Every year, we here at Scale begin the annual planning season by sharing, with our founders and the wider Scale community, our most recent data and benchmarks to help provide a sense of direction as folks dive into their annual planning process. As we’ve done in 2021 and 2022, we’ll be sharing the “whisper numbers” for growth in 2023 and how a sampling of companies are expecting the year to shake up.

This year we’ve also put together a list of annual planning tools and resources to help you through the annual planning process and share helpful advice going into 2023.

Now, before diving into the details, here’s the high-level summary:

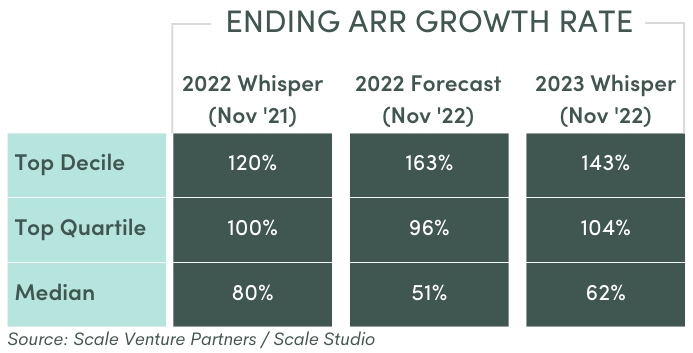

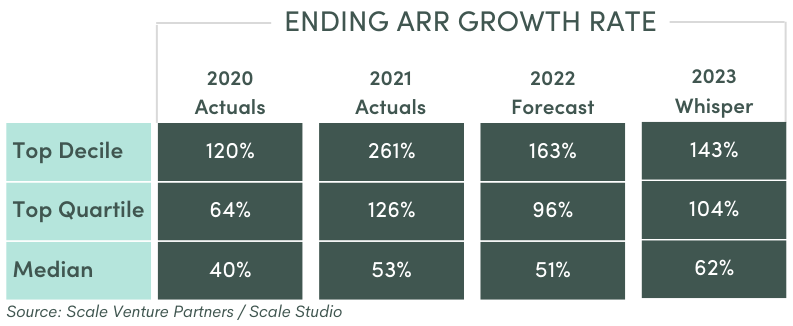

- 2023 Whisper Numbers: Median ARR Growth for 2023 is expected to be around 62%, which is actually ~10% higher than the 51% median growth rate we’re expecting to see in 2022. Top-decile growth rate estimates, however, have come down to 143% in 2023 vs 163% in 2022.

- 2022 Estimate Accuracy was Mixed: Current 2022 median growth forecast is 51%, vs 80% in the original whisper numbers from last year. However, current 2022 top-decile growth forecast is 163%, compared to only 120% in the original whisper numbers.

While lower-than-estimated 2022 median growth is to be expected given the macro shifts from late-2021 to now, it is interesting that the median growth for 2023 is currently forecast to be higher than 2022. That said, there is so much uncertainty in the markets right now that these estimates are likely to be very volatile over the coming months, so we’ll have to see where 2023 target growth lands once we’ve closed out the year in January.

Q322 Recap

As we covered in our most recent Scale Studio Flash Report, growth continued to slow in Q322 as economic headwinds hit software spend:

- 51% Median ARR Growth Rates lower than prior quarter final results of 67% in Q222 and 58% in Q122.

- 160% Top Decile ARR Growth Rates identical to previous quarter. Though this is a dramatic drop in growth compared to 253% in Q122.

- 13% of companies overachieved against Q322 plans. This is lower than even the original Covid Shock in Q220.

- 57% Median Plan Attainment down from our Q222 final result of 73%. Plan Attainment compares a company’s actual ARR for a period to its annual plan ARR target for that period.

While it’s hard to determine how much of the drop in growth is attributable to software companies pulling back on aggressive sales and marketing spend vs. customers pulling back spend as they rationalize their software subscriptions, anecdotally it seems as though we are shifting from the former to the latter.

Looking Back: How Accurate Were Last Year’s Whisper Numbers?

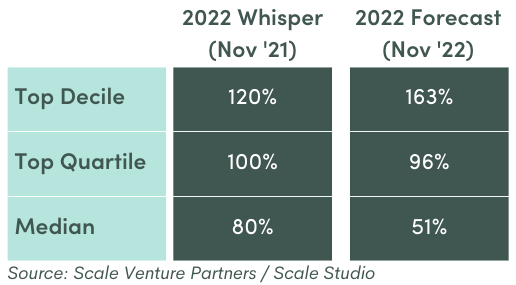

As we touched on above, the accuracy of last year’s whisper numbers is a mixed bag.

Looking just at the 2022 whisper numbers (from November 2021) vs the most recent 2022 forecast for these companies, we can see how the whisper number estimates played out:

For top-quartile performers and lower, actual 2022 performance is expected to come in below what was forecast at the end of 2021. However, for top-decile performers, this year is looking like it will end above expectations.

How will this year’s whisper numbers hold up?

Looking Forward: Whisper Numbers for 2023

As we’ve done in past years, this month we reached out to our portfolio CEOs and CFOs to ask how much they expect to grow ARR in fiscal 2023. Here’s what they said:

Surprisingly, early 2023 median and top-quartile growth estimates are about the same, if not a bit higher, than latest 2022 forecasts.

Of course, these estimates could still be revised over the next couple of months as companies finalize their 2023 plans, and next year’s macro environment could surprise to the upside or the downside (as we’ve said before, forecasting macro trends is a fool’s errand). One thing that we can learn from them, however, is that folks are fairly confident the worst is behind us and growth will start to stabilize next year.

What to keep an eye on in 2023

Whereas last year the question everyone was asking was “can we grow faster”, now the question is “can we grow cheaper”.

The focus for 2023 will undoubtedly be on efficient growth – trying to grow as fast as you can with stricter capital constraints. This may mean needing to sacrifice some incremental growth to save a more significant amount of cash. Within the framework of our Growth vs Burn Matrix, this may mean shifting from the upper-left, “high growth, high burn multiple”, quadrant to the bottom-right, “low growth, low burn multiple”, quadrant.

Best wishes to all the stressed out founders and finance leaders fighting the annual planning fight, and remember to check out our Annual Planning Hub for helpful tools and resources.