Throughout 2020, we’ve shared Scale Studio data covering the aggregate performance of Scale’s portfolio of enterprise technology companies. Today we’re closing the books on a turbulent year with the release of data on Q4 and FY20.

If you would like to catch up, here are the articles beginning with Q1:

- What Just Happened? Flash Report on Q1 SaaS Sales

- Admitting Ignorance: Planning in the Time of COVID

- What a Difference a Quarter Makes: COVID’s Impact on Q2 Performance

- Enterprise SaaS Returns to Growth Mode: Scale Studio Q3 Data

- 2021 Whisper Numbers: Startups Plan for Significant Enterprise Software Re-Acceleration

The headline for Q4 might not be as dramatic as the surges in COVID or GameStop or silver futures, but our data shows that the strength in Q3 continued into the final quarter of the year. Below we share Q4 and full-year data, and conclude with thoughts on how to evaluate whether the current momentum can continue throughout 2021.

Companies Recovered and Met Revised 2020 Plans

2020 began like most years for our portfolio. After solid growth in 2019, companies laid out plans to again surpass the growth achieved in the prior year. But those plans weren’t in place that long before the initial ripples of COVID in January turned into a full on shockwave in March, when suddenly the floor fell out. Deals that were committed never materialized. The corporate spending faucet was quickly shut off.

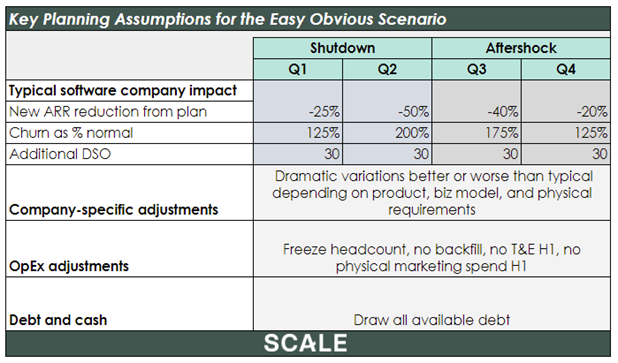

At that point, we worked with our portfolio companies to re-plan the balance of 2020. While still targeting growth in Net New ARR (NNARR, the measure of new recurring revenue added in a period net of churn), projections were trimmed by about 30% on average. We published an article on re-planning that outlined a baseline set of assumptions that we called the “Easy, Obvious Scenario”.

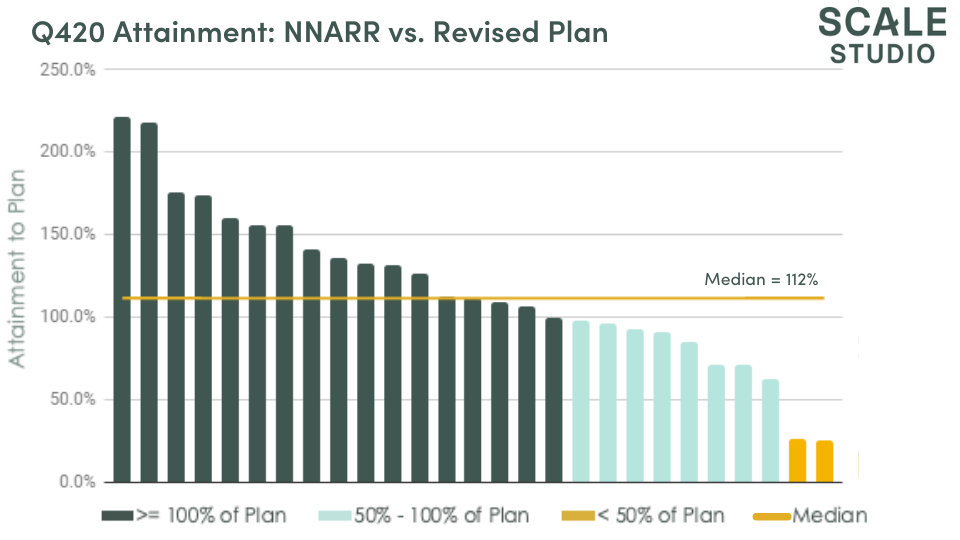

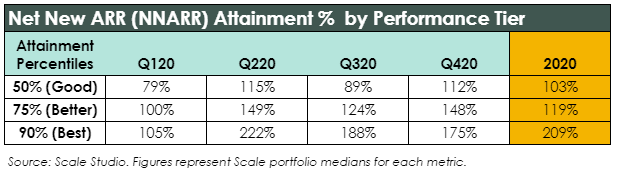

For most portfolio companies, the recovery came quickly. So much so that by Q4, attainment (the percentage of plan that a company achieves) hit a median of 112% compared to the 79% attainment turned in by the median performer in Q1.

For the full year, the data shows middle-of-the-pack companies just coming in above plan at 103% attainment. But this is in contrast to the top performers (top decile) which handily beat NNARR targets by achieving more than 200% of plan, propelled by the COVID tailwinds that benefited some, but certainly not all, of SaaS.

You can see the gap between performance tiers in the full year attainment trends:

More Companies Attained Plan After Q1 Shock

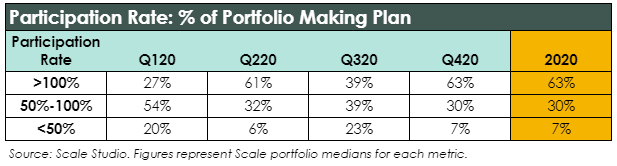

Another gauge of the health of the overall market is the portfolio’s participation rate, the number of companies that hit their growth targets. Here again, Q120 data reflected the shockwaves throughout SaaS, where a 21% median miss resulted in only 27% of companies making plan for the quarter.

For the balance of the year, we saw more typical participation rates, with 63% of companies achieving their annual objective. What’s also interesting to see is that very few companies fell below 50% of their 2020 plan. While one could assume that this is due to aggressive replanning, in fact, even those that were severely impacted at the beginning of the year have seen some wind in their sails towards the back half of the year.

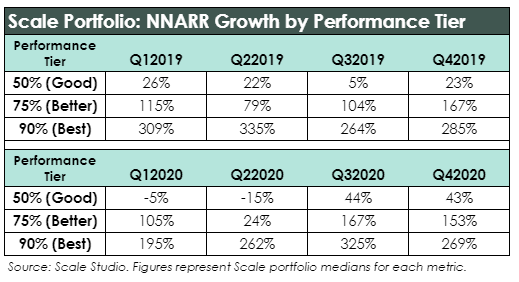

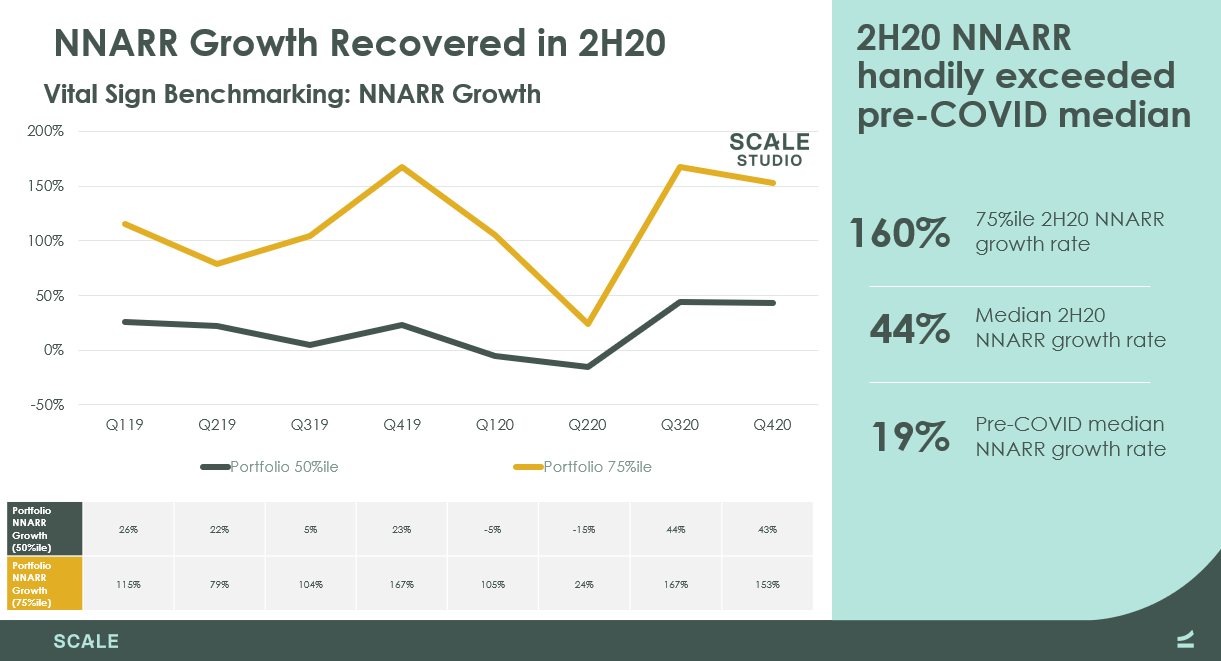

The Return of NNARR Growth

Company attainment explains a big part of the story of 2020, but the growth of Net New ARR added per quarter is the other part to the tale. To meet their 2020 projections, our companies needed to not just tread water, but grow the amount of NNARR added each period.

And they did. Q420 was a banner quarter, with the 43% median NNARR growth handily beating 23% from the same period a year ago. In fact, the second half of 2020 saw NNARR growth not seen broadly in SaaS for the past two years. And that’s not taking into account the best performers in the portfolio. To get into the top echelon of NNARR growth, companies needed to do more than 2.6x NNARR compared to the same period a year ago.

The gap between median performers and the top-tier competitors was wide in 2019, and stayed wide in 2020. Credit is due to these top performers, who faced the same out-of-nowhere operational challenges that every company did, but hardly missed a beat getting back to business. 2020 could have been a write-off, yet many companies thrived.

What Does Strong 4Q Data Mean for 2021?

Is the recent growth momentum sustainable?

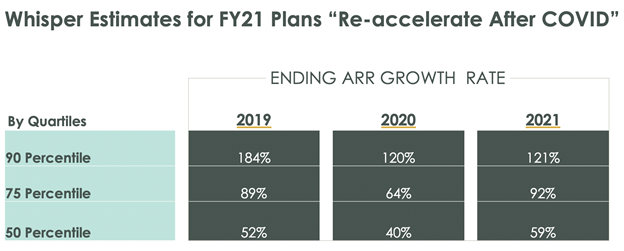

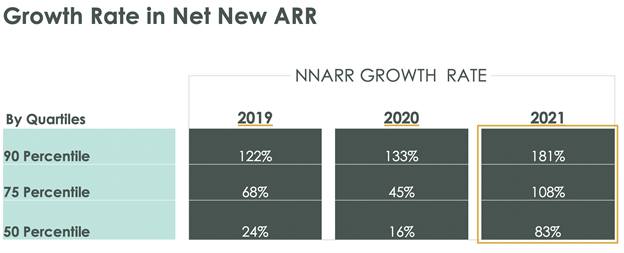

At the risk of pouring cold water on rosy forecasts for 2021, we have some thoughts for how to connect the data we’ve shared here to your own business. It starts with the “whisper numbers” we calculated at the end of last year. These capture our portfolio’s aggregate growth forecasts for 2021.

Expectations for ARR growth came in at 59%. The glass half full view says this shows confidence in further acceleration in new sales for the full year. It’s certainly attainable.

But look at it another way: on top of real strength in demand during the second half of 2020, companies still expect an 83% increase in the pace of NNARR growth during 2021. That’s quite literally a lot of work. Even just carving out, for example, the needed sales hiring and onboarding, that’s a tall order. Again, it’s entirely possible but requires consistent high-caliber execution.

We see two big risks that every company should pay attention to:

- Strength in 2H20 was “catch up” buying. Enterprises put software purchasing on hold at the start of COVID and as business conditions improved in the second half, started buying again. Thus there’s a risk that some portion of sales strength is artificial and the underlying growth rate is lower.

- Annual plans are more than usually optimistic. The data above shows the median company in our portfolio beat lowered post-COVID plans, plans that were made at a time when the world felt like it was ending. Strength in 3Q and 4Q may have made them overly optimistic about 2021. Like a pendulum: things seemed really bad in April so numbers came way down; things look really strong in December so forecasts went way up.

For early stage companies, the real risk comes down to valuation. As we’re seeing in the public markets, companies that are performing well are commanding unprecedented forward growth multiples. Likewise, private venture-stage companies are raising money at premium valuations based upon aggressive expectations for growth. There’s little room for walking back the growth you’re signaling and your investors are expecting.