for that thesis.

- Koah frames its product as monetization for GenAI apps via an SDK and “native, context-aware ads” inside conversations; it’s explicitly pitching “AdSense for GenAI.”

- ZeroClick emphasizes intent interpretation plus “privacy-safe summaries,” with brands competing to supply relevant context for answer enrichment.

- OpenAds positions itself as an AI-native ad platform for the open web that generates hyper-contextual creative based on content and user intent.

These approaches differ (some look more like in-chat “sponsored modules,” others like creative generation for publishers), but they’re all converging on the same bet: AI creates new inventory, and it will need new ways to monetize.

We’re still in the early innings of consumer AI apps. Most of what exists today looks fragile: thin wrappers around foundation models with high churn and unclear defensibility. But that’s exactly how new platforms start. In the early 2010s, the majority of Shopify stores failed within their first year, yet the platform kept growing because the category was real even when most individual stores weren’t.

People continue using niche AI chatbots even when ChatGPT, Claude, and Gemini exist because those apps tailor the intelligence to resonate with specific use cases and audiences. A fitness coach bot speaks differently than a study helper. A companion app has different constraints than a travel planner. The wrapper is the product when it makes the underlying intelligence feel purpose-built for you.

As foundation models get cheaper, faster, and more capable, and as developers learn what actually works in conversational interfaces, we’ll see the same pattern: most of today’s AI apps will fade, but the category will grow, and the winners will build real businesses. A DSP that can serve this expanding ecosystem—from today’s experimental wrappers to tomorrow’s breakout products—has a long runway ahead.