Scale Studio Flash Updates analyze a representative sample of enterprise software startups to measure industry growth rates and the health of the SaaS market. The most recent updates were the 2022 Whisper Numbers, 3Q21, and 2Q21.

What You Need to Know Right Now

- Preliminary 4Q data shows strength across enterprise SaaS as companies continue to accelerate going into 2022.

- Forecasts for 2022 are strong and show confidence in the post-COVID era.

- In fact, an increase in Median Plan Attainment shows more startups are mastering post-COVID planning and forecasting.

4Q21 Performance Highlights

- 72% Median ARR Growth Rate again shows sequential growth and highlights continued market durability post-COVID.

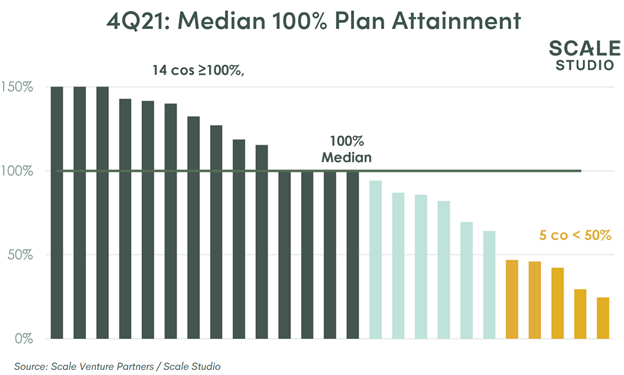

- 54% of sampled companies overachieved against 4Q21 plans.

- 100% Median Plan Attainment, higher against aggressive goals. (Plan Attainment compares a company’s actual ARR for a period to its annual plan ARR target for that period.)

- 43% of sampled companies are accelerating growth, higher than the 33% historical average.

4Q21 Analysis

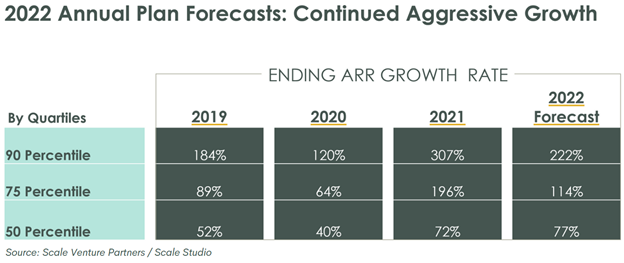

In November, when we published 2022 Whisper Numbers, founders and CFOs were clearly optimistic about the prospects for growth in 2022. A lot has happened since then, including the renewed uncertainty that came with the Omicron surge. So it’s good to see that 2022 plans developed post-Omicron still retain a sense of bullish optimism. Here is the updated 2021 performance data and 2022 plan targets:

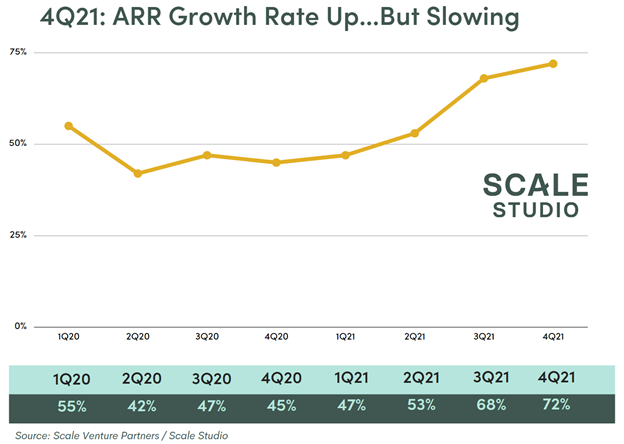

72% Median ARR Growth Rate in 4Q is another quarter of sequential growth and proof SaaS and cloud startups have mastered hybrid work models and other COVID-driven adjustments. Many startups are operating at peak efficiency.

We described 3Q21 as the first real test of the great reset that happened at the start of lockdown in 2Q20. Fourth quarter results suggest – for enterprise software at least – COVID is officially in the rear-view mirror. It’s an open question whether more recent headwinds like supply chain, inflation, and tight labor markets will curb growth later in the year. This may be “priced in” to 2022 forecasts that show expected growth easing from the red-hot 2021.

4Q21 Growth Rate and Plan Attainment Data

ARR Growth: Median year-on-year ARR growth for 4Q21 was 72%, up from 68% the prior quarter and 45% in 4Q20. This continues the unbroken streak of sequential quarter-on-quarter growth that began in 4Q20.

Note, however, that while the actual 4Q21 growth rate is at a record high, the growth rate increase is slowing with just a 4% bump in 4Q versus to 3Q. We’ll be watching whether this is the start of ARR growth leveling off.

Median Plan Attainment: In the 3Q21 Flash Update, Median Plan Attainment was 93%, in line with the long-term trend. 4Q21 saw that figure pop to 100% Median Plan Attainment. This was driven in part by 14 of 25 sampled companies coming in above plan – and many significantly so including three at 150%+ of plan.

What’s Ahead in 2022?

With 2022 just getting under way, the potential headwinds we identified in late 2021 still remain untested. Two big expense categories come with question marks:

- Real estate. Companies are still right-sizing their physical real estate needs. Until the post-COVID office is a reality, costs from this real estate transition remain unknown.

- Employment costs. This one is likely to roil P&L for some time. Factors like record-high unfilled job openings relative to near-record-low unemployment point to widespread difficulty in finding and hiring talent. Doing so will be expensive for some time to come.

Growth is a perennial issue for startups, and the bar to join the top 10% growth rate club is higher than ever. It is possible that some startups growing quickly will, nonetheless, fail to convince investors they deserve premium hyper-growth multiples. This could make it slightly more difficult to land top-tier venture backing in an ultra-competitive market.

Whisper numbers for 2022 highlight differences between growth tiers. High-growth 90%ile and 75%ile startups expect growth to ease somewhat from elevated 2021 levels; yet typically these companies also often under-forecast then over-deliver by year’s end. For companies in the median growth tier, however, forecasts expect 2022 growth to inch higher than already elevated 2021 levels.

We look forward to sharing what we learn about market conditions in the next Flash Update covering 1Q22 performance.