Doubling Down on Cognitive Apps: Announcing Scale Fund VIII

Today we’re excited to unveil our new fund, Scale Venture Partners Fund VIII. This $900M fund gives us the opportunity to continue to invest in the category-defining technology companies that are being built today. We want to thank our amazing founders and investors, new and returning, for making this fund possible.

It’s been two years since we announced Fund VII, which we raised in the throes of early-COVID, and a lot has changed since then. We celebrated the IPO of WalkMe and the acquisitions of portfolio companies Lever, Solvvy, and Agari. We invested in 16 new companies, including AppOmni, Viz.ai, Comet, and Archipelago. Many others in our portfolio came out of COVID stronger, and are seeing strong growth even in today’s challenging environment.

Investing in the Future of Software

We believe it’s always a good time to build an innovative company. But now is especially good; rapid digitization during the course of COVID made the market hungry for software solutions that deal with the new way we all work. The last two years have been a time of unparalleled growth in artificial intelligence and machine learning capabilities, making building intelligent applications easier and faster than ever. This combination of market opportunity and technological capability means that even in the face of economic headwinds, great companies will emerge, and we are excited to help build them.

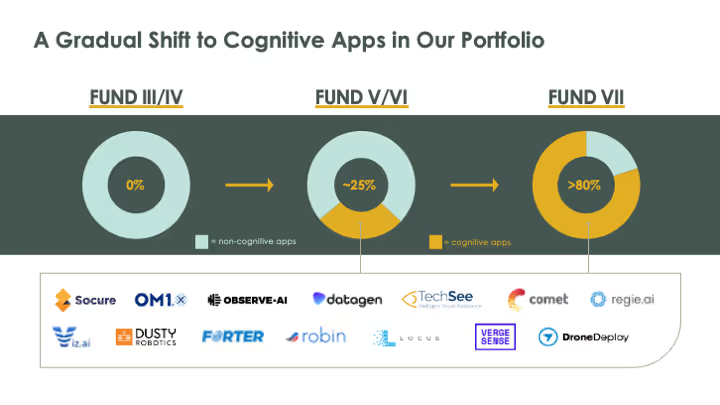

In fact, we’ve seen this movie before. In the last downturn, Scale was particularly focused on investing in enterprise cloud-based SaaS applications, at the time an emerging category that transformed the markets in less than two decades. For several years now, we’ve been focused on how AI-powered applications transform traditional SaaS applications, by augmenting manual work and offering data-driven predictions. While the last two decades were largely defined by the shift from on-premises to cloud software, we believe that the next decade will be defined by the addition of machine intelligence to software, a trend we’ve labeled cognitive apps.

We previously articulated our cognitive apps thesis when we announced Fund VII, and we’re happy to share that nearly two-thirds of the investments we’ve made from that fund have some form of machine learning core to the product. Looking ahead, we only expect this trend to continue as the reach of AI permeates our focus markets like cybersecurity, devops, data infrastructure, fintech, productivity, vertical SaaS, and many others.

One area where we are increasingly devoting time is an emerging breed of Generative AI applications, which expand the reach of machine learning beyond merely understanding to creating. These applications tend to employ foundation models, allowing entrepreneurs to build software more quickly and easily than even a year ago. Investments in Textio, Datagen, and most recently Regie AI, show our early conviction in this space.

Scaling Scale

As our portfolio companies do, we’ve been busy maturing Scale. We’ve grown our team, expanded our platform, and deepened the support for our current and future portfolio companies.

We are now seven partners strong, with recent the promotions of Eric Anderson and Jeremy Kaufmann to Partner. Sam Baker was promoted to Principal, and John Gianakopolous and Noah Gross were promoted to Vice President.

Javier Redondo recently joined us as a Principal focused on infrastructure and business software with a particular interest in open source and fintech. He joins Scale from Anyscale, where he led product efforts for the development of a managed compute offering and was a regular contributor to the Ray project.

We’re joined by a class of talented associates that represent backgrounds ranging from Product to Machine Learning to Investment Banking at companies like Rubrik, Morgan Stanley, Deutsche Bank, and QuantCo.

Rounding out our Scaling and Marketing team, we welcomed Craig Rosenberg as Chief Platform Officer and Hillá Watkins has joined us as Chief Marketing Officer. Craig joins us from Gartner, where he was a Distinguished VP. He joined Gartner via the acquisition of Topo, an advisory firm he co-founded that focused on GTM for early-stage technology companies. Hillá joins us from Pendo, where she was VP of Brand, responsible for all content, community, and creative marketing. Hillá created ProductCraft, Pendo’s global community for product professionals.

Supporting Scaling with Go-to-Market Expertise and Insights

We made our first major investment in our Scaling Platform back in 2015 when Dale Chang joined our team. Since then, we have built capabilities to deliver direct advisory and playbooks to our portfolio companies. This work has been supported by data from our proprietary analytics platform, Scale Studio.

With the addition of Craig and Hillá, we continue to extend our capabilities to help our portfolio companies transition from founder-led growth to a repeatable go-to-market machine. They will continue to build and manage our Scaling Platform, which delivers targeted expertise to help our portfolio companies drive efficient hyper-growth. Since joining, they have increased the breadth of advisory capabilities, introduced more playbooks for our founders and expanded the Scale Go-To-Market Network. The expansion of the network gives our portfolio companies access to recognized experts and leaders in Marketing, Sales and Customer Success. This network builds on the success of our functional communities which has helped our portfolio executives learn from and collaborate with their peers.

In support of our Scaling Platform, we continue to invest in Scale Studio, our proprietary analytics platform. As companies shift their focus from growth-at-any-cost to efficient growth, they can use Scale Studio to understand how their growth, efficiency, retention, and burn rate compare to more than 1,000 private and public companies.

It’s worth repeating: we believe it’s always a good time to build an innovative company. But now is especially good. Both in the data and in our community, we see that innovation hasn’t slowed and we don’t intend to slow down either. If you’re a founder working on something great, we would love to meet you.

News from the Scale portfolio and firm