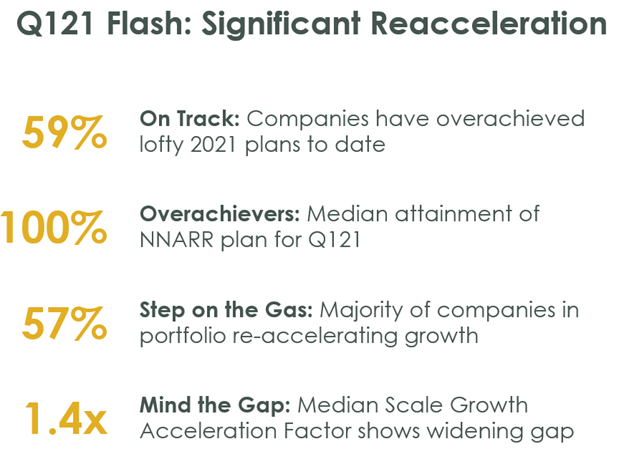

Scale portfolio companies ended 2020 with a lot of optimism about 2021, as seen in annual plans with some pretty lofty growth expectations. By April, preliminary Q1 performance data convinced us that the growth re-acceleration is real. Today, we’re sharing the full analysis of Q1 performance (now including companies with April quarters) and the big takeaway is that enterprise SaaS remains on track for a strong 2021.

As you can see in this overview, 59% of Scale portfolio companies have overachieved on 2021 plans to date.

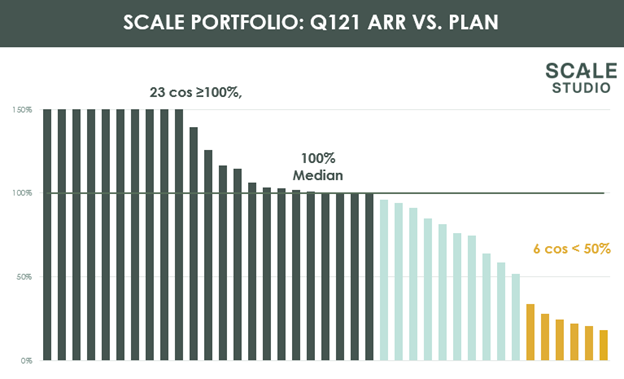

Almost across the board, business conditions and execution were strong. Twenty-three portfolio companies reported ARR at or above their late-2020 plans.

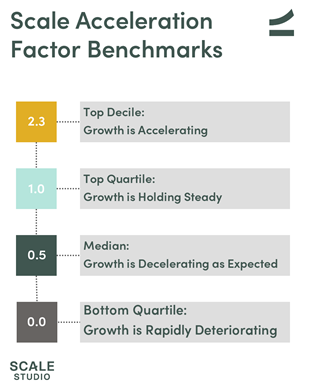

One new metric we’re tracking is something we call the Scale Acceleration Factor, which is a quick way to measure NNARR growth rate relative to ARR growth rate. Here is a summary of what different acceleration factors mean:

Across the portfolio, the median Q1 acceleration factor was 1.4x, showing that growth is holding steady or accelerating. Note the spread between performance tiers:

- 90th percentile: 8.55

- 75th percentile: 4.47

- 50th percentile: 1.39

- 25th percentile: 0.10

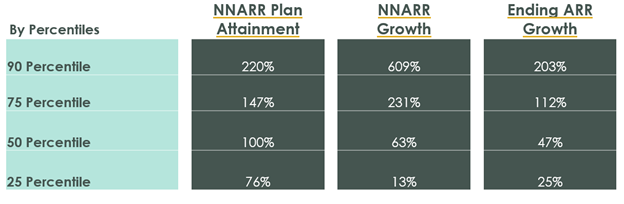

We’ve written about the power of NNARR Growth Rate to predict future growth. Q1 portfolio data showed a typical spread between top performers and the median across NNARR Plan Attainment, NNARR Growth, and Ending ARR Growth. Here are those figures. Note that NNARR Plan Attainment is defined as the ratio between a company’s actual Net New ARR Growth versus forecast NNARR growth.

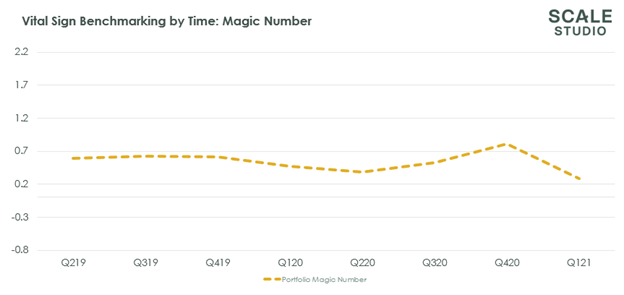

One metric that we’re watching is the Q1 drop in the Magic Number sales efficiency metric. There are signs that companies are “buying growth” with increased Sales and Marketing spending. Data shows the portfolio’s median Magic Number dropped to 0.3 during the quarter from its recent high of 0.8 in Q4 and the long-term median of 0.7.

On the bright side, that drop was not mirrored in Net Sales Efficiency, which improved during the quarter and seems to indicate that COVID churn concerns have waned. We’ll continue to keep an eye on these metrics in coming quarters.

As always, you can benchmark your startup’s performance in growth, efficiency, churn, and burn at www.scalestudio.vc.