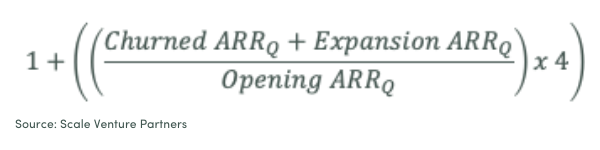

Annualized Net Retention takes longer to say than to explain: It’s the best metric for early-stage startups to understand how every $1 in sales grows over time. The formula annualizes the net difference between churn and expansion dollars. The more net expansion, the higher your Annualized Net Retention metric.

Annualized Net Retention (ANR) is a very powerful metric because it reflects the overall effectiveness of all operations that interface with the customer: Sales, Marketing, and Customer Success in particular. Each of these teams has its own set of metrics to track performance, but Annualized Net Retention sits above those metrics to provide a single view of how well your company retains and expands.

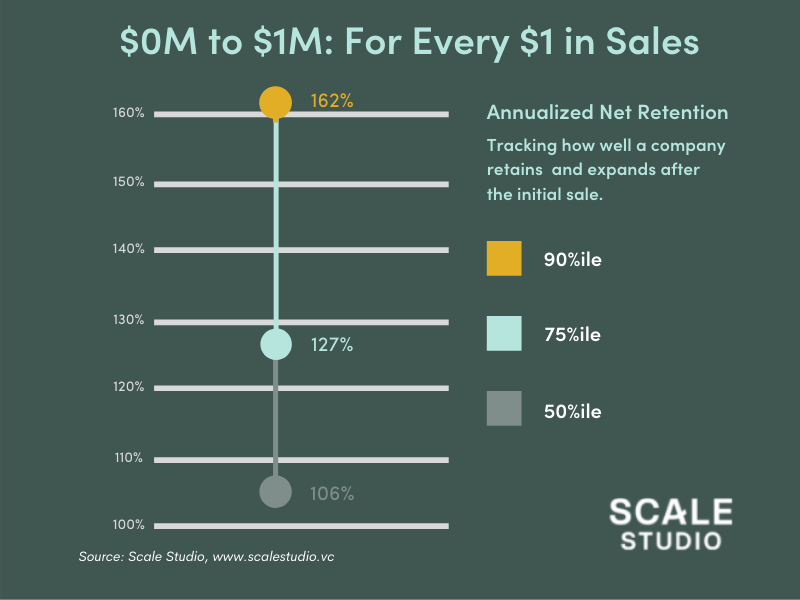

As you can see from the “Good, Better, Best” benchmarks below, there’s a large gap between good and better performance and top-tier performance. The 162% number for top percentile means those startups turn every $1 in sales into $1.62. You can think of that “extra” as a growth booster — after all, upsell and expansion make their way into the revenue line.

Note that in many cases, median performers tend to struggle more with churn, which cancels out some of the success with upselling. That operational problem is then a drag on those startups’ growth rates.

We recommend that founders get started early building ANR tracking into their internal performance metrics. We’ve written a lot about how to get started with churn and retention tracking: