Scale’s quarterly Scale Studio Flash Updates use our proprietary data platform, Scale Studio, to analyze a representative sample of enterprise software startups and provide a real-time look into industry growth rates and the health of the SaaS market. Today, we explore the results of Q2, 2023.

What you need to know right now

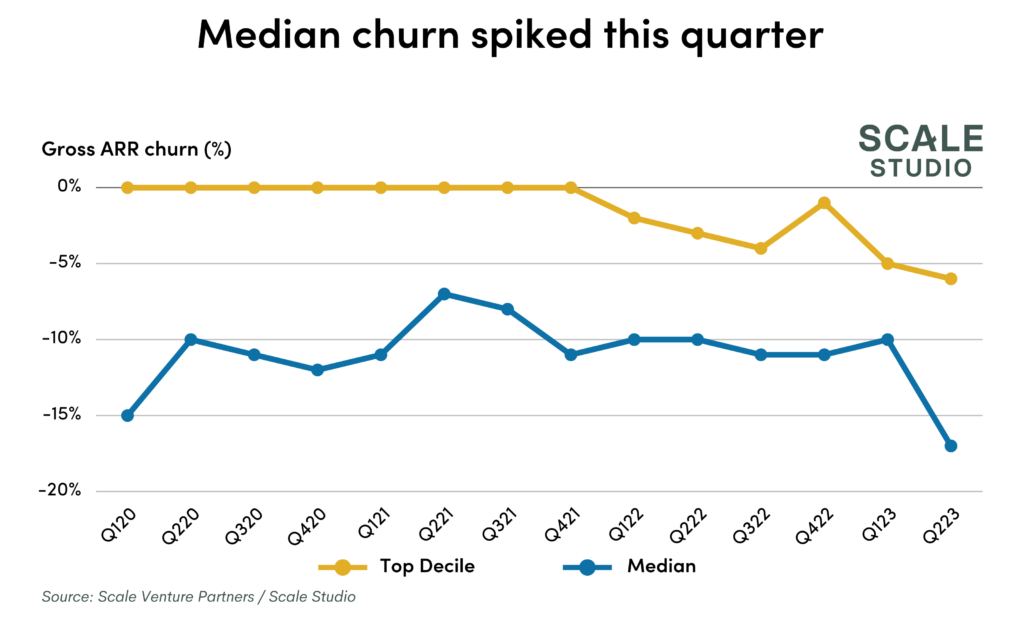

In last quarter’s Flash Update, we ended on an uncertain note about what Q2 would bring: either a bump in new ARR and growth, or an increase in churn and decrease in growth. Looking at the Q2 data, it seems the latter is unfortunately the case, both for private and public tech companies.

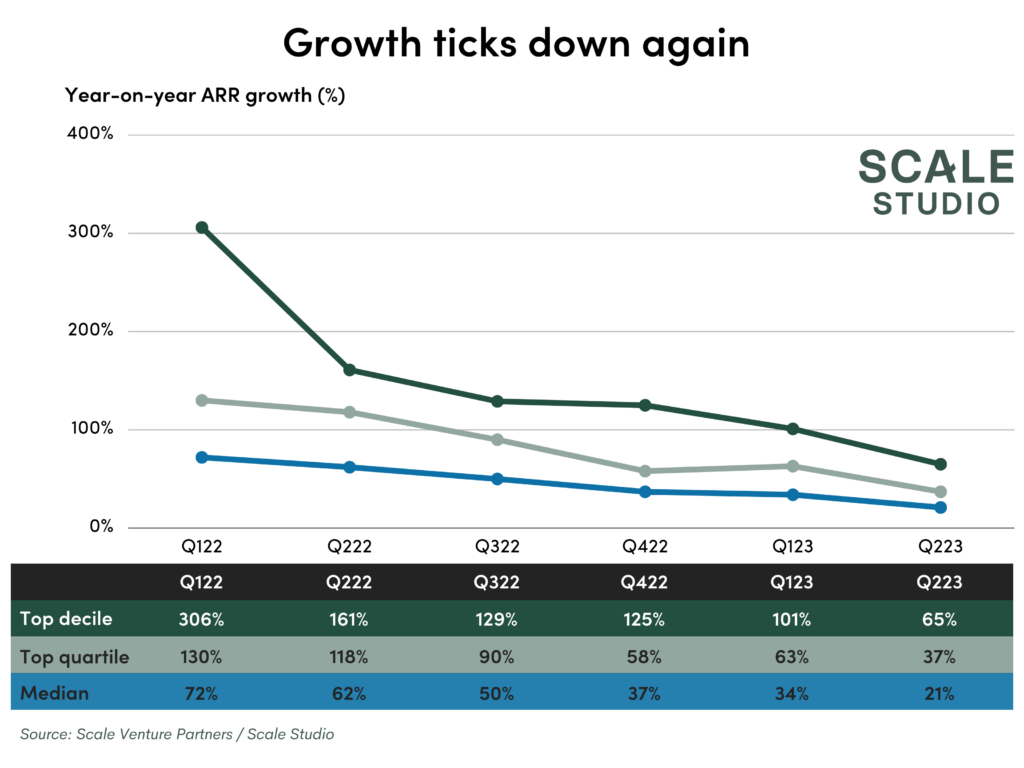

Q223 data indicates that the growth slowdown continued for another quarter, with most companies missing plans again as churn spiked. Median year-on-year ARR growth fell again to 21%, with similar decreases across quartiles. Median plan attainment was 40% as companies continued to miss plans after Q1.

Reflecting back on our post in Q1, we said that in Q2 companies could accelerate growth if they closed their Q1 deals that slipped into Q2, or they could see higher churn as customers continued cost-cutting and started canceling SaaS subscriptions. Looking through the data and analysis below, it’s clear the more pessimistic scenario played out and churn is the main driver of the decreased growth.

Q223 performance key findings:

- Median ARR Growth Rate was 21%, lower than Q123 growth of 27%

- Median Plan Attainment was 40%, lower than Q123

- Churn spiked to 17%, higher than Q123 annualized churn of 10%

Q223 growth rate analysis

Growth rates slid again, with median ARR growth of 21% continuing to fall below pre-COVID levels. Top-decile growth also continued to fall, with even the fastest-growing companies only achieving a 65% year-on-year growth rate. Looking at the graph below, we can see that the current top-decile growth is similar to the median growth at the peak of the COVID-fueled SaaS growth boom in 2021.

A more extreme version of Public company growth

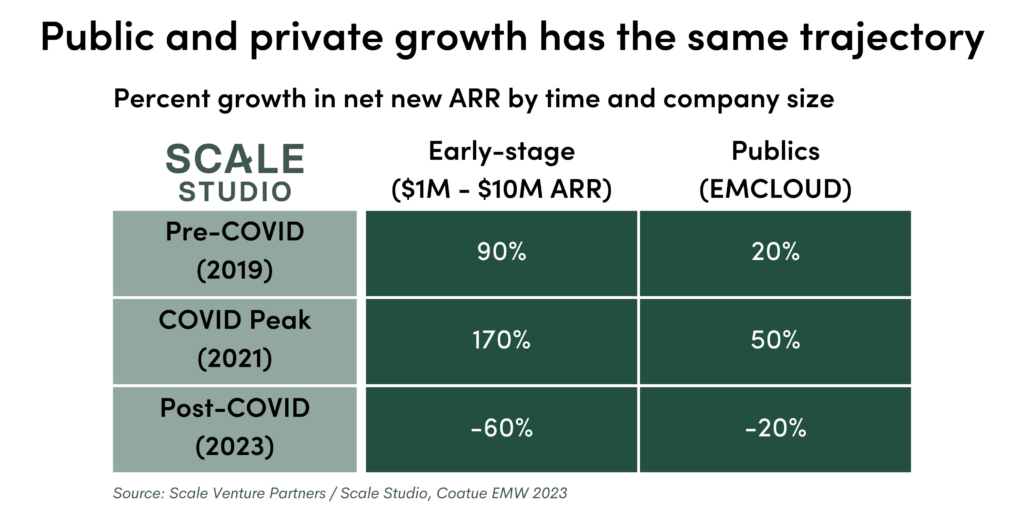

Below we can see that startups are like public companies on steroids – a more extreme version of the growth swings we’ve seen in public tech markets. Looking at the table below we can see the same growth trends across early-stage startups and public tech companies (from Coatue’s 2023 EMW Conference).

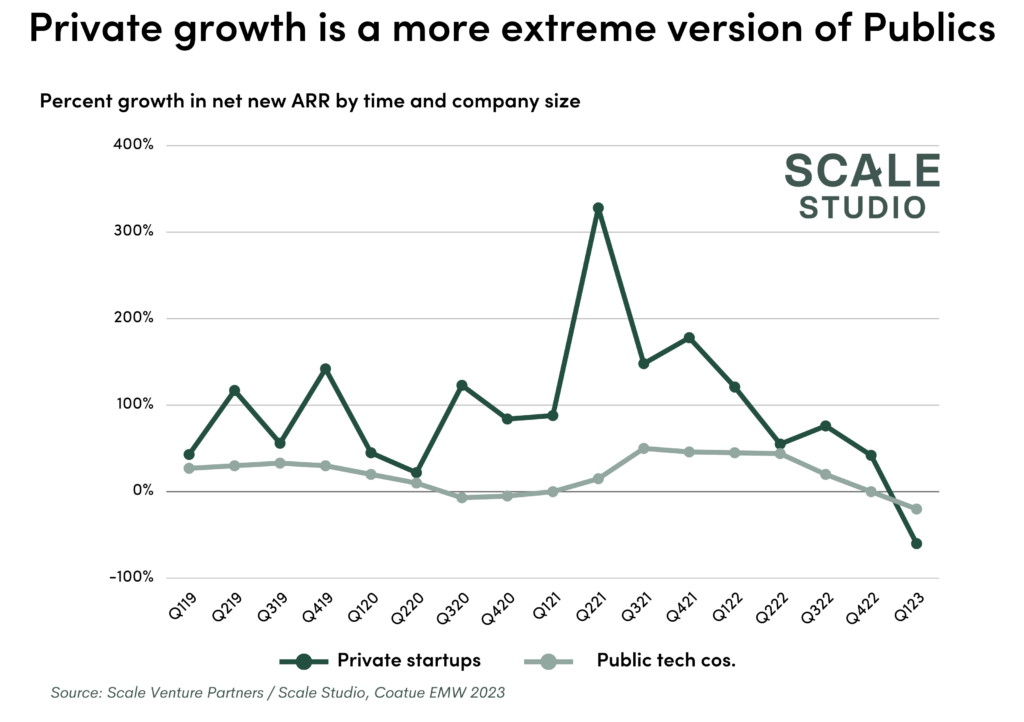

One quick but slightly technical note is that in the charts below we are looking at the percent change in Net New ARR, NOT direct year-on-year ARR growth. By looking at the change in Net New ARR, we can get a better sense of a company’s current growth trajectory.

If we look at private and public quarterly NNARR growth rates overlaid on top of each other, it’s clear that the early-stage startups are seeing the same swings in growth as the public tech companies, just more drastically and with higher volatility. The highs are higher and the lows are lower.

Early-stage startup performance is like public companies on steroids. The pre-, during, and post-COVID story is similar across early-stage startups and public tech companies. Net New ARR growth was flat pre-2020, dipped down for a year, jumped back up to 2-3x what it used to be, then fell way down in 2022 and 2023, and is not negative.

What is driving the slowdown in growth?

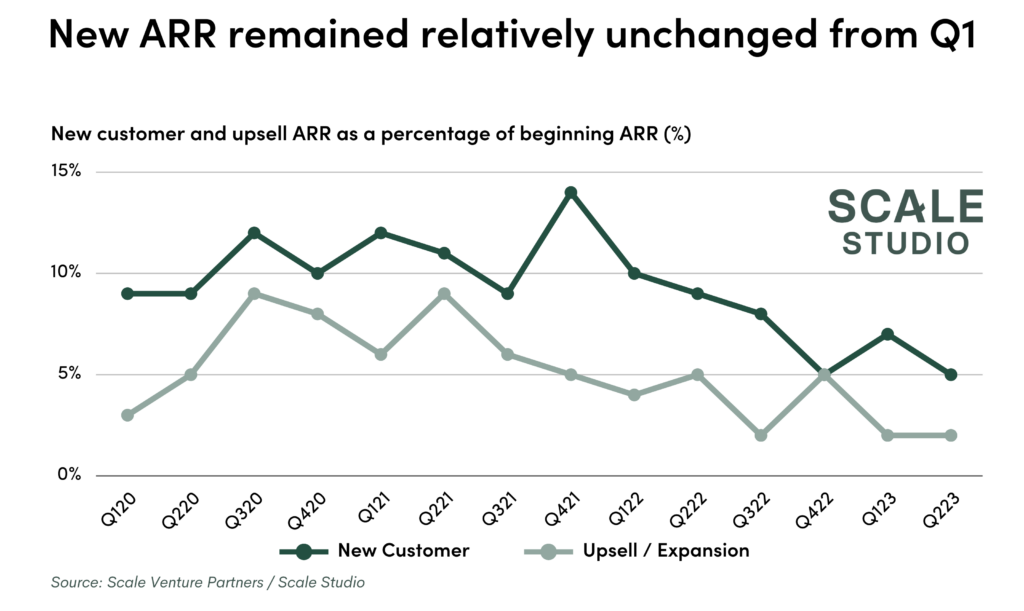

Last quarter, we looked at ARR from new customers, upsell, and churn as potential drivers of the growth slowdown. Overall new ARR was trending down last quarter, with both new customer and upsell ARR falling from 2022 levels. Looking at the same data this quarter, the new customer and upsell ARR have remained at similar levels, with a tick up in upsell balancing out a tick down in new customer ARR.

Looking at churn, however, paints a very different picture. Last quarter we noticed that median churn had remained relatively flat throughout the pandemic and post-pandemic market. In Q2, however, we saw a larger increase in churned ARR across the board, with annualized gross churn increasing from 10% to 17%. This is a strong headwind in the face of reaccelerating growth, pushing companies to miss their plan if the churn was surprising (which many optimistic plans did not anticipate) and driving growth down overall.

The worst-case scenario seems to have happened, with a significant increase in churn driving down ARR while deals continued to slip and did not drive a large increase in new ARR. There is a silver lining, however. Throughout this tumultuous market, most startups have been driving towards profitability to weather the storm. While currently hurting, these companies will live to fight another day once the software market stabilizes and churn rates and new ARR growth revert back towards historic levels. We will have to see how the churn and new ARR story develops in the second half of the year.

Recent Flash Reports