Scale’s quarterly Scale Studio Flash Updates use our proprietary data platform, Scale Studio, to analyze a representative sample of enterprise software startups and provide a real-time look into industry growth rates and the health of the SaaS market. Today, we explore the results of Q3, 2023.

What you need to know right now

Last quarter we saw growth fall to the lowest levels since Q1 2020, driven by a spike in churn and continued macro headwinds. The most recent data from Q3 has some signs that the worst could be behind us as churn slowly improves and growth rates start stabilizing.

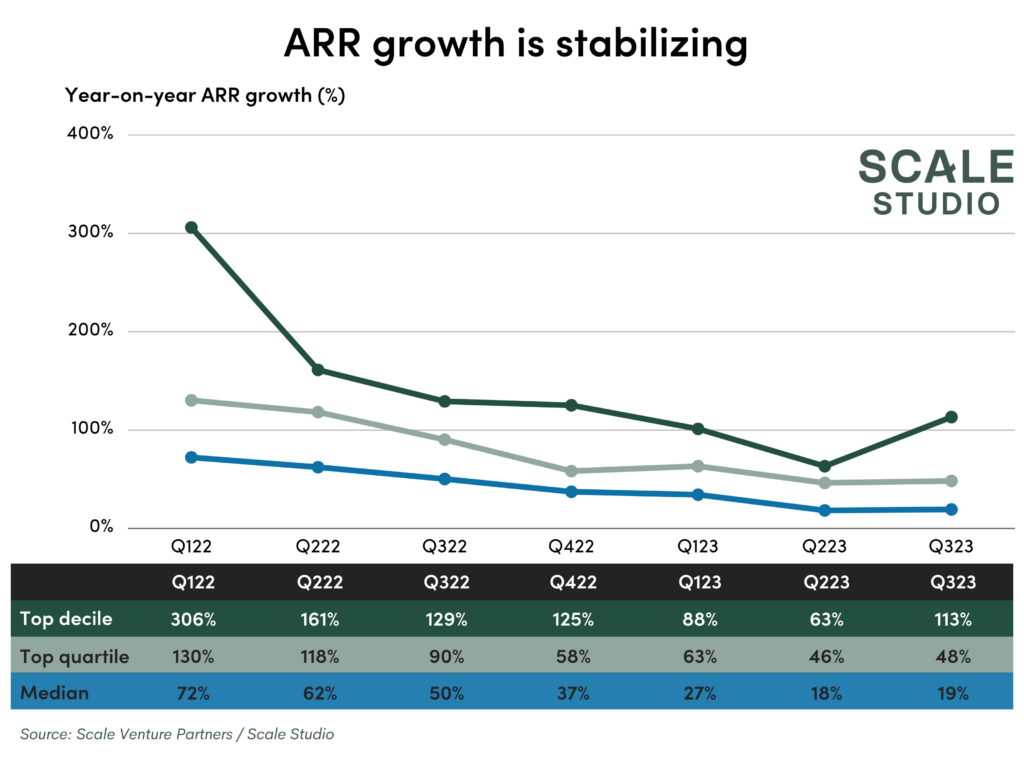

Q323 data shows stabilization of growth rates, with median ARR growth virtually identical to what it was last quarter, ticking one percent higher to 19%. The biggest positive note is that top-decile growth nearly doubled to 113%. However, 20% of companies beat their Q3 plans, another indication that the gap between high and low performers is growing.

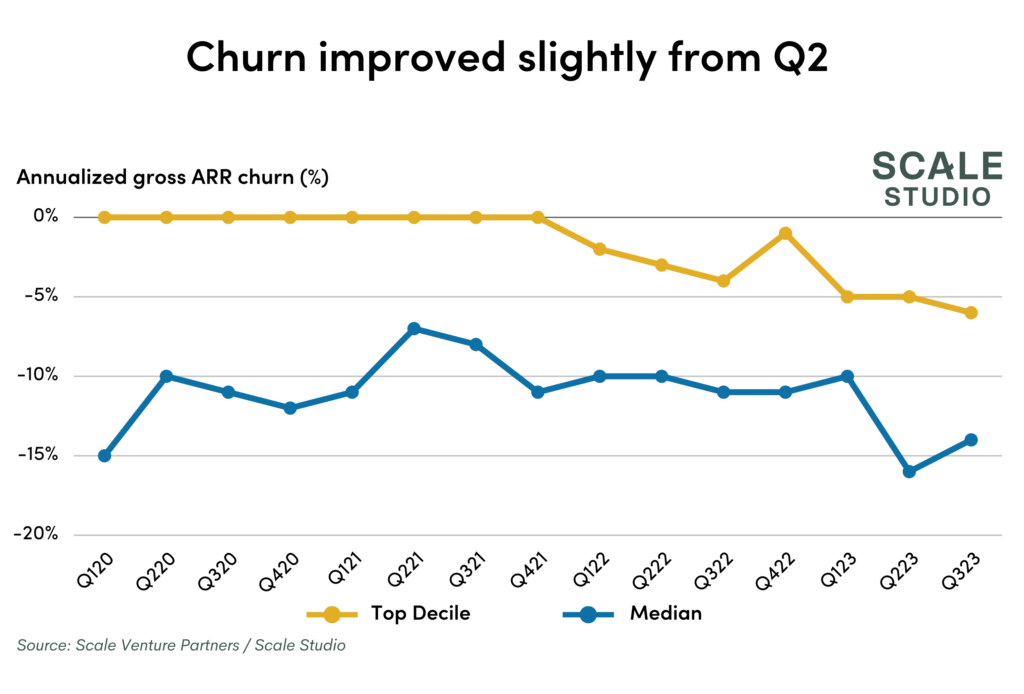

While still depressed, growth rates may start increasing again in the next couple of quarters as the bulk of the tech slowdown has worked its way through the system. Churn was the primary driver of the continued slowdown in growth last quarter. This quarter, churn improved a bit, with only 14% annualized churn in Q3 (vs. 16% in Q2). We’ll see if this decrease in churn continues into Q4 and 2024.

Q323 performance key findings:

- Median ARR growth rate was 19%, the first quarter since Q122 that growth did not decline and 1% higher than Q223 growth of 18%

- Top-decile ARR growth rate was 113%, significantly higher than Q223 top-decile growth of 63%

- Churn ticked down to 14%, lower than Q223 annualized churn of 16%

Q323 growth rate analysis

Growth rates are starting to stabilize after having fallen continuously since early 2022, with median ARR growth of 19% in Q3 coming in a tad higher than the 18% median ARR growth we saw at the end of Q2. More surprisingly, top-decile growth rates were significantly higher than we’ve seen in any quarter this year, with top-decile growth of 113% nearly twice as high as the 63% we saw last quarter.

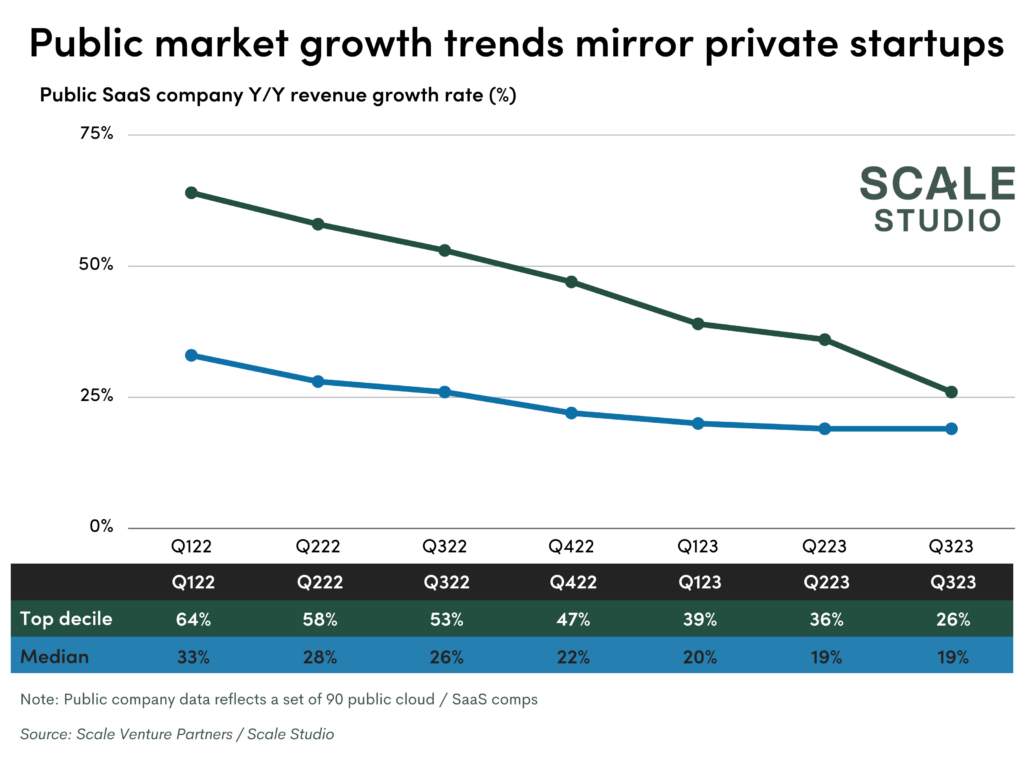

This continues to mirror public company growth

As we’ve seen in the past couple of quarters, startup performance is closely mirrored in public SaaS company performance. Looking at a set of 90 comparable public cloud companies below, we see the same trend for median growth rates, with growth stabilizing in 2023, albeit at a much lower level than before. Contrary to private startups, top-decile public companies haven’t seen the same rebound in growth, with top-decile public company growth still falling in Q3.

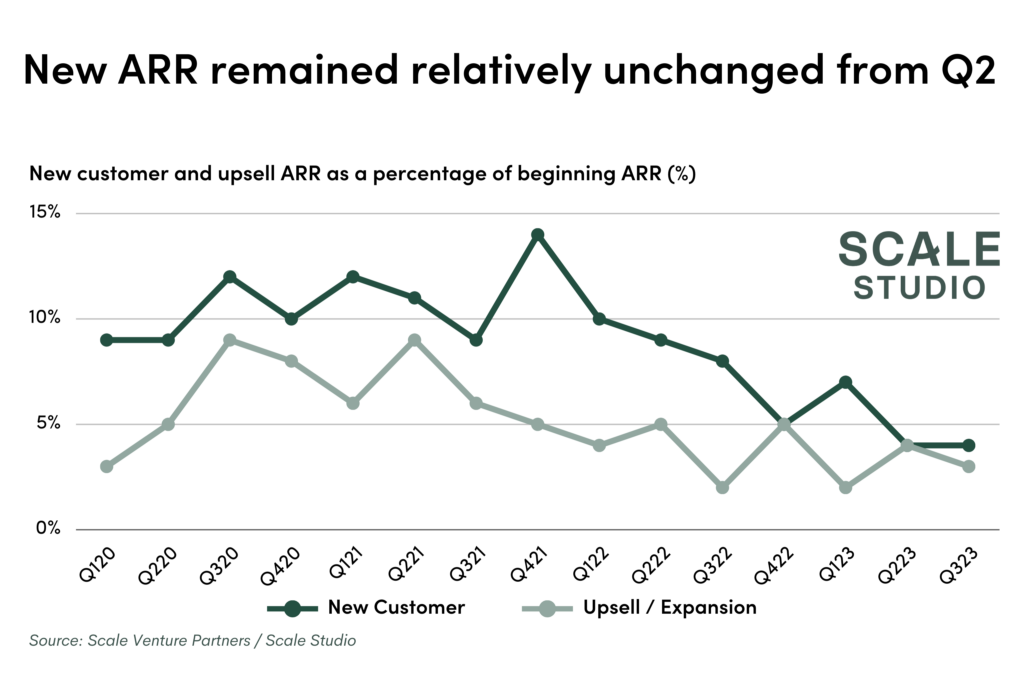

Similar to growth rates, churn and new ARR mix are also flat

Looking at ARR from new customers, upsell, and churn, we see that there haven’t been any large swings in one direction or another. The new ARR mix is similar to what it was throughout 2023, with ARR from new customers and upsell remaining around the same levels they were at in Q2.

Churn actually slightly improved from last quarter to 14%, but is still higher than in any quarter other than Q120. This is heading in the right direction, however, so hopefully the trend continues and churn can return to regular levels in 2024.

Although still below historical trends, ARR growth rates have stabilized in Q3 as the worst of the tech slowdown has passed. As we saw earlier, top-decile growth rates not only stabilized but significantly increased in Q3. The stabilizing growth rates, downtick in churn, and general efficiency improvements we’ve seen this year paint a hopeful picture for 2024. While we’re still far from a full recovery, at least the bleeding seems to have stopped.