Round sizes are up. Valuations are up. There are more investors than ever hunting unicorns around the globe. But for all the talk about the abundance of venture funding, there is a lot less being said about what it all means for entrepreneurs raising their early funding rounds.

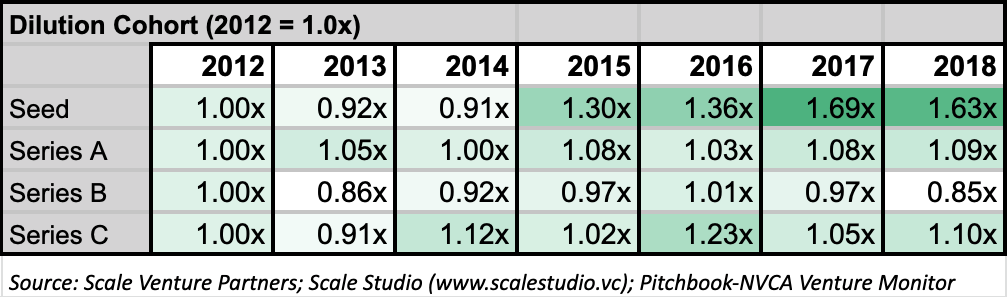

Take for instance Seed-stage dilution. Since 2014, enterprise-focused tech companies have given up significantly more ownership during Seed rounds. What gives?

Scale is an investor in early-in-revenue enterprise technology companies, so we wanted to better understand how this trend in Seed-stage dilution impacts companies raising Series A and Series B rounds. Using our Scale Studio dataset of performance metrics on nearly 800 cloud and SaaS companies as well as Pitchbook fundraising records covering B2B software startups, we started connecting the dots between trends in valuations, round sizes, and winner-take-all markets.

Bottom line for founders: Don’t let all the capital in venture mislead you. There’s an important connection between higher Seed-stage dilution and increased investor expectations during Series A and Series B rounds.

These days, successful startups are growing up faster than ever.

The Elephant in the (Conference) Room

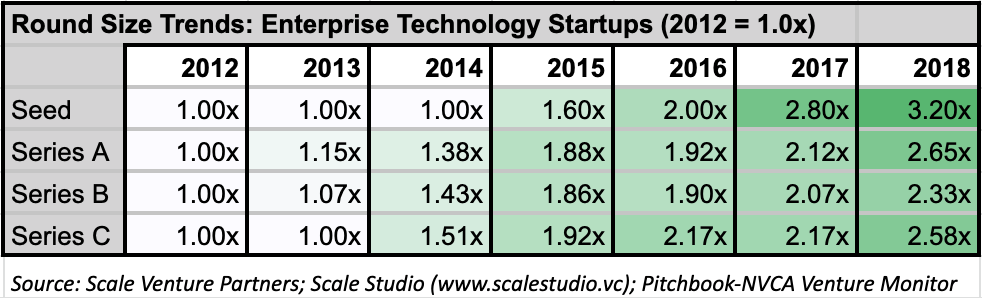

It’s worth reminding ourselves just how financing round sizes for enterprise-focused technology startups have ballooned over the past several years.

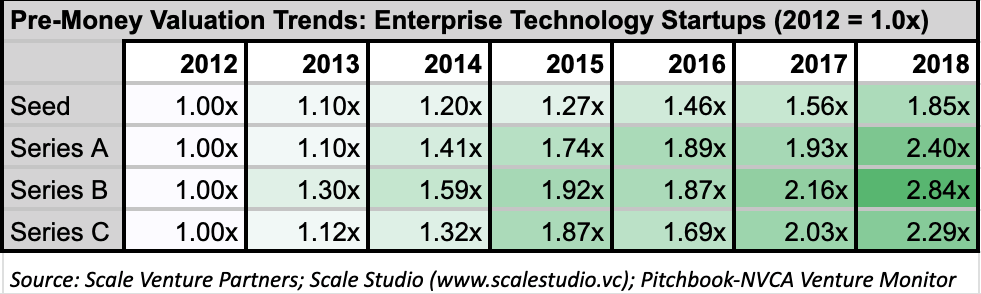

The other side of the coin is the equally dramatic increase in pre-money valuations over the same time period:

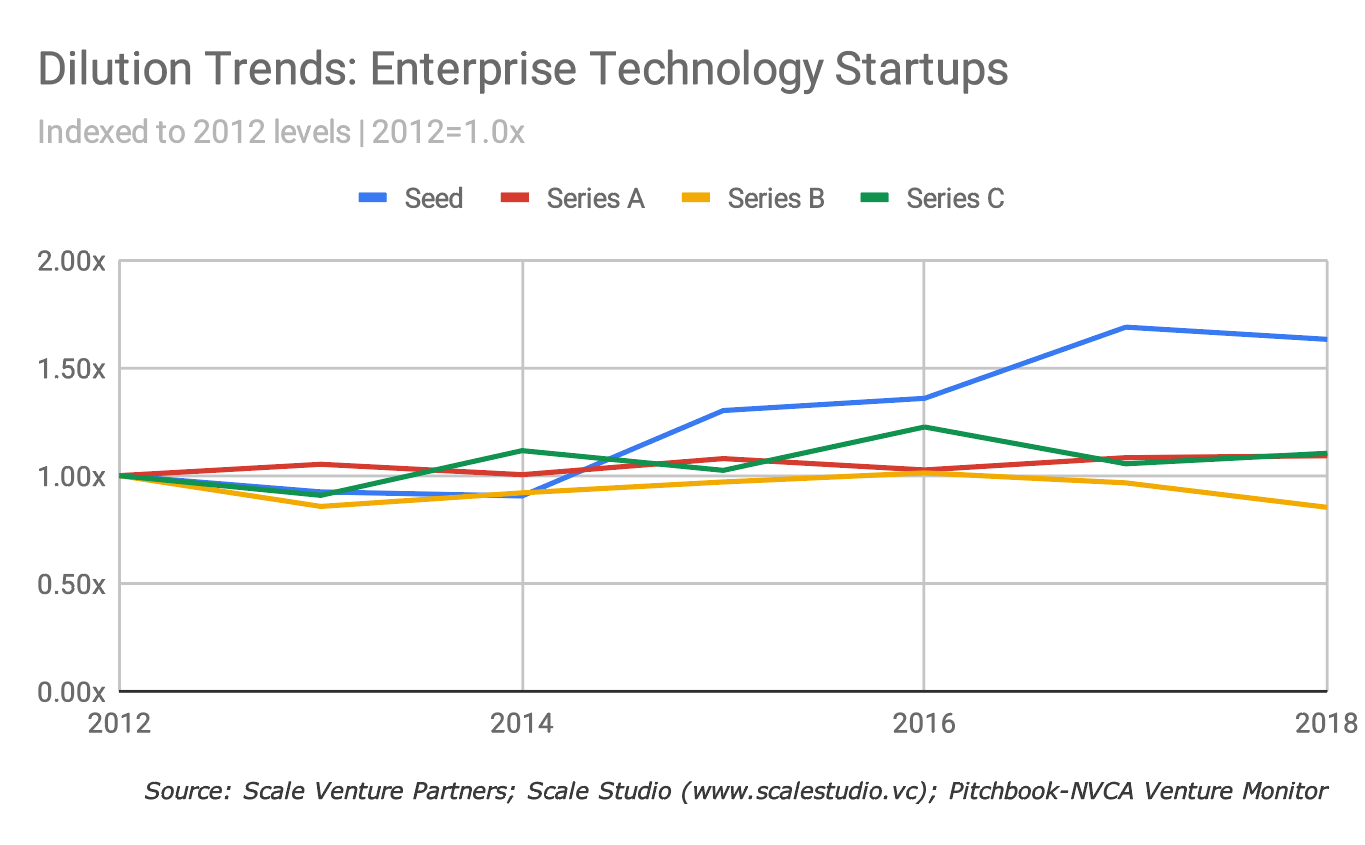

Dilution trends look quite different. Instead of across-the-board shifts, we see the change almost entirely concentrated in Seed rounds.

While funding round sizes have increased across the board from Seed onwards, Seed rounds in particular have exploded in size and number, with entrepreneurs accepting almost twice the amount of dilution today as they were 7 years ago. From the entrepreneur’s perspective, those checks may be larger but they’re also far more expensive. Note that I said “checks”, plural. According to the 2019 V21 Analysis:

Companies are consuming more Seed capital than ever before. In 2018, the average company had raised a total of $5.6M prior to raising a Series A, up from $5.2M in 2017 and 4.3x more than the $1.3M of 2010.

Seed funding is still being raised on vision, TAM, and team. Yet startups are often completing multiple Seed-stage raises: Seed, Super Seed, Post-Seed, and other flavors of pre-A financing. More capital is being raised pre-Seed and Seed, giving founders the runway they need to position their companies to go under the intense spotlight of today’s A and B rounds.

When you look at the whole picture, an interesting story emerges. Founders today are making a trade-off that wasn’t necessary just a few years ago. They’re taking more capital and dilution up front, then scaling their businesses to the point where they can attract as much capital as they need to take and hold market leadership.

After all, investors perceive many markets as winner-take-all. We’re looking for signs of leadership in those markets earlier than ever, then de-prioritizing short-term valuation considerations in order to secure ownership in market leaders over the long term.

Even a well-run #2 player is a tough sell to investors these days.

Financing Strategy Domino Effect: Seed to A to B to C

Founders should be thinking about what these trends mean for their fundraising strategy.

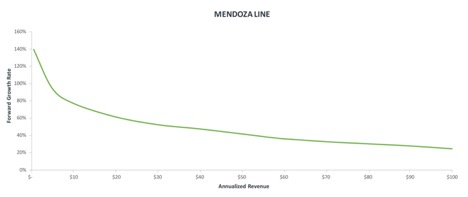

Seed funding initiates a domino effect of larger rounds at every stage from Seed to C and beyond. By C, your company is either the clear leader or struggling to attract the top-tier venture investors able to write today’s larger checks. This can be seen in the data underlying the Mendoza Line of SaaS, Scale’s concept for the minimum growth rate required for a startup to achieve escape velocity for an IPO.

Here’s an overview of exactly what we mean by “higher expectations”.

Series A

The median Series A round was 2.7x larger in 2018 than 2012, while dilution percentages remained steady: companies in this round give up about about 23% ownership on average.

You can no longer raise an A on vision. Pre-revenue Series A’s are still a thing, but barely. Recent research into Series A rounds found that:

A stunning 82% of companies completing their Series A in 2018 were generating revenue, up 5.5x from 15% in 2010. This figure was 56% a mere 2 years earlier in 2016.

We’ve already touched on why. Access to more capital during an extended Seed stage means that Series A rounds now come with significantly higher performance expectations. Even if you’re raising capital pre-revenue, investors still expect to see engagement metrics that clearly demonstrate traction.

On the product side, investors at this stage want evidence that your tech is super sticky. They are going to want to see one or more performance metrics trending up, like seat utilization rate or depth of usage.

On the sales side, a strong Series A pitch delivers multiple reference customers landed and retained by a high-performance sales team. And the pressure’s on: startups can’t really afford even a bad month because the time between rounds is so tight you generally won’t have runway to delay for a quarter.

Series B

Larger Series B rounds mean there is an even higher bar for performance: it should be crystal clear that your company is the leader in its market.

That starts with sales. Investors are going to want to see proof of leadership, like:

- Predictable sales with 50%+ of reps hitting quota consistently

- Cohort growth and stable retention

- Top-quartile growth and efficiency metrics

- Hiring and retaining sufficient sales capacity to exceed growth targets

It’s important to succinctly communicate your performance to investors in their preferred language: metrics. Find that experienced and hungry VP of Finance early and give them the resources to build infrastructure and establish reporting processes.

On the product side, investors want to see multiple reference customers who are outright champions. On-list and off-list customers who tell the same story about your product indicate not only a high-quality product but a large market for that product. Keep in mind that these reference checks help investors validate and cross-check their own market size calculations.

Remember, your B round doesn’t happen in a vacuum. Investors will focus on the total amount of capital your company has raised getting to B and set expectations accordingly.

The successful Series B pitch makes clear you’re undeniably on the path to market leadership.

Your Destiny Is (Largely) Written by C

If “A is the new B” and “B is the new C”, then today’s Series C rounds come with expectations once reserved for a pre-IPO company. Successfully raising a C round today requires showing that you’re clearly winning. Flawless metrics, a steep and smooth growth curve, and a deep bench of experienced talent delivering faultless execution.

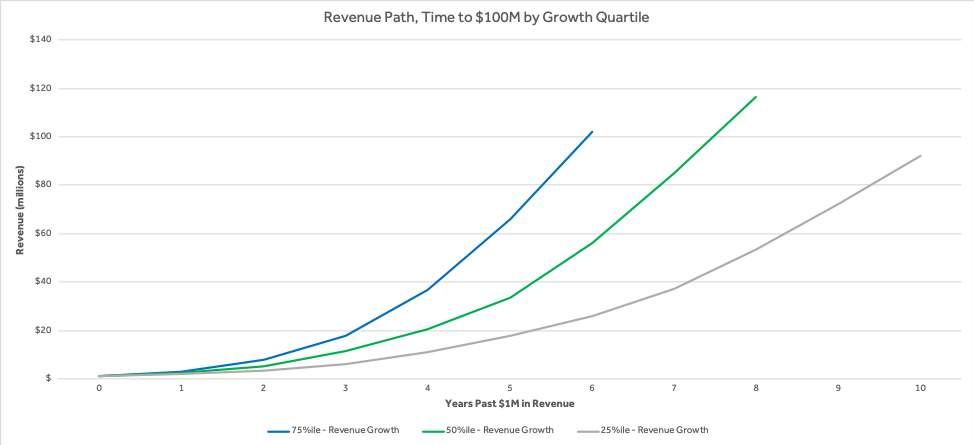

Why are venture investors such “growth junkies”? Early growth compounds in a way that greatly impacts (reduces) the time it takes for a startup to reach that magic $100 million in revenue level where a new world of options opens up. By Series C, it’s clear to investors which one of those curves your company is on.

Scale partner Rory O’Driscoll wrote about the importance of growth at every stage of a startup’s trajectory in the Four Vital Signs of SaaS. Here’s why:

In aggregate, the divergence between successful startups and struggling startups takes place almost out of the gate.

These days, there may be an abundance of capital in venture capital. But positioning your company to meet heightened investor expectations is harder than ever. From those first days after your Seed rounds, keep your vision firmly fixed on where you need to be at every funding milestone ahead of you.

John Gianakopoulos contributed to this article. An excerpt of this article appeared previously on TechCrunch.