By almost any measure, 2021 was a banner year for U.S. venture capital investing and venture-backed exit activity. Yet for all the headlines on record-setting mega-public offerings, or venture dollars returned, there was very little discussion of what the supersized year might mean for today’s venture-backed startups whose IPO is still over the distant horizon.

It is worth noting that, not unlike most years, the venture-backed alumnae of 2021 are made up of companies that have been building technology over the past decade. In a year of such exuberance, this is a frequently overlooked characteristic within the ecosystem: building transformative technology takes time. This process continues today with an emerging class developing new future standards.

To keep a pulse on long-range trends, Scale has maintained the Great Exit Database (or “G.E.D.”) to analyze every venture-backed exit that has occurred over the past two decades. We first wrote about the G.E.D. last year following the completion of our 2020 analysis. What follows is a recap of our 2021 findings.

The 2021 Report Card

Starting from the top, 2021 set records in the following categories:

- For total exits in Technology > $100M

- For total exits in Enterprise Software > $100M

- For total Technology exits > $1B

- For total Technology exits > $10B

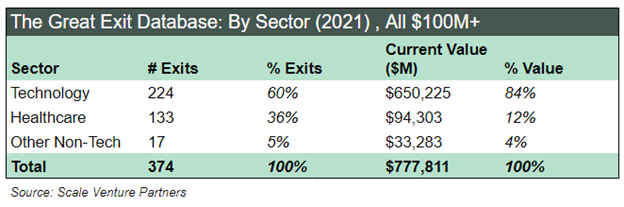

All told, in 2021 there were 374 U.S. venture-backed exits greater than $100M, representing $778B of deal value. Technology exits represented the lion’s share of exits, both in terms of deal count (60%) and, by far, aggregate value (84%).

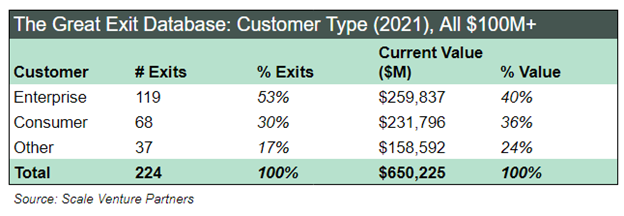

The table below drills down into the 224 exits within Technology. The majority by deal count (119 or 53%) occurred within Enterprise Software, which is Scale’s primary area of focus.

One of the most striking data points from this year’s graduating class is the pronounced skew towards what we refer to at Scale as “Great” ($1B+) and “Super Great” ($10B+) exits. Within the 119 Enterprise software exits > $100M, for example, 47 (or 39%) were greater than $1B+, and 7 (or close to 6%) were greater than $10B. To state the obvious, many of the top exits in 2021 were super-sized.

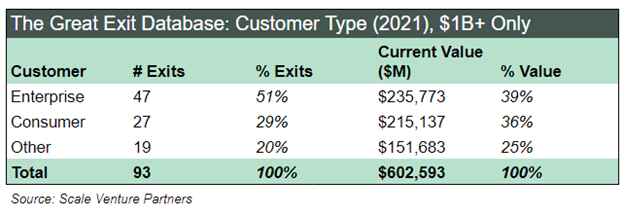

Record Number of $1B+ Exits

The skew towards $1B+ was not just isolated within Enterprise software exits but occurred systematically across the entire tech sector. These mega-deals north of $1B represented the $603B of the $650B (or 93%) in total Tech exits. A little more than half (51%) fell within the Enterprise segment. There were fewer $1B+ Consumer deals (27 in total or 29%) but these outcomes tended to skew larger in terms of their aggregate deal value.

Ten-Year Lookback: 2021 in Perspective

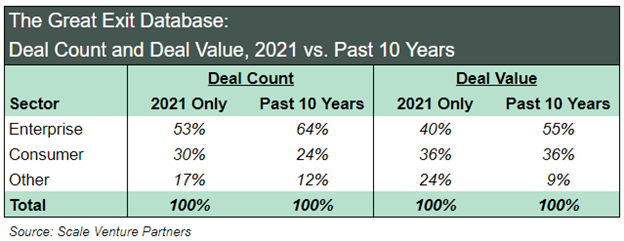

While 2021 was, by all accounts, a banner year for VC-backed exits, we always believe it’s important to ground the exit activity in any given year within a broader context. To do so, we’ve conducted a ten-year lookback of all venture-backed exit activity. Our findings are shown in the following table, which compares all $100M+ exits by deal count and deal value.

The story here is one of great consistency. While exits within Enterprise software retreated a bit in 2021 relative to the ten-year trend, the segment has still driven the strongest contribution within tech exits over the past decade (both in terms of deal count and aggregate value). The percentage of value driven by Consumer was virtually unchanged in 2021 vs. the segment’s contribution over the past decade.

Takeaway for the Years Ahead

As we step back from this year’s analysis, we balance both a short-term and long-range view. The past decade has been marked by the strongest wave of exits to ever hit the venture ecosystem, and 2021 was a particularly exuberant year. We believe that this activity may provide a hopeful message to early-stage founders. There has, and will likely continue to be, a sustained interest in groundbreaking technology in which immense value is created. And the past two years (2021, in particular) has demonstrated the opportunity for particularly transformative exits.

While there is no guarantee that recent patterns of record-breaking activity will continue, our analysis would suggest that the scale of many of 2021’s top exits would have still been well above average over the past decade. And for businesses building truly enduring technology, the golden window of opportunity will always be there.

Acknowledgements:

An especially big thank you to my teammate, Max Abram, for helping spearhead the efforts and analysis that went into this year’s post.