The math of Net New ARR isn’t rocket science. However, when trying to understand the relationship between NNARR, ARR, and the growth rates of these measures, it’s quite easy to get tripped up. At any point in time, your company’s Ending ARR Growth Rate and NNARR Growth Rate are different positive or negative percentages. The relationship between these numbers tells you whether or not your overall growth rate is accelerating. It works out like this:

- If the Net New ARR Growth Rate is greater than the Ending ARR Growth Rate, the company is accelerating growth. This is a really good thing. It is easier (even expected) at early growth stages. And harder as companies grow bigger.

- If the Net New ARR Growth Rate is positive, but less than the Ending ARR Growth Rate, the company’s growth is decelerating, but at a typical pace as indicated by the predictable growth decay. Again, growth rates tend to slow as companies get bigger.

- If the Net New ARR Growth Rate is negative but the Net New ARR dollars added are still positive, then the company is decelerating quickly. So long as NNARR is a positive number, the company is still growing in absolute terms, albeit slowing down rapidly.

- If the Net New ARR number itself is negative then the company is shrinking. And for a subscription revenue company, this is a terrifying result.

Wow, that’s a lot to remember. There has got to be an easier way!

The Bright Line of the Growth Acceleration Factor

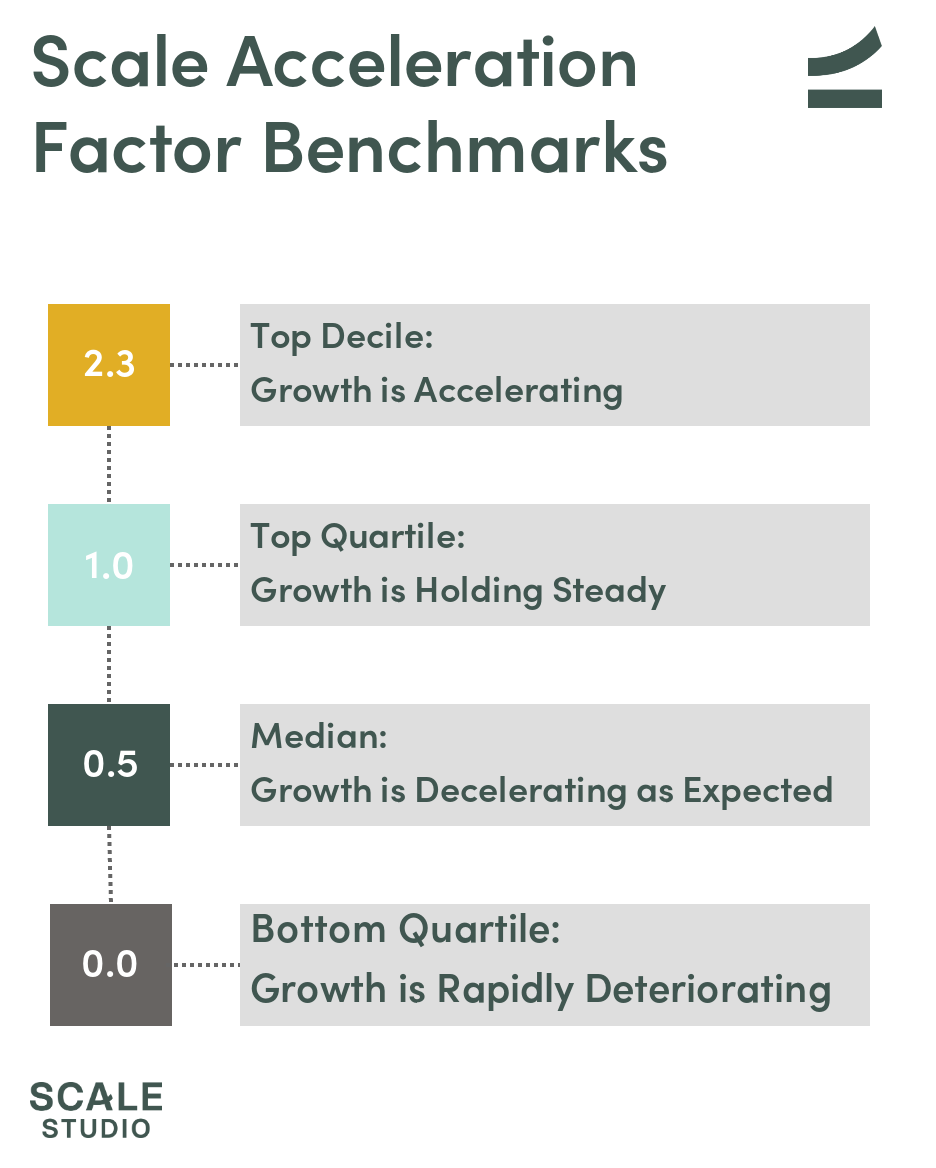

To simplify the math into a rule of thumb that takes just two numbers, we devised the Scale Acceleration Factor. To calculate, divide your NNARR Growth Rate by your Ending ARR Growth Rate for that quarter. Congratulations if your Scale Acceleration Factor is greater than 1. That means that you are accelerating growth. But don’t necessarily fret if your Scale Acceleration Factor is less than 1 as that is what is fairly typical in recurring revenue software models.

In fact, based upon our Scale Studio benchmarks, we have found that roughly 25% of companies in any time period are able to achieve a Scale Acceleration Factor of greater than 1, meaning that they are accelerating their growth trajectory. And companies able to keep the Scale Acceleration Factor above 1 for multiple periods fall into the top decile. The balance of companies behave as most do, with a predictable decay in their Ending ARR growth rate. The bottom quartile of companies typically will have a negative Scale Acceleration Factor which indicates that their growth is slowing down dramatically. Remember, we’re talking about growth rates not growth so, in these cases, ARR can still be growing but future growth is at risk.

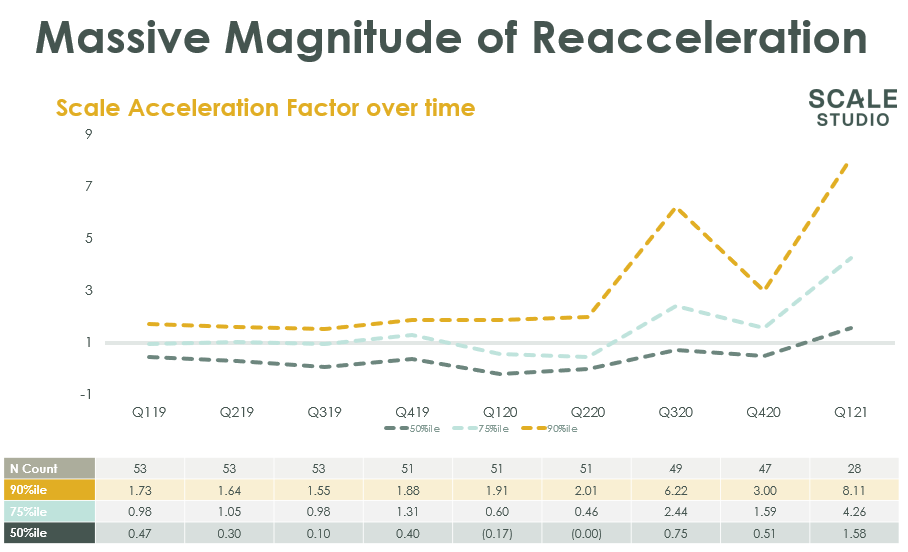

If we look back over the past 2+ years, we can see the impact of COVID on our portfolio of companies and how their Scale Acceleration Factor has fluctuated. For the top decile of companies, COVID provided some tailwinds and accelerated growth even in 1H20. This acceleration continued throughout 2020 and we saw a massive spike in Q121.

For the top and second quartile of companies, we saw a precipitous drop in their Scale Acceleration Factor in 1H20 but rapid recovery occurred in 2H20. What’s even more impressive is that the second quartile of companies actually re-accelerated their growth, topping historical top quartile performance!

Looking Forward

Is this level of growth acceleration sustainable long-term? Practically, no. If the median company continued to accelerate at this pace, the compounding effect of accelerating growth would soon mean that the company’s revenue would eclipse the economies of many countries. But this level of acceleration could well be the norm for the next few quarters, effectively resetting what “normal” growth looks like.