In case you missed it, check out the Q1 Flash Update here. Flash Reports are based on Scale Studio performance metrics covering Scale’s portfolio of enterprise technology companies.

What You Need to Know Right Now

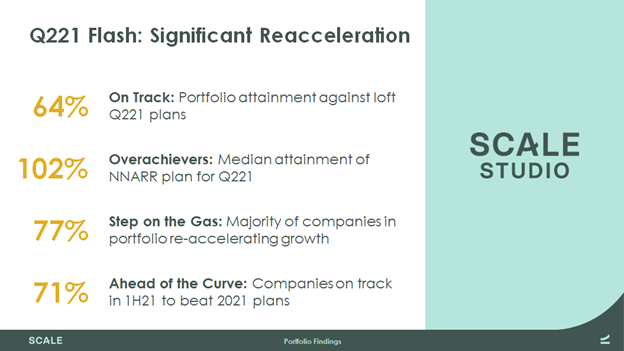

Q2 marked another quarter of strong performance where the majority of our portfolio companies met or exceeded plans and continued to accelerate growth. The strong recovery out of COVID is real and companies are poised to exceed lofty expectations set at the beginning of the year.

First, the Facts of Q221

This quarter followed the trend we saw in Q1, with company performance outpacing the lofty growth plans set at the end of 2020. Some highlights:

- Currently, 64% of reporting companies achieved or overachieved Q2 plans.

- Combined with Q1 data, 71% of reporting companies are beating 1H21 plans, setting the foundation to achieve full-year 2021 goals.

- Median attainment across the portfolio is 102% of plan.

- 77% of companies have Net New ARR Growth Rates eclipsing their Ending ARR Growth Rates, which indicates accelerating growth.

A Deeper Analysis of Q221 Performance

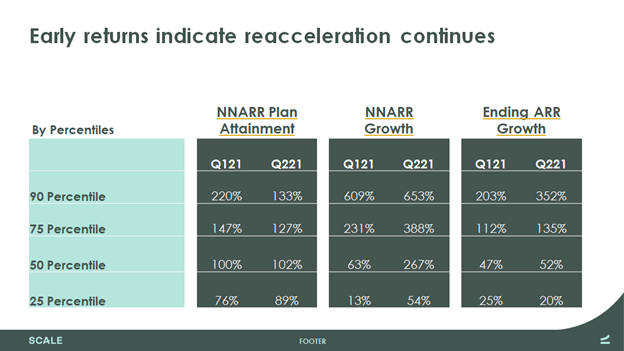

On the surface, Q2 looks very similar to Q1. Median attainment of plan was pretty much identical, but there are some subtle differences that are worth noting.

Attainment Normalizes. If we look at overachievement, Q2 had a more typical distribution of growth, with the top decile reaching 133% of plan. This is compared with 220% of plan in Q121. Q2 is more representative of typical top-decile performance in the portfolio.

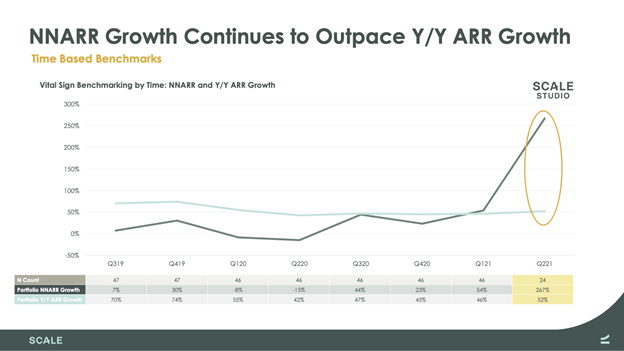

Recovery from the COVID Recession. A year ago, Q220 marked the shortest recession in U.S. history, lasting just two months but with a staggering 31.4% plunge in GDP. SaaS companies weren’t spared. We witnessed a median NNARR Growth Rate of -15%. While companies were still growing, the slowdown in growth was dramatic. Fast forward to today and what we’re seeing is dramatic growth coming off of the long-term low. Top-decile performance has stayed consistently explosive, with companies turning in >6x NNARR growth. And while NNARR growth is compared with a low base in 2020, there is a clear trend of strong NNARR growth.

One quick caveat to all this data is that it is based on early returns from the portfolio. We’ve historically seen early reporters lean towards positive news. That being said, the data represents nearly 70% of our June quarter ends, so we expect the results to stay roughly the same as we compile data from the remaining companies including our July quarter ends. We will publish a full Flash Report highlighting overall portfolio performance across using our Four Vital Signs framework.