2022 Whisper Numbers: Growth Rolls On (With an Asterisk)

What You Need to Know Right Now

It’s annual planning season and we’re in close contact with our founders right now, sending them data and benchmarks to jump start or cross check their 2022 projections. As we did for 2021, we thought we’d share the key data points we’re passing along to them, including this year’s “whisper number” of growth expectations for 2022. Here’s the nutshell with more details below:

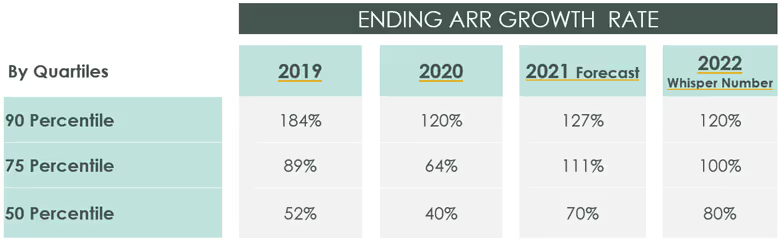

- 2022 Whisper Number: Median ARR Growth rate in 2022 is forecast to be 80%, indicating increasing confidence compared to the 2021 Whisper Number of 59%. Similarly, top quartile growth rate in 2022 is forecast to be 100% compared to 92% in 2021.

- 2021 Overachievement: Median forecast growth rate of 70% surpasses the original whisper number estimate of 59%.

Together these numbers paint a picture of enterprise SaaS on track to surpass 2021 whisper numbers and annual plan targets — and then get even more aggressive about 2022. See “What to Watch in 2022” below for a discussion of two areas of uncertainty in all the optimism.

Q321 Recap

In our most recent Scale Studio Flash Update, Q3 results fell right in line with the enterprise SaaS growth streak that started four quarters back:

- Median Ending ARR Growth Rate hit 68% in Q321, compared to 47% in Q320. It was the third straight quarter of sequential growth rate increases.

- Median NNARR Growth Rate hit 83% in Q321, compared to 44% in Q320. This leading indicator of future growth is trending positive.

- Median plan attainment (that is, each sampled company’s YTD ARR as a percentage of its 2021 annual plan ARR targets) is 93%, a solid result against a tough comparison considering aggressive 2021 plan targets.

Third quarter was the first real test for enterprise SaaS since the great reset of mid-2020. Q3 performance shows that startups passed with flying colors. We’re clearly seeing continued strong growth as 2021 winds down. It does appear that the sector, in many respects, is returning to pre-COVID norms.

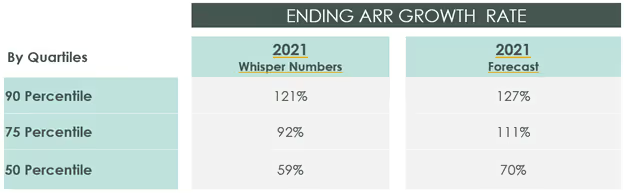

Reality Check: 2021 Whisper Numbers

Before we look in more detail at 2022, let’s double check that 2021 whisper numbers mattered. Spoiler: they were surprisingly accurate, even conservative.

Here is that comparison. The Whisper Numbers column shows expectations as they stood during annual planning for 2021 in late 2020. 2021 Forecasts correspond to each sampled company’s current targets.

As you can see, the whisper numbers were a good estimate of how the year would turn out (barring some shock during Q4!). If anything, estimates were conservative relative to actual performance.

Let’s see what’s in store in 2022.

Whisper Numbers for 2022

We followed the same process to capture 2022 whisper estimates. We asked 20+ CEOs and CFOs how much they expected to grow ARR in fiscal 2022. Here’s what they said:

Not a lot of surprises here. Companies expect the growth environment that has buoyed enterprise SaaS since the COVID trough a year ago to roll on through at least 2022.

This is a small sample set, so don’t focus too much on the absolute changes (for example, 75th percentile slowing from 111% to 100%). The overall trend tells a story of widespread strong growth. If a company is struggling, it’s most likely because of company-specific issues and not related to overall demand for enterprise software.

What to Watch in 2022

Q3 performance and 2022 whisper estimates tell us that growth is on track. But growth may be more expensive in 2022.

Two factors put an asterisk on the statement “Strong growth will continue in 2022.” Two big expense categories come with a lot of uncertainty right now:

- Real estate. Physical real estate usage is in flux with a lot of change on the horizon during 2022. Companies are still figuring out the post-COVID office, with a lot of office space likely to come back online next year. Some companies may end up seeing cost savings (and thus upside) from real estate but the uncertainty makes it hard to plan for. (Incidentally, we recently led a funding round for VergeSense, which has a platform for finding value in office space.)

- Employment costs. The so-called “Great Resignation” has superstar employees leaving companies in record levels. Stories of talent getting poached at 2 or 3x compensation are making the rounds. It’s safe to say that both hiring costs and salaries are going higher in 2022. Again, this will look different at different companies, but it’s a safe bet compensation goes higher in 2022 relative to 2021.

We’re hosting an event with our CFOs this week, and will have more to say on these topics on the blog afterwards.

Best wishes to all the stressed out founders and finance leaders fighting the annual planning fight. We have resources that might help make things go faster and easier:

- A new Annual Planning Tool on the Scale Studio Tools page. The downloadable spreadsheet generates a draft annual plan using just 4 data points and a lot of Studio benchmarks to estimate OpEx levels.

- Also on Scale Studio, new Board Deck templates that are pre-populated with performance benchmarks tailored to your revenue level.

- Scaling: Seed to Series A is a new content hub for founders leading early-stage startups.

- SaaS Metrics: Vital Signs, another new content hub, consolidates resources on running a startup using growth, efficiency, churn, and burn metrics.

- Annual Planning for SaaS Companies gives a Board member’s perspective on the planning process.

News from the Scale portfolio and firm