Metrics matter. The Scale team leans heavily on startup metrics for a lot of reasons, but first and foremost it’s this: performance data tells a quantitative and qualitative story about a company. That’s a somewhat subtle point: a metric like Net Sales Efficiency is high or low because of realities like the company’s sales motion, go-to-market strategy, how much value customers get from the product, and so on. Metrics allow investors and startups alike to gauge the effectiveness of a whole bunch of factors all at once. And speak a common language about the results.

The challenge in SaaS is that there are an endless number of metrics, and an endless number of opinions on which metrics matter and when they matter and how to even calculate them in the first place. That’s true especially for growth metrics.

But we can untangle some of that to answer a very reasonable question: What’s the best growth metric for founders to use in the early-in-revenue period?

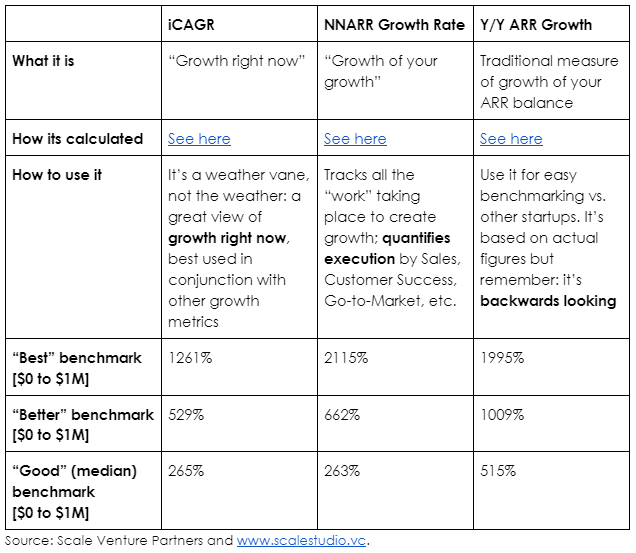

Here’s a summary table of three key measures of top line growth: iCAGR (instantaneous compound annual growth rate), NNARR growth rate, and Y/Y ARR growth rate.

There are some trade offs. Tracking Y/Y ARR growth rate is easy, but because it’s backwards looking, it has little predictive value. Gathering all the data to track your NNARR growth rate quarter after quarter pays off big, but might be too big a lift during the early-in-revenue period when your Finance team is stretched.

Our standard advice is this: just get started where you can, but have a plan for getting more sophisticated with growth tracking as your resources and capabilities expand with time.

Dive deeper into growth rates: