The theme of 2024 is cautious optimism. With improved ARR growth rates across the board and two consecutive quarters of median GAAP revenue growth improvement, it looks like the worst is over. So, where do we go from here?

We’re seeing startups aiming for a more sustainable way of operating, focusing on customer retention and upselling, and keeping burn rates lower than the “growth at any costs” days.

- 2023 growth: 2023 growth improvement reflected improved churn and a focus on expansion of the existing customer base.

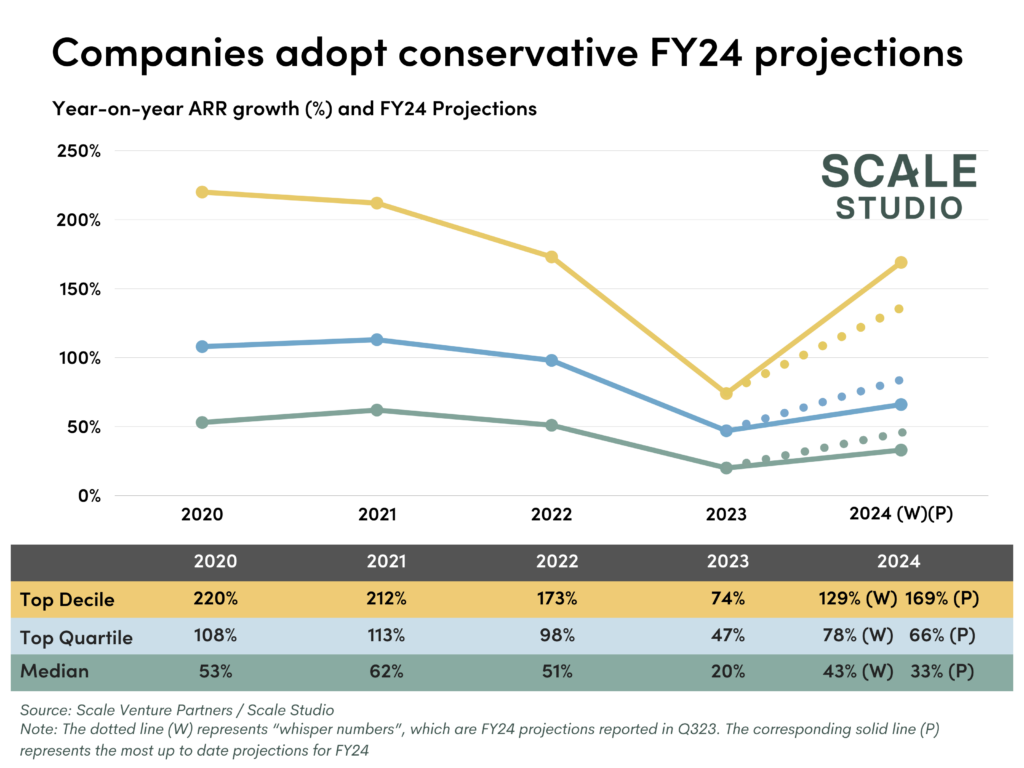

- 2024 forecasting: 2024 forecasts point to continued improvement in growth compared to 2023, but still in the “managed expectations” category,

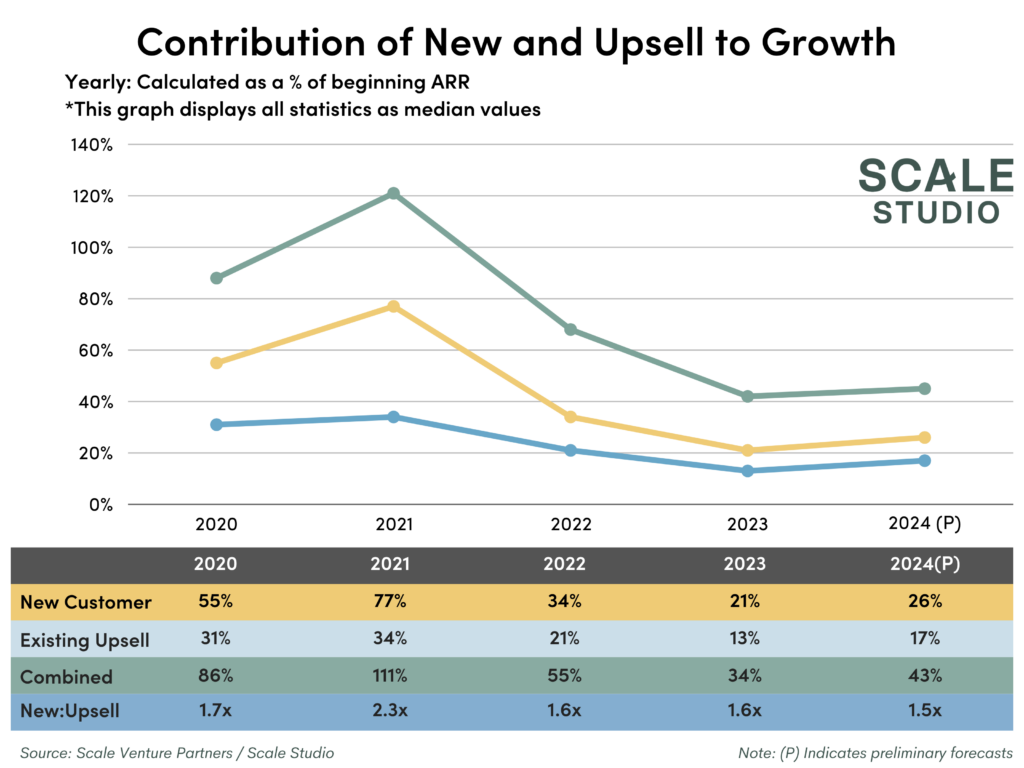

- Where is the growth coming from?: Startups can’t grow without new customer acquisition, but the ratio of new to upsell as a percentage of growth has changed. Expansion of the customer base will continue to play a bigger role in 2024 than in years past.

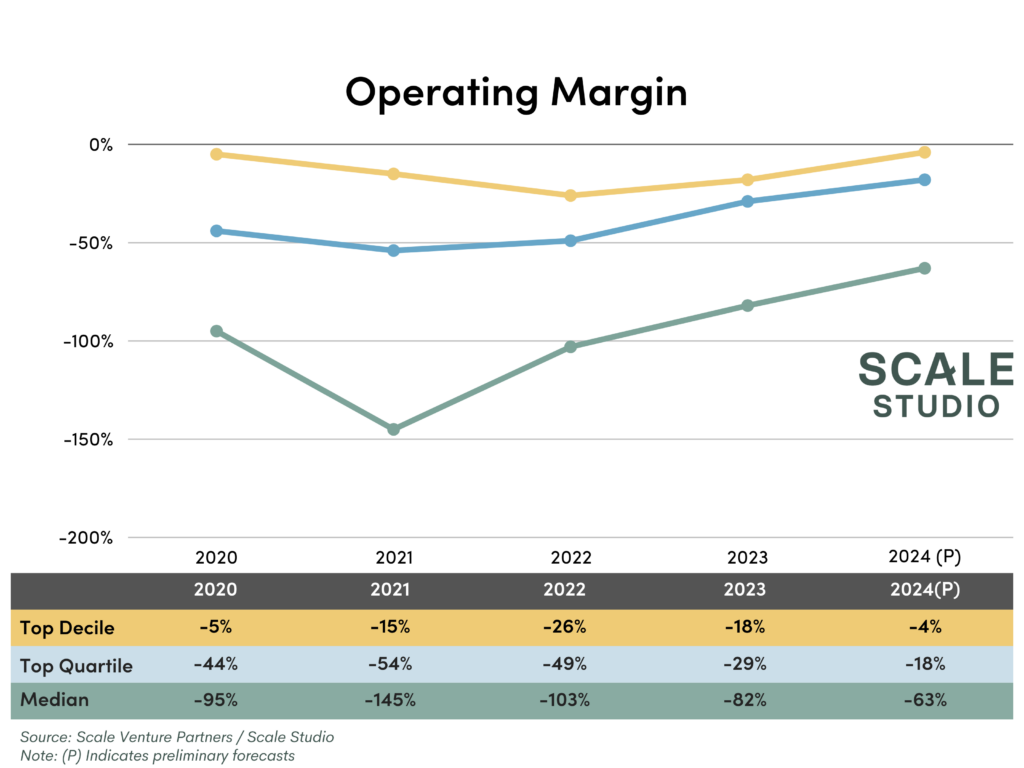

- Efficiency still matters: If companies achieve their plans, 2024 will be the most capital efficient year for startups in a long time, with both controlled costs and (gentle) reacceleration.

While we’re still figuring out the new formula for success, one thing is crystal clear: the era of high growth coupled with high spending is over. We’re now witnessing companies shift from aggressive expansion to a more sustainable, lean growth approach, and can expect this trend to continue for the foreseeable future. Here are the details on what we saw in 2023 and what we anticipate in 2024 based on Scale Studio planning data.

What drove the growth uptick in the second half of 2023?

In our latest Q423 flash report, we’ve spotted a slight uptick in growth among private startups when we look at Annual Recurring Revenue (ARR) and GAAP revenue despite lukewarm market conditions. So, what’s behind this growth? We saw three major themes: stabilizing churn rates, expanding business with current customers, and spending cash efficiently.

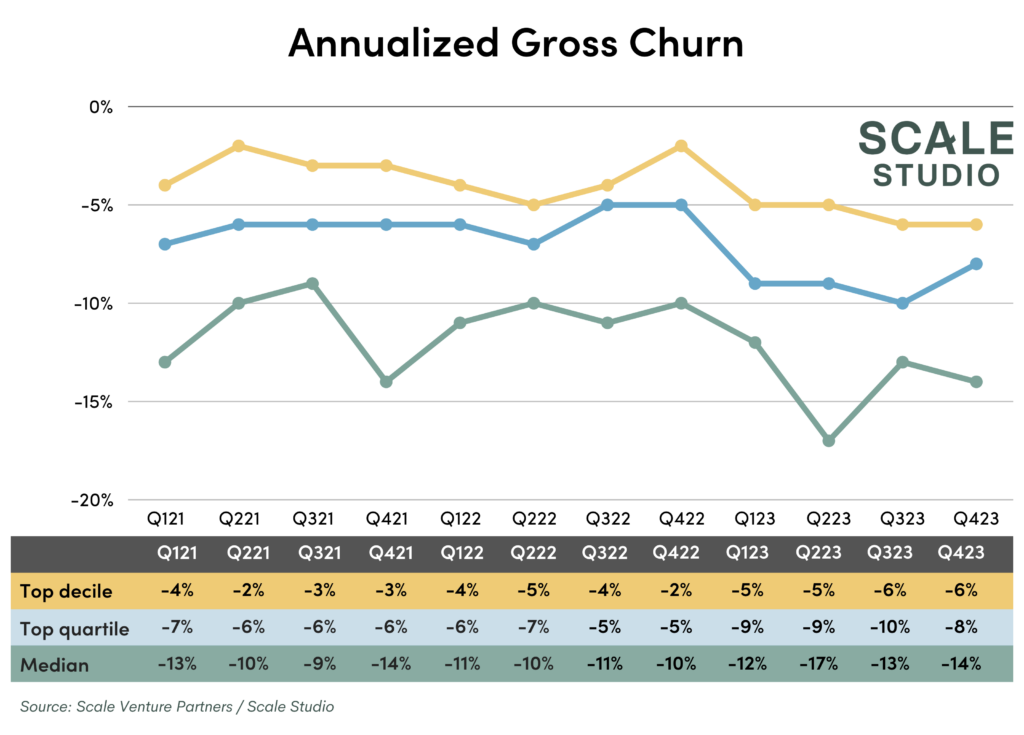

Stabilizing churn

As a whole, we saw performance bottom out across all metrics in Q223, with Q323 emerging as the first quarter of improvement for many companies. Churn hit a three year high in Q223, and while we have seen performance improve at a slower rate from Q323 to Q423, the most recent quarter still marks a 3% improvement over Q223. This is roughly in line with the long term median of 13% annualized gross churn. In this case, we see stability as good news on its own. With these numbers in mind, we can reasonably credit a focus on retention as the foundation of sustainable growth.

Startups begin to lean on upsell to sustain growth

Startups aren’t only stabilizing churn; they’re getting more out of the customers they have. Typically when examining SaaS revenue, we look at the split between acquiring new customers and upselling existing consumers to understand where and how SaaS startups are growing.

At its peak in 2021, new customer acquisition contributed over 2x to overall growth compared to existing customer expansion. We are now seeing that gap close. Our preliminary forecast of 2024 shows this trend continuing, with new customers contributing only 50% more growth than existing customers. The really good news is that we are forecasting a positive uptick in growth contribution from both new and existing customers for the first time since 2021.

How does stronger growth translate to burn and efficiency?

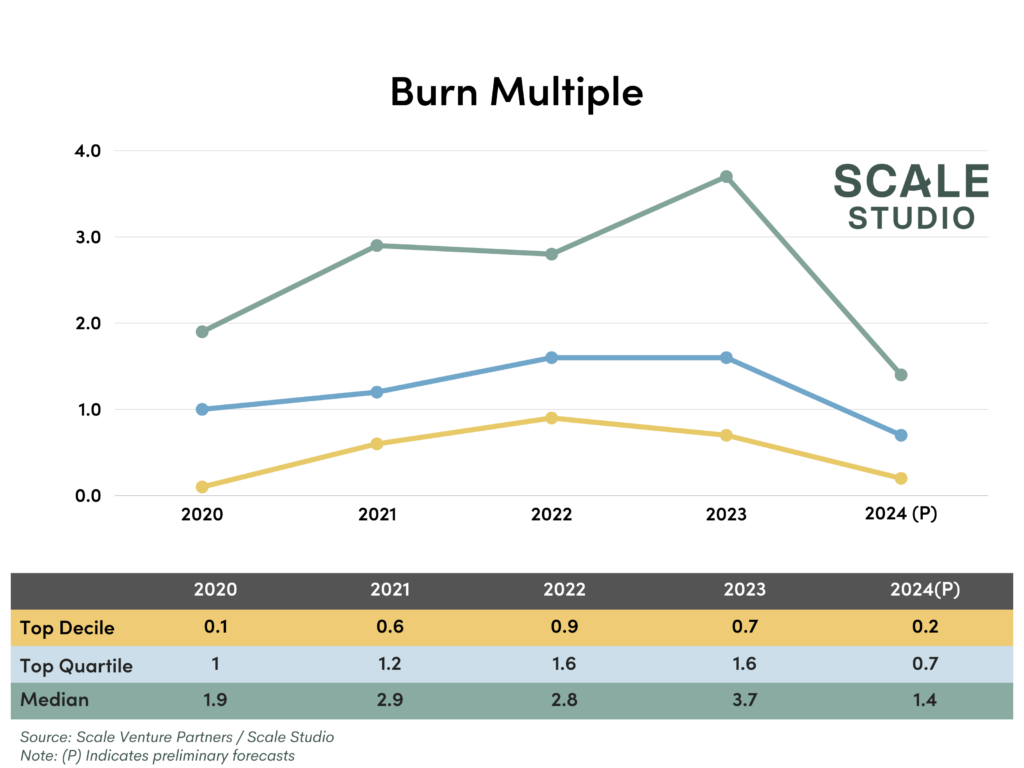

As we saw in 2021, startup growth can be unsustainable. If you’re spending $3 for every $1 in new ARR, you’re going to run out of money pretty quickly. In today’s funding environment that spells trouble. Thankfully, the growth we saw above is paired with some of the lowest startup burn rates we’ve seen in the last couple of years.

As the top decile approaches near-breakeven, we’re seeing startups across the spectrum enter (and hopefully end) 2024 with much healthier operating margins than before. In our analysis, the median tech startup in 2024 expects to burn less than half of what they did in 2021, with operating margin improving to (63%) in 2024 from (145%) in 2021. You can see the steady improvements in operating margin since 2021 as companies realized the era of hypergrowth was temporary and they needed to cut back. Unfortunately, we’ve seen these cutbacks materialize as companies lay off hundreds of thousands of employees across the tech sector. Hopefully these cuts set companies up for sustainable long-term success and future expansion (we’ve started seeing companies rehire the same employees they let go last year).

Looking at burn multiple, which measures how much a company burns for every dollar in net new ARR, we can see that in 2024 companies are planning for a significant improvement in capital efficiency. 2023 saw a spike in capital inefficiency as companies saw growth fall off a cliff and struggled to get costs under control, but now that costs have come down and growth is starting to rebound, burn multiples are significantly improving. Even in 2021, when growth was at all-time highs, we didn’t see burn multiples this good due to the concurrent burning of astronomical amounts of money in an interest-free environment. It took a couple of years for startups to reign in burn against slowed growth, especially in a slower-than-expected growth environment like in 2023. It’s not until this year, now that companies have gotten spend fully under control and are starting to reaccelerate, that we’re seeing efficiency improve again. In fact, if companies achieve their plans, 2024 will be the most capital efficient year for startups in a long time.

What does that mean for growth in 2024?

Startups are going into 2024 with the hard-earned wisdom from 2023, and their annual planning reflects that. Last quarter we shared the “whisper numbers”, a preliminary look at what companies expected growth to be this year. Now that most companies have reported Q423 results and annual plans for 2024 are finalized, forecasts have been slightly revised down, with the median tech startup forecasting 33% growth in 2024. This is still higher than the 20% growth we saw in 2023, but lower than the preliminary 2024 target of 43% we saw in November.

The revised forecasts are lower across quartiles, except the top decile. This is consistent with the general trend we saw in Q323, where top-decile startups started accelerating more quickly than the median and top-quartile.

The continued outperformance (or at least forecast outperformance) of top-decile companies reflects the consolidation of market power into those companies that have truly demonstrated product-market fit and bring value to their customers, as we saw in 2023 with increased upselling. Comparing this to the public markets, we’ve seen the top companies consistently outperform the long tail of tech companies that are still trying to find their groove.

It’s still early, but companies are cautiously optimistic

All of this optimism comes with a huge caveat—we were here this time last year too, and we all saw what happened to growth rates in 2023. 2023 was a bad year for tech companies and their employees. While stocks are back at all-time highs, it’s still a tough time for a lot of cash-strapped startups that are trying to balance growth with capital efficiency and shooting for profitability, all while still trying to keep enough juice in the business that they can raise their next round. We’re hopeful that the headwinds of 2023 are in the past and we’ll start to see growth reaccelerate in 2024. We’re seeing early signs this could be the case, but we’ll have to wait and see.

That being said, we are unsure whether startups will ever go back to playing by the pre-2023 rules. We expect new operating principles to emerge over the next few quarters that will dictate what building a healthy company looks like. We’ll track and share them over the coming quarters.